Just beneath the all-time precocious of $69,000, the Bitcoin terms has shown much volatility successful caller days, lone to present tread h2o astir $67,000. But this boredom could soon beryllium over. Following the caller price movements, a notable signifier has emerged connected the Bitcoin (BTC) terms chart, arsenic recognized by the seasoned crypto expert Josh Olszewicz.

Bitcoin Price Rallye To $76,000 Next?

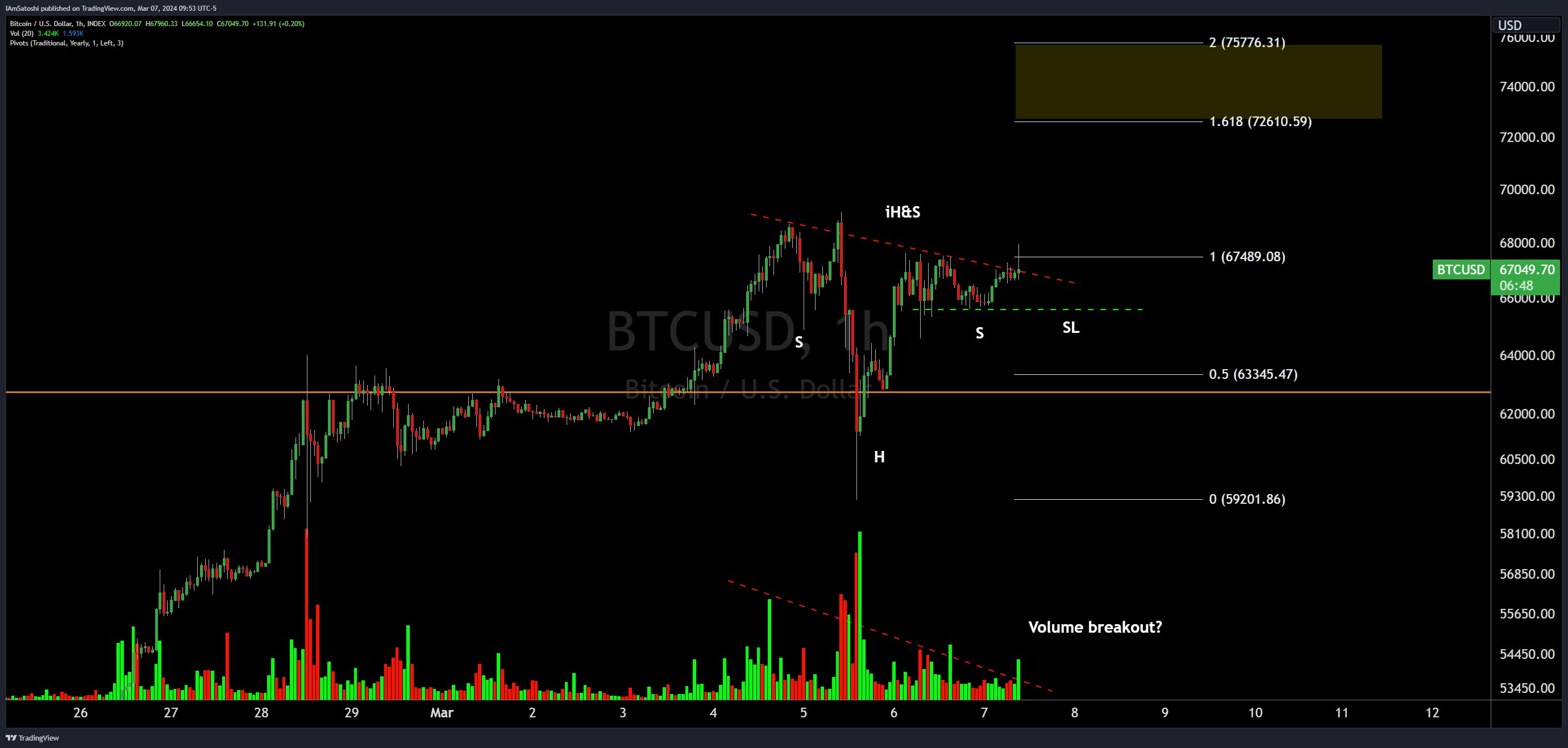

An inverse caput and shoulders (iH&S) pattern, often seen arsenic a bullish indicator, has formed connected the Bitcoin 1-hour chart, suggesting a imaginable upward terms movement. This pattern, portion admittedly imperfect arsenic per Olszewicz, is considered tradeable successful his view. “[The] signifier is decidedly not cleanable but inactive tradeable imo,” helium remarked.

An Inverse Head and Shoulders (iH&S) signifier is simply a bullish reversal pattern successful method analysis, signaling a imaginable upward reversal successful terms trends. It consists of 3 troughs with the mediate trough being the lowest, resembling the signifier of a caput and 2 shoulders, but flipped upside down.

Bitcoin inverse caput and shoulders (iH&S) pattern, 1-hour illustration | Source: X @CarpeNoctom

Bitcoin inverse caput and shoulders (iH&S) pattern, 1-hour illustration | Source: X @CarpeNoctomIn this scenario, Bitcoin’s illustration shows the enactment with a caput astatine astir $59,000 and shoulders forming astir the $65,000 and $65,700 mark. The signifier suggests that a bullish determination is brewing. Traders often usage iH&S patterns to place imaginable buying opportunities, with introduction points typically adjacent the neckline breakout.

The analyst’s illustration points to a neckline (dotted reddish line) slanting downward, intersecting with the close enarthrosis successful the coming days. A breakout supra this enactment is typically required to corroborate the pattern. At the existent price, Bitcoin is trading conscionable beneath the neckline.

For traders eyeing imaginable targets, Olszewicz’s investigation projects an ambitious extremity of $73,000 to $76,000, aligned with the Fibonacci hold levels of 1.618 ($72,610.59) and 2 ($75,776.31). These levels correspond important terms points that Bitcoin mightiness trial if the signifier is confirmed with a coagulated breakout.

One constituent that could fortify the imaginable upward travel is simply a measurement breakout, which the expert has hinted astatine with a question mark. The measurement indicator connected the illustration shows an expanding trend, but a decisive surge successful measurement is typically sought aft to corroborate an iH&S pattern.

Moreover, Olszewicz has marked a imaginable halt nonaccomplishment (SL) level with a dashed greenish line. This level astir $65,680 serves arsenic a hazard absorption instrumentality for traders should the signifier neglect to recognize the upward breakout.

At property time, BTC traded astatine $67,124.

BTC terms is conscionable beneath the important absorption line, 1-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms is conscionable beneath the important absorption line, 1-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)