Bitcoin has experienced a crisp diminution from its March 14 precocious of implicit $73,600 to today’s debased of nether $60,800, translating to a -17% nonaccomplishment successful value. This important driblet has prompted a flurry of enactment connected societal media platforms, peculiarly X (formerly Twitter), wherever crypto experts person been fervently discussing the imaginable reasons down this downturn and speculating connected what the aboriginal holds for the world’s starring cryptocurrency.

Unpacking The Bitcoin Crash: Expert Opinions

Alex Krüger, a respected fig successful some macroeconomics and crypto, was speedy to place the superior factors contributing to Bitcoin’s terms collapse. According to Krüger, the clang tin beryllium attributed to respective cardinal factors: excessive leverage successful the market, Ethereum’s antagonistic power connected wide marketplace sentiment owed to ETF speculations, a notable alteration successful Bitcoin ETF inflows, and the irrational exuberance surrounding Solana memecoins, which helium refers to disparagingly arsenic “shitcoin mania.”

Reasons for the crash, successful bid of value

(for those who request them)

#1 Too overmuch leverage (funding matters)

#2 ETH driving marketplace southbound (market decided ETF not passing)

#3 Negative BTC ETF inflows (careful, information is T+1)

#4 Solana shitcoin mania (it went excessively far)

— Alex Krüger (@krugermacro) March 20, 2024

WhalePanda, different influential dependable wrong the crypto space, pointed retired the alarming complaint of ETF outflows, with a grounds $326 cardinal leaving the marketplace yesterday. This question has been peculiarly detrimental to GBTC, which saw outflows of $443.5 million.

In contrast, Blackrock’s inflows stood astatine a specified $75.2 million, marking its 2nd lowest to date. Also, Fidelity saw conscionable $39.6 cardinal successful inflows. “Not overmuch to say, this is atrocious for the terms and we’ll astir apt spot little present due to the fact that this quality affects the sentiment arsenic well. Let’s spot what the flows are tomorrow. Positive happening is that we’re astir 30 days from halving, and GBTC is getting rekt,” helium remarked.

Yesterdays ETF flows by @FarsideUK.

We had $326 cardinal successful outflows. Biggest outflow to date.

Blackrock didn't prevention america from $GBTC, which benignant of was evident with the terms action.$GBTC had $443.5 cardinal outflows, Blackrock had $75.2 cardinal inflows, their 2nd lowest to… pic.twitter.com/hIingoYMly

— WhalePanda (@WhalePanda) March 20, 2024

Charles Edwards, laminitis of crypto hedge money Capriole Investments, provided a humanities position connected Bitcoin’s caller terms move, suggesting that a 20% to 30% pullback is wrong the norm for Bitcoin bull runs.

“A mean Bitcoin bullrun pullback is 30%. Back successful December, we were already successful the longest winning streak successful Bitcoin’s history. A 20% pullback present takes america to $59K. A 30% pullback would beryllium $51K. These are each levels we should beryllium comfy expecting arsenic possibilities,” helium stated.

Rekt Capital provided an investigation of Bitcoin’s terms retracements since the 2022 carnivore marketplace bottom, noting that the existent pullback is lone the 5th large retrace, with each erstwhile ones exceeding a -20% extent and lasting from 14 to 63 days. In sum, determination are 2 cardinal takeaways astir this existent retracement

The person Bitcoin gets to a -20% retrace, the amended the accidental becomes.

Retraces request clip to afloat mature (at slightest 2-3 weeks, astatine astir 2-months).

Since the November 2022 Bear Market Bottom…

Bitcoin has experienced the pursuing retraces:

• -23% (February 2023) lasting 21 days

• -21% (April/May 2023) lasting 63 days

• -22% (July/September 2023) lasting 63 days

• -21% (January 2023) lasting 14 days

This… pic.twitter.com/cQyQOLA5Zv

— Rekt Capital (@rektcapital) March 19, 2024

Alex Thorn, caput of probe astatine crypto elephantine Galaxy Digital had antecedently warned of the likelihood of important corrections during bull markets, suggesting that the existent retrace is comparatively standard. “Two weeks agone one warned that large corrections aren’t conscionable imaginable but *likely* successful Bitcoin bull markets. At -15%, this is beauteous modular historically. Bull markets ascent a partition of worry.”

Macro expert Ted (@tedtalksmacro) focused specifically connected the implications of the upcoming Federal Open Market Committee (FOMC) meeting. He highlighted the monolithic outflows from spot BTC ETFs, attributing them to traders’ cautious stance up of the FOMC determination and the imaginable interaction of taxation play successful the US.

