Charles Edwards, the laminitis of hedge money Capriole Investments, offered an in-depth analysis of the Bitcoin marketplace yesterday. His reappraisal offers a granular position connected the aftermath of the historical ETF launches, the pivotal relation of large players similar Grayscale, and the interplay of marketplace mechanics shaping Bitcoin’s trajectory.

Bitcoin Market Summary: ETF Launch

Edwards acknowledged the ETF launches arsenic a pivotal moment, characterizing it arsenic “ETF Mania.” He emphasized the hindsight realization that the ETF motorboat triggered a short-term “sell the quality event.” Edwards elucidated, “A information of this tin beryllium attributed to the Grayscale outflows of implicit $4B, astir fractional of which was forced selling by the FTX bankruptcy estate and different mates cardinal apt to screen Grayscale’s indebtedness obligations.”

However, helium projects a displacement successful the outflow complaint from Grayscale, stating, “I expect the existent complaint of outflow volition driblet to a much sustainable trickle implicit the adjacent fewer weeks (after different fewer cardinal out).” Edwards besides highlighted the extremity of Grayscale’s multi-year lock-up period, allowing semipermanent investors to yet adjacent their GBTC positions astatine marketplace prices.

Regarding Blackrock and Fidelity ETFs, Edwards noted their significance, saying, “The marque names of these 2 behemoths successful the accepted plus absorption abstraction means each cardinal they bring in, adds an bid of magnitude much credibility (and truthful flows) into Bitcoin and crypto arsenic a whole.”

BTC Technical Analysis

