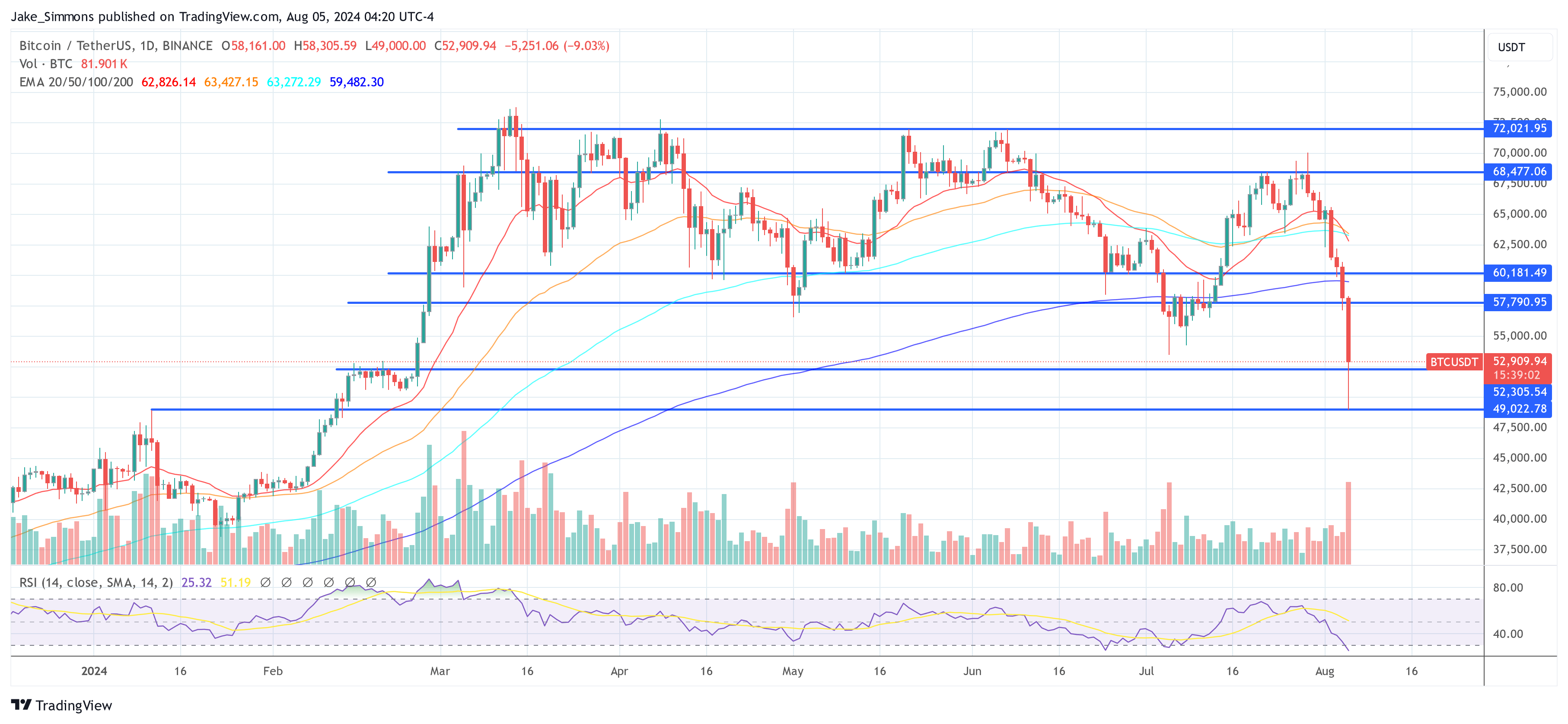

Over the past 24 hours, the crypto marketplace has witnessed a terrible downturn, with Bitcoin’s terms tumbling down 15% to a debased of $49,000 connected Binance (BTC/USDT), marking a important departure from its $70,000 precocious past week—a 26% crash. Similarly, Ethereum (ETH) plunged 39% from $3,400 to $2,100. This downward inclination was not isolated but echoed crossed the altcoin spectrum, which experienced adjacent steeper declines.

