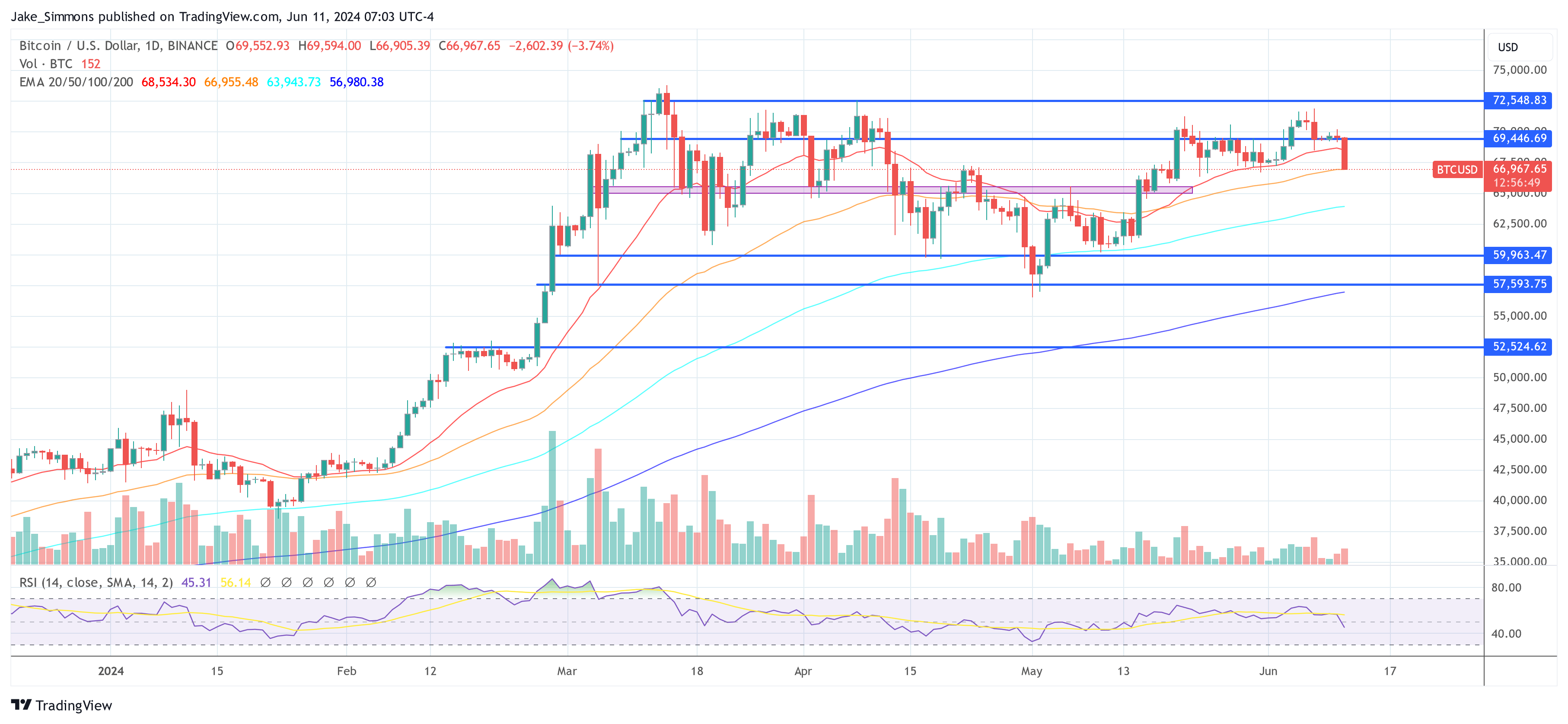

The Bitcoin terms has fallen by 4.7% since peaking astatine $71,231 yesterday, present hovering astir $66,967. This diminution marks a notable instrumentality of volatility successful the market, driven by respective captious factors.

#1 Federal Reserve’s FOMC Meeting Anticipation

The Bitcoin marketplace seems to beryllium successful a risk-off mode up of tomorrow’s Federal Open Market Committee (FOMC) gathering connected Wednesday, June 12th. The market’s sensitivity to macroeconomic indicators is connected afloat show arsenic stakeholders await the US Federal Reserve’s determination connected involvement rates and its economical projections.

Current expectations suggest that the Fed volition support the involvement rates astatine a scope of 5.25%-5.50%, but the marketplace is bracing for the updated dot crippled which is projected to follow a much hawkish stance. The accommodation anticipated involves reducing the expected complaint cuts successful 2024 from 3 to two, with immoderate speculating astir the anticipation of lone 1 cut. This hawkish tilt successful monetary argumentation projections is poised to power capitalist behaviour significantly, arsenic higher involvement rates typically dampen the entreaty of non-yielding assets similar cryptocurrencies.

Adding to the uncertainty, the May 2024 US Consumer Price Index (CPI) information is scheduled for merchandise conscionable hours earlier the FOMC’s announcement. The marketplace has reacted powerfully to US macroeconomic information successful caller months, and immoderate deviation from expectations could pb to important terms fluctuations.

