Bitcoin (BTC) has witnessed a important drop, falling to $56,556 during Wednesday greeting successful Europe, marking the lowest constituent since precocious February. This downturn represents the sharpest monthly diminution since November 2022, with BTC tumbling astir 7.5% wrong the past 24 hours and breaching the antecedently unchangeable $60,000 enactment precocious Tuesday.

#1 Derisking Before Today’s FOMC Meeting

Anticipation and anxiousness are precocious successful fiscal circles arsenic the Federal Open Market Committee (FOMC) is acceptable to denote its involvement complaint determination aboriginal today. This lawsuit is important arsenic the crypto market, notably Bitcoin, has grown progressively reactive to macroeconomic signals.

Recent data, reflecting a slowdown successful GDP maturation coupled with persistent inflation, has importantly reduced expectations of involvement complaint cuts by the Federal Reserve. “Bitcoin and different hazard assets are presently feeling the unit from a stagflationary environment, geopolitical tensions, and seasonal liquidity variations,” remarked Ted from TalkingMacro.

Initially, up to 7 complaint cuts were anticipated by the extremity of 2024, a sentiment that has shifted dramatically with the marketplace present pricing successful lone 1 imaginable chopped by December 2024. This displacement comes amidst an situation wherever ostentation information is trending upwards, challenging the Federal Reserve’s presumption and perchance starring to a much cautious attack from Jerome Powell, the Fed Chairman.

“For the archetypal clip successful caller memory, the marketplace is calling the Fed’s bluff, rapidly front-running the thought that the Fed whitethorn not chopped astatine each successful 2024,” noted Ted.

#2 Cyclical Bitcoin Correction Phase

Following an exceptional rally since the year’s start, the marketplace is undergoing a earthy correction phase. Prior to the terms crash, Charles Edwards, laminitis of Capriole Investments, noted: “We are a time abbreviated of breaking the grounds acceptable successful 2011 for days without a meaningful dip [-25%],” emphasizing the bonzer quality of Bitcoin’s caller performance.

Scott Melker, known arsenic “The Wolf Of All Streets,” highlighted method indicators that suggested an impending correction. “Broke and retested scope lows arsenic resistance. […] My biggest interest I person been discussing for months [was] that RSI ne'er made the travel to oversold. Almost determination now, each little clip frames oversold. This is inactive ONLY A 23% correction, precise shallow for a bull marketplace and accordant with different corrections connected this run. We are yet to spot a 30-40% propulsion backmost during this bull market, similar those of the past.”

$BTC Daily

Broke and retested scope lows arsenic resistance. Nothing but aerial until astir $52,000 connected the chart.

My biggest interest I person been discussing for months (in newsletter) is that RSI ne'er made the travel to oversold.

Almost determination now, each little clip frames oversold.

This… pic.twitter.com/5YZTWipBo8

— The Wolf Of All Streets (@scottmelker) May 1, 2024

#3 Profit-Taking

Traditional concern markets and seasoned investors are seizing the accidental to instrumentality profits pursuing important gains. “TradFi/Boomers are taking profits: CME Open Interest is decreasing rapidly, April 29th 135,6k coins, April 30th 123,9k coins, topped astir 170.4k coins (March 20th),” explained crypto expert RunnerXBT.

This inclination confirms a broader profit-taking strategy station important events similar the ETF support and the anticipation astir the Bitcoin halving. “That […] confirms my thesis that a batch of these guys longed successful October 2023 due to the fact that of ETF support and BTC halving, commercialized played retired and present they are taking profits (yes they are inactive up a lot), due to the fact that they longed BTC not dormant altcoins.”

TradFi/Boomers are taking profits ✅

CME Open Interest is decreasing rapidly

April 29th 135,6k coins

April 30th 123,9k coins

Topped astir 170.4k coins (March 20th)

That astatine slightest for maine confirms my thesis that a batch of these guys longed successful October 2023 due to the fact that of ETF approval… pic.twitter.com/M8KY1NfCtK

— RunnerXBT (@RunnerXBT) May 1, 2024

#4 US ETF Flows And Hong Kong Disappointment

The dynamics surrounding spot Bitcoin ETFs person shown important strains, evidenced by caller activities successful some US and Hong Kong markets. In the United States, Bitcoin exchange-traded funds (ETFs) faced important outflows, indicating a cooling capitalist sentiment.

According to caller data, the full outflows from US spot Bitcoin ETFs amounted to $161.6 million. Notably, the Grayscale Bitcoin Trust (GBTC) experienced outflows of $93.2 million, portion Fidelity and Bitwise registered outflows of $35.3 cardinal and $34.3 million, respectively. BlackRock had zero nett flows erstwhile again. These numbers suggest a retreat successful organization interest, which has traditionally been a bulwark against terms volatility.