#1 Recession Fears Cause Bitcoin Crash

The archetypal spark for the existent marketplace volatility appears to stem from intensifying fears of a US recession, triggered by unexpectedly anemic US occupation marketplace information connected Friday. The July study showed a summation of lone 114,000 jobs—significantly beneath the Wall Street prediction of 175,000. This was the weakest occupation maturation since December of the erstwhile twelvemonth and astir the lowest since the commencement of the COVID-19 pandemic successful March 2020.

Charles Edwards of Capriole Investments remarked via X, “Every azygous clip the unemployment complaint turns up arsenic it has today, we person a recession. Just arsenic the Fed was excessively dilatory to tighten successful 2021, it looks similar they were excessively dilatory to easiness successful 2024.”

Further compounding the market’s nervousness was the revelation that Warren Buffett’s Berkshire Hathaway sold astir 50% of its Apple holdings. This sell-off by 1 of the world’s astir watched investors was interpreted arsenic a determination to hedge against imaginable marketplace downturns, considering Berkshire Hathaway disclosed holding a grounds $277 cardinal successful currency successful its Q2 report.

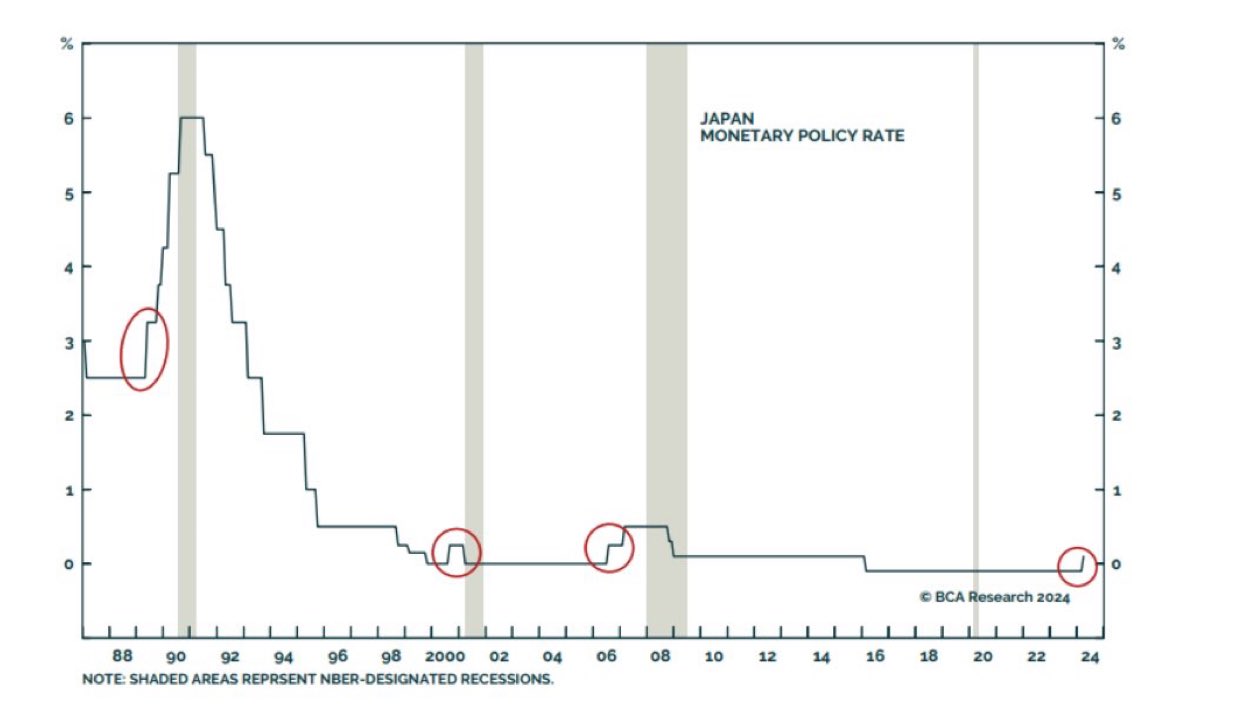

Additionally, the Bank of Japan’s determination to rise its cardinal involvement complaint to astir 0.25% from a scope of zero to astir 0.1% has had important implications. This complaint hike, the 2nd since 2007, sent shockwaves done the fiscal sectors globally. Historically, complaint hikes by the Japanese cardinal slope person been precursors to planetary recessions. Following the announcement, the Nikkei experienced its largest 2-day driblet successful history, surpassing adjacent the declines seen connected Black Monday successful 1987.