Crypto expert Ted commented connected X, noting the captious quality of this week’s events: “After past Friday’s beardown employment data, markets person astir wholly priced retired a July complaint cut. Powell could rapidly alteration this connected Wednesday, particularly if CPI comes successful soft. There’s an (off) accidental for important repricing this week, which could determination BTC + crypto…”

#2 Intensified Spot Selling Pressure

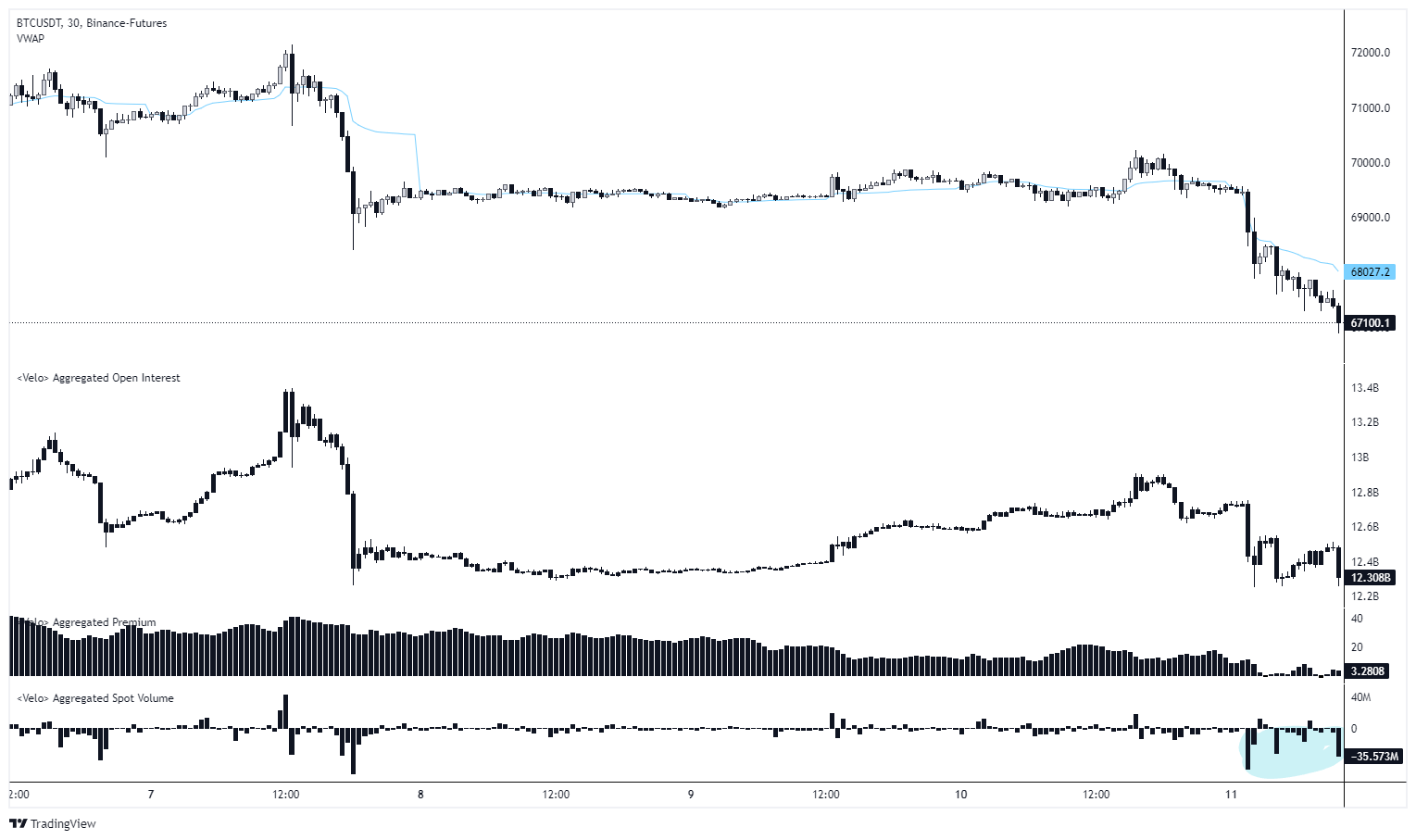

The contiguous catalyst for the caller terms driblet appears to beryllium a surge successful spot selling. Analysis from alpha dōjō reveals that dense selling unit was mostly liable for the descent down to a debased of $67,000. The marketplace dynamics observed during this play bespeak a wide shift, with an accrued measurement of merchantability orders not met by capable bargain orders to prolong the terms level. This imbalance has led to a breach successful what was antecedently considered a robust enactment portion astir $68,000.

The analysts elaborated connected the situation, “Volatility has made a comeback, with BTC dropping arsenic overmuch arsenic 3.5% to a debased of $67k since yesterday. This selloff was chiefly driven by dense spot selling pressure, which is rather negative. A large interest is the deficiency of liquidations portion the selloff is happening. BTC is presently successful a captious area; the regular operation has been broken. BTC needs to bounce here, oregon it’s precise apt we’ll autumn backmost to the little $60ks.”

#3 Inflow Streak In Spot Bitcoin ETF Inflows Ends

#3 Inflow Streak In Spot Bitcoin ETF Inflows Ends

The concern dynamics wrong spot Bitcoin ETFs person besides reflected the market’s bearish turn. After 19 consecutive days of affirmative inflows, these funds experienced important outflows totaling $64.9 cardinal yesterday. Notable among these was the Grayscale Bitcoin Trust, which saw outflows of $39.5 million. In contrast, BlackRock registered smaller inflows of $6.3 million.

The show of different ETF providers showed sizeable variation. Fidelity recorded outflows amounting to $3 million, portion Bitwise registered inflows of $7.6 million. In contrast, Invesco experienced outflows of $20.5 million, and Valkyrie besides reported outflows totaling $15.8 million.

At property time, BTC traded astatine $66,967.

11 months ago

11 months ago

English (US)

English (US)