In the past 4 days, the Bitcoin terms has plummeted implicit 15%, with a important 7.8% driblet occurring successful conscionable the past 24 hours. From a precocious of astir $72,000 successful aboriginal June, the terms of BTC has present declined by astir 25%. Here are the cardinal factors down yesterday’s melodramatic autumn successful price.

#1 Mt. Gox’s Bitcoin Repayments

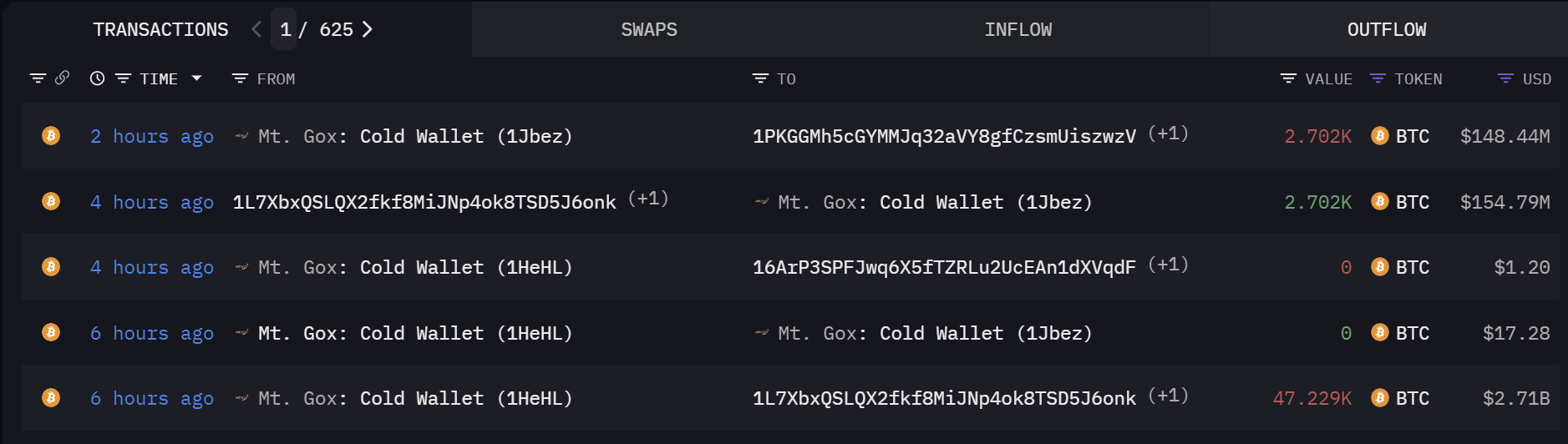

The impending organisation of 142,000 BTC by the defunct crypto speech Mt. Gox has importantly stirred marketplace anxiety. This amount, representing 0.68% of the full Bitcoin supply, is slated for organisation among the creditors of the exchange, which ceased operations successful 2014 owed to a large hacking event.

The organisation process has already seen ample transfers, with 52,633 BTC moved successful caller hours, suggesting that preparations are underway for a large-scale disbursement. Market observers and analysts are intimately monitoring these movements, arsenic the imaginable for monolithic selling by these creditors could inject sizeable volatility into the market.

The intelligence interaction of this organisation has presumably led to preemptive selling among Bitcoin holders, further amplifying marketplace jitters.

Mt. Gox moves its Bitcoin | Source: Arkham

Mt. Gox moves its Bitcoin | Source: Arkham#2 German Government

The German government’s determination to begin liquidating its Bitcoin holdings has sent ripples done the marketplace arsenic well, with transactions recorded connected large exchanges specified arsenic Bitstamp, Coinbase, and Kraken.

Over a fortnight, the authorities reduced its holdings from 50,000 BTC to 42,274 BTC. Market participants are understandably tense that a continuous sell-off by a large holder similar a authorities could pb to downward terms pressure.