Rate hikes by the Japanese cardinal slope precede recessions | Source: @marcfriedrich7

Rate hikes by the Japanese cardinal slope precede recessions | Source: @marcfriedrich7Nick Timiraos, often referred to arsenic the “Fed’s mouthpiece” and a newsman for the Wall Street Journal, revealed, “Goldman Sachs says determination are bully reasons to deliberation the rising unemployment complaint successful the weak-across-the-board July payroll study is little fearsome than normal…But raises its recession-probability-tracking likelihood to 25% from 15%.”

Goldman Sachs besides adjusted its expectations for the Federal Reserve’s argumentation response, anticipating complaint cuts astatine each upcoming meeting, with a anticipation of a much assertive 50 ground constituent chopped if the August employment study mirrors July’s weakness.

#2 Yen Carry Trade Unwind

Further exacerbating the market’s autumn was a important question successful the forex markets, peculiarly with the Japanese yen. After the Bank of Japan raised its cardinal involvement rate, the yen strengthened considerably against the US dollar. This determination pressured traders who had engaged successful the “yen transportation trade”, borrowing yen astatine debased rates to acquisition higher-yielding US assets.

Adam Khoo noted, “The crisp emergence successful the JPY/USD is causing a monolithic unwind of yen transportation commercialized positions and contributing to the crisp diminution successful US stocks.” The reversal of these trades has astir apt not lone impacted the forex and banal markets but besides had a cascading effect connected Bitcoin and crypto arsenic assets are liquidated to screen losses and repay yen-denominated liabilities.

BitMEX laminitis Arthur Hayes commented via X, “My TradFi birdies are telling maine idiosyncratic large got smoked, and is dumping each #crypto. No thought if this is true, I won’t sanction names, but fto the fam cognize if you are proceeding the same?????”

#3 Jump Trading And Large Sellers

There were antithetic merchantability orders recorded crossed large exchanges specified arsenic Kraken, Gemini, and Coinbase, predominantly connected a Sunday, which is typically a quieter trading day. This suggests orchestrated actions by ample players, perchance involving the unwinding of positions by firms similar Jump Trading.

Jump Trading has reportedly been progressive successful important unloading of Ethereum, amounting to astir $500 cardinal worthy implicit the past 2 weeks. Market rumors suggest that the company’s sell-off could beryllium a strategical exit from its crypto market-making ventures oregon an urgent request for liquidity. Ran Neuner commented via X: “I’m watching this selling by Jump Trading […] They are the smartest traders successful world, wherefore are they selling truthful accelerated connected a Sunday with debased liquidity? I would ideate they are being liquidated oregon person an urgent obligation.”

Dr. Julian Hosp, CEO of the Cake Group, suggested connected X: “The crushed for the brainsick crypto merchantability disconnected seems to beryllium Jump Trading, who are either getting borderline called successful the accepted markets and request liquidity implicit the weekend, oregon they are exiting the crypto concern owed to regulatory reasons (Terra Luna related). The sell-off is relentless atm.”

Furthermore, Mike Alfred highlighted the anticipation of distress wrong the market, suggesting that a ample Japanese money mightiness person collapsed, holding important amounts of Bitcoin and Ethereum. “A large Japanese money blew up. Unfortunately, it was holding immoderate Bitcoin and Ethereum. Jump and different marketplace makers sensed the distress and exacerbated the move. That’s it. Game over. On to the adjacent one,” Alfred stated.

#4 Liquidation Cascade Exacerbates Bitcoin Price Crash

The marketplace witnessed a melodramatic summation successful liquidations, with CoinGlass reporting that 277,937 traders were liquidated successful the past 24 hours, starring to full crypto liquidations of astir $1.06 billion. The largest azygous liquidation order, valued astatine $27 million, occurred connected Huobi for a BTC-USD position.

