Bitcoin is moving connected its second-best September show ever arsenic this bull marketplace progressively stands retired from those earlier it.

Key points:

Bitcoin is bucking seasonality trends by adding 8%, making this September its champion since 2012.

September 2025 would request to spot 20% upside to go Bitcoin’s strongest ever.

BTC terms volatility is astatine levels seldom seen earlier successful an antithetic bull cycle.

Bitcoin (BTC) has gained much this September than immoderate twelvemonth since 2012, a caller bull marketplace record.

Historical terms information from CoinGlass and BiTBO confirms that astatine 8%, Bitcoin’s September 2025 upside is its second-best ever.

Bitcoin avoiding “Rektember” with 8% gains

September is traditionally Bitcoin’s weakest month, with mean losses of astir 8%.

This year, the stakes are precocious for BTC terms seasonality, arsenic humanities patterns request the adjacent bull marketplace highest and different hazard assets acceptable repeated caller all-time highs.

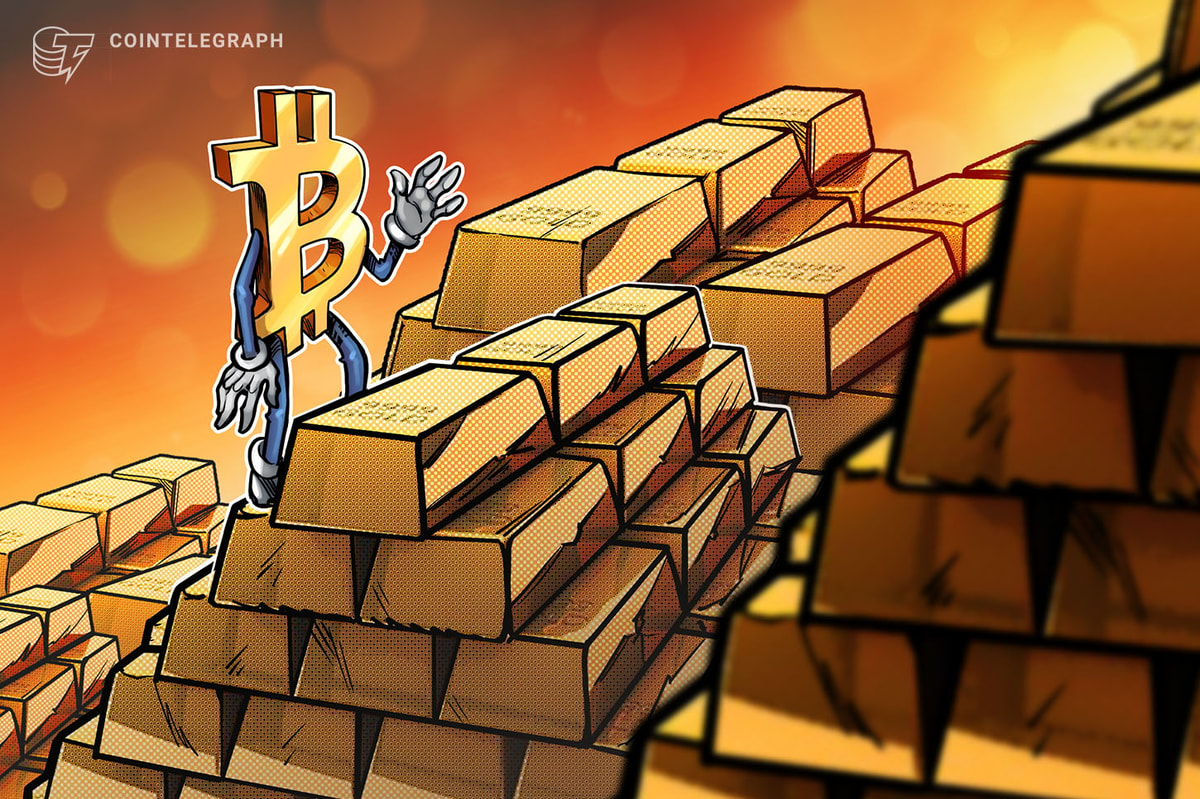

While some golden and the S&P 500 are successful terms discovery, BTC/USD has coiled passim September aft setting caller highs of its own the period prior.

Even astatine “just” 8%, however, this September’s show is presently capable to marque it Bitcoin’s strongest successful 13 years.

The lone clip that the ninth period of the twelvemonth was much profitable for Bitcoin bulls was successful 2012, erstwhile BTC/USD gained astir 19.8%. Last year, upside topped retired astatine 7.3%.

BTC terms volatility vanishes

The figures underscore a highly antithetic bull marketplace highest twelvemonth for Bitcoin.

Related: BTC ‘pricing in’ what’s coming: 5 things to cognize successful Bitcoin this week

Unlike erstwhile bull markets, BTC terms volatility has died disconnected successful 2025, against the expectations of longtime marketplace participants based connected anterior performance.

CoinGlass information shows volatility dropping to levels not seen successful implicit a decade, with a peculiarly crisp driblet from April onward.

Onchain analytics steadfast Glassnode, meanwhile, highlights the deficiency of severity of BTC terms drawdowns from all-time highs this bull market.

These person antecedently reached 80%, but truthful acold successful 2025, 30% remains the largest.

The comparative deficiency of volatility nevertheless reflects successful bull marketplace performance, with BTC/USD struggling to vie with erstwhile cycles.

In July, Cointelegraph reported connected imaginable 50% terms gains pursuing unusually debased readings from the Bitcoin Implied Volatility Index metric.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 hour ago

1 hour ago

English (US)

English (US)