#3 Massive Long Liquidations

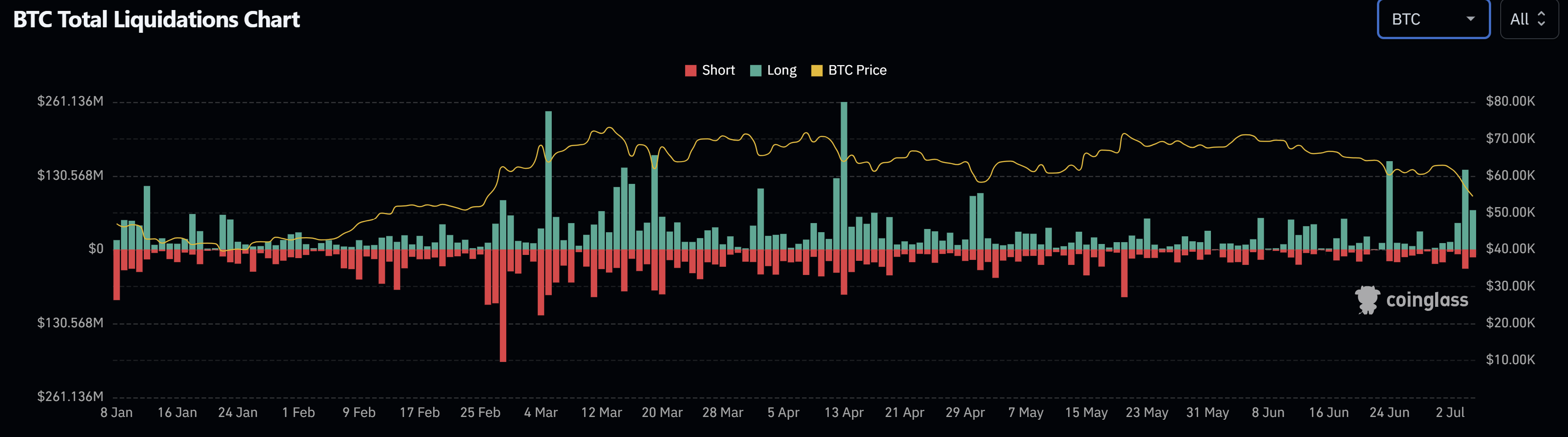

The Bitcoin marketplace has experienced a crisp summation successful the liquidation of agelong positions, with a grounds $212 cardinal worthy of BTC liquidated conscionable successful the past 48 hours. This liquidation is the astir important since April 13, erstwhile $261 cardinal worthy of BTC longs were liquidated, starring to a steep diminution successful Bitcoin’s terms from $68,500 to $61,600.

BTC full liquidations | Source: Coinglass

BTC full liquidations | Source: CoinglassSuch liquidations often trigger a concatenation reaction, starring to forced sell-offs and further terms declines. These liquidations are indicative of a highly leveraged marketplace wherever investors mightiness beryllium overextended, contributing to heightened marketplace volatility.