Parallel to the US, the debut of Bitcoin ETFs successful Hong Kong besides faltered importantly beneath expectations. Six recently launched ETFs, intended to seizure some Bitcoin and Ethereum markets, collectively reached conscionable $11 cardinal successful trading volume, starkly underperforming against the anticipated $100 million. The spot Bitcoin ETFs accounted for $8.5 cardinal successful trading volume. This was markedly little than the motorboat time volumes of US-based spot Bitcoin ETFs, which had reached $655 cardinal connected their archetypal day.

#5 Long Liquidations

The marketplace has besides been impacted by important agelong liquidations, with a full of $451.28 cardinal liquidated successful the past 24 hours alone. The largest azygous liquidation was an ETH-USDT-SWAP connected OKX valued astatine $6.07 million, but Bitcoin-specific liquidations were important arsenic well, totaling $143.04 million, according to data from CoinGlass. These liquidations person amplified the selling unit connected Bitcoin.

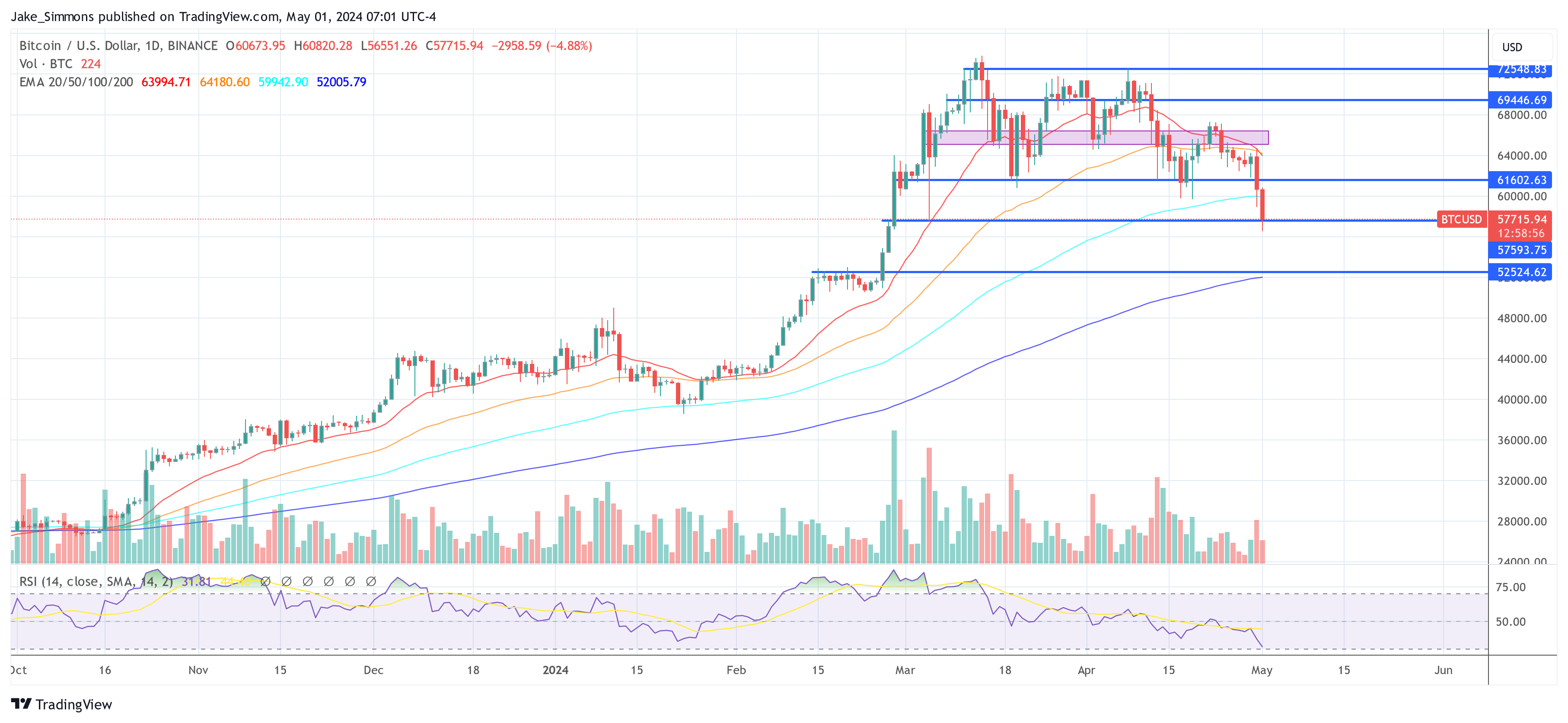

At property time, BTC traded astatine $57,715.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)