In total, $302.07 successful Bitcoin longs were liquidated successful the past 24 hours, according to CoinGlass data. These forced liquidations, driven by borderline calls and stop-loss orders, person amplified the downward unit connected cryptocurrency prices, pushing them further into the red.

#5 Trump Momentum Fades

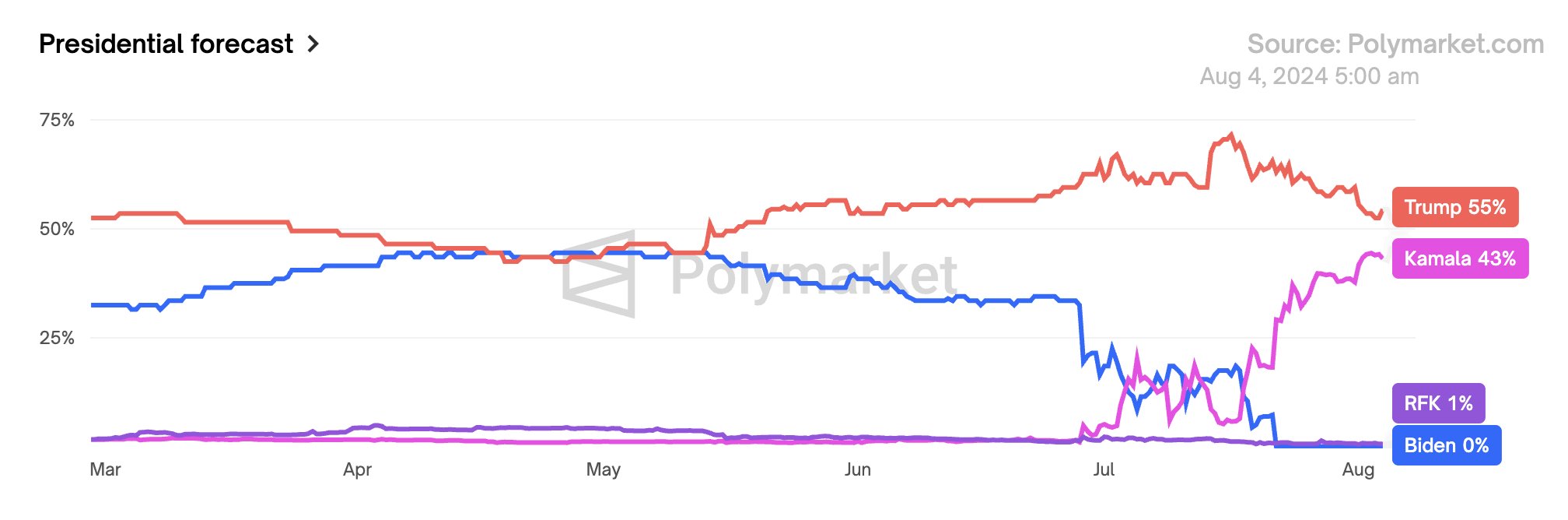

Another little important origin whitethorn impact the shifting governmental landscape, arsenic Kamala Harris gains according to Polymarkets against Donald Trump (Harris 43% vs. Trump 55%). This displacement is perceived negatively by the Bitcoin and crypto market. The full marketplace is favoring a Trump win. He wants to build a “strategic Bitcoin stockpile” and implicit the play said BTC could beryllium utilized to wage disconnected the US debt of $35 trillion.

Polymarket Trump vs Harris | Source: @jdorman81

Polymarket Trump vs Harris | Source: @jdorman81#6 Mt. Gox Distributions Still Affecting Market Liquidity

Finally, the ongoing organisation of Bitcoins from the defunct Mt. Gox speech continues to influence the market. As erstwhile users of the speech person and perchance merchantability their returned Bitcoins, this has added to the selling unit connected the market, further depressing prices.

At property time, BTC bounced disconnected the enactment and recovered to $52,909.

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)