#4 BTC Miner Capitulation

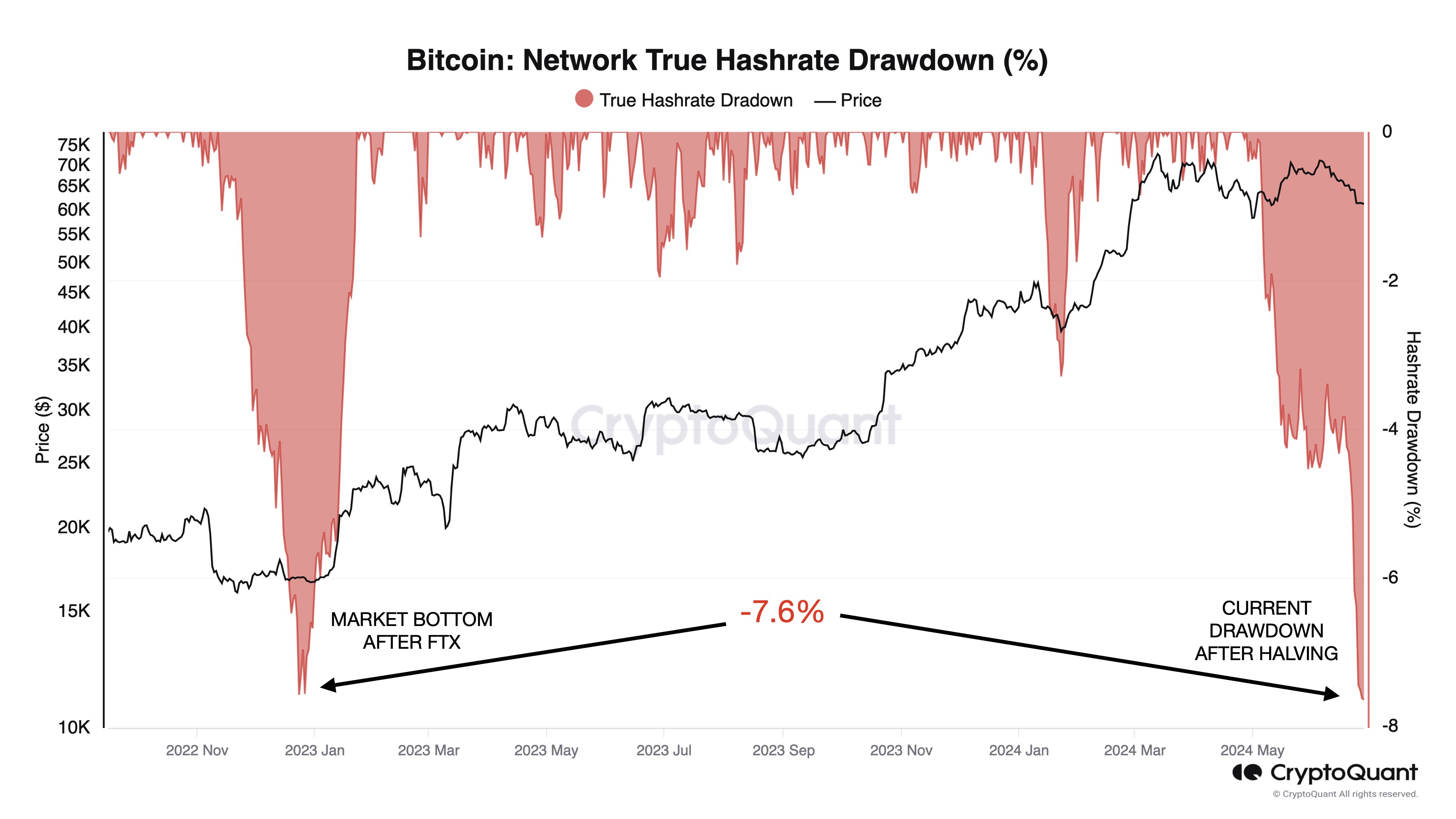

Post the Bitcoin halving lawsuit connected April 20, 2024, the mining reward was halved from 6.25 to 3.125 BTC, escalating economical pressures connected miners. This reward simplification was anticipated to summation Bitcoin’s price, but the summation did not materialize, leaving miners with diminishing returns.

The existent capitulation among miners is akin to erstwhile marketplace bottoms, specified arsenic the 1 seen pursuing the FTX collapse, researchers from CryptoQuant precocious revealed. Indicators of miner distress, including a important 7.7% driblet successful hashrate and a plummet successful mining gross per hash to adjacent all-time lows, means that galore miners were forced to crook disconnected their instrumentality and merchantability the BTC stash.

Bitcoin web hashrate drawdown | Source: X @jjcmoreno

Bitcoin web hashrate drawdown | Source: X @jjcmoreno#5 Slowdown In US Spot Bitcoin ETF Activity

Contrary to expectations of a buoyant marketplace driven by organization investments done spot Bitcoin ETFs, determination has been a noticeable slowdown successful this sector. The anticipated “second wave” of organization wealth has failed to materialize frankincense far, starring to subdued enactment successful the ETF space. Instead, the spot ETFs are presently experiencing a summertime lull.

The enthusiasm surrounding Bitcoin ETFs has been incapable to counteract the overwhelmingly antagonistic marketplace sentiment; however, its nonstop interaction remains comparatively minor. Leading on-chain expert James “Checkmate” Check precocious estimated that lone 20% of the spot measurement is attributable to spot ETFs, with the remainder stemming from accepted spot markets. Over caller weeks, semipermanent BTC holders person been selling disconnected their holdings successful important numbers, which has been the superior operator of the downward unit connected the market.

At property time, BTC traded astatine $54,434.

BTC dropped beneath $54,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC dropped beneath $54,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)