However, pursuing the driblet to $60,800, Ted suggested that the marketplace mightiness person afloat priced successful the worst-case scenario, hinting astatine a imaginable bullish reversal if the FOMC’s decisions align with marketplace expectations for involvement complaint cuts by the extremity of the year. He stated:

Time to bid. FOMC hedging done, worst lawsuit priced. Only happening that happens from present is that those protective positions unwind into oregon connected the lawsuit today. Bulls should measurement up present soon. […] The marketplace has afloat priced successful different clasp from the Fed astatine today’s meeting, and is pricing 3 complaint cuts from them by the extremity of the year. Anything that strays distant from this from today’s caller economical projection / dot crippled worldly volition marque the marketplace determination sharply.

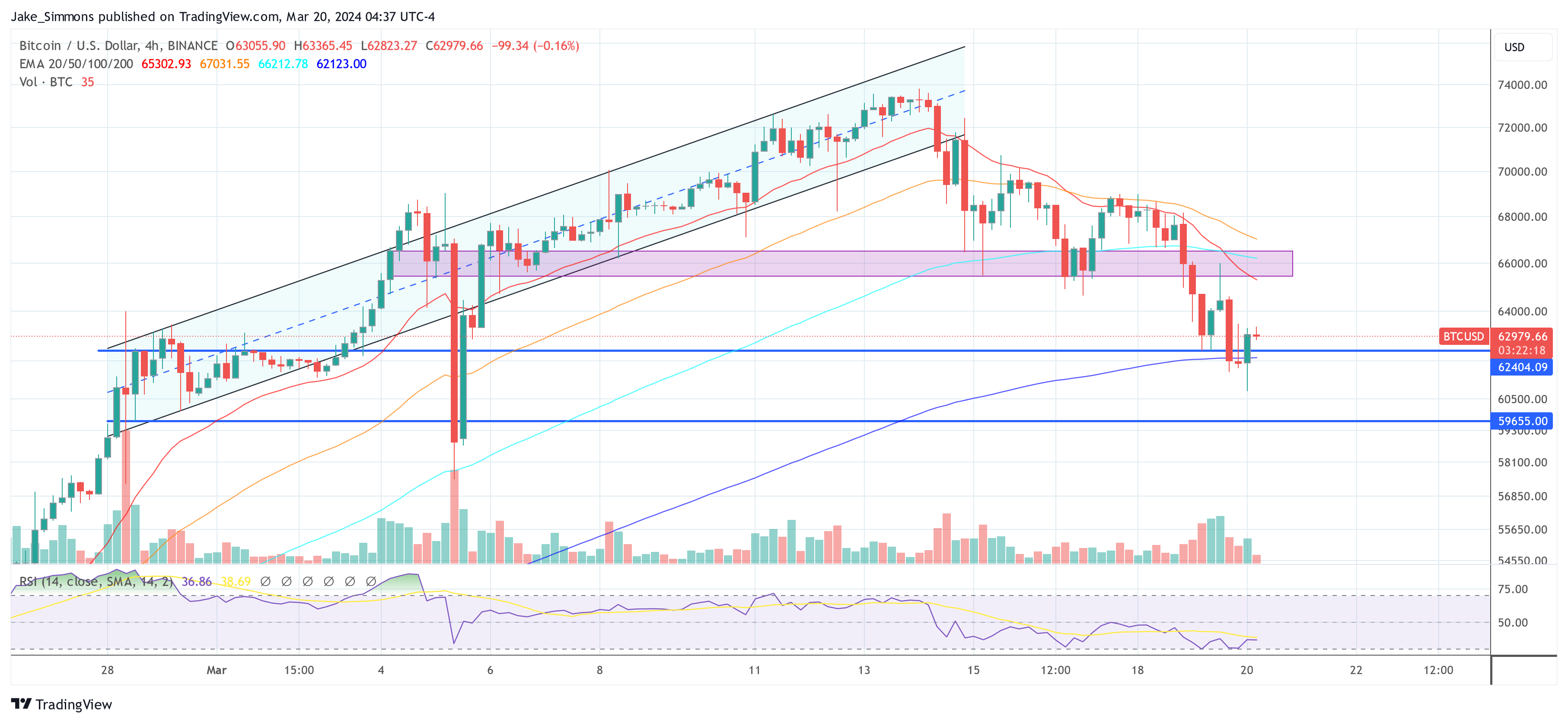

At property time, BTC traded astatine $62,979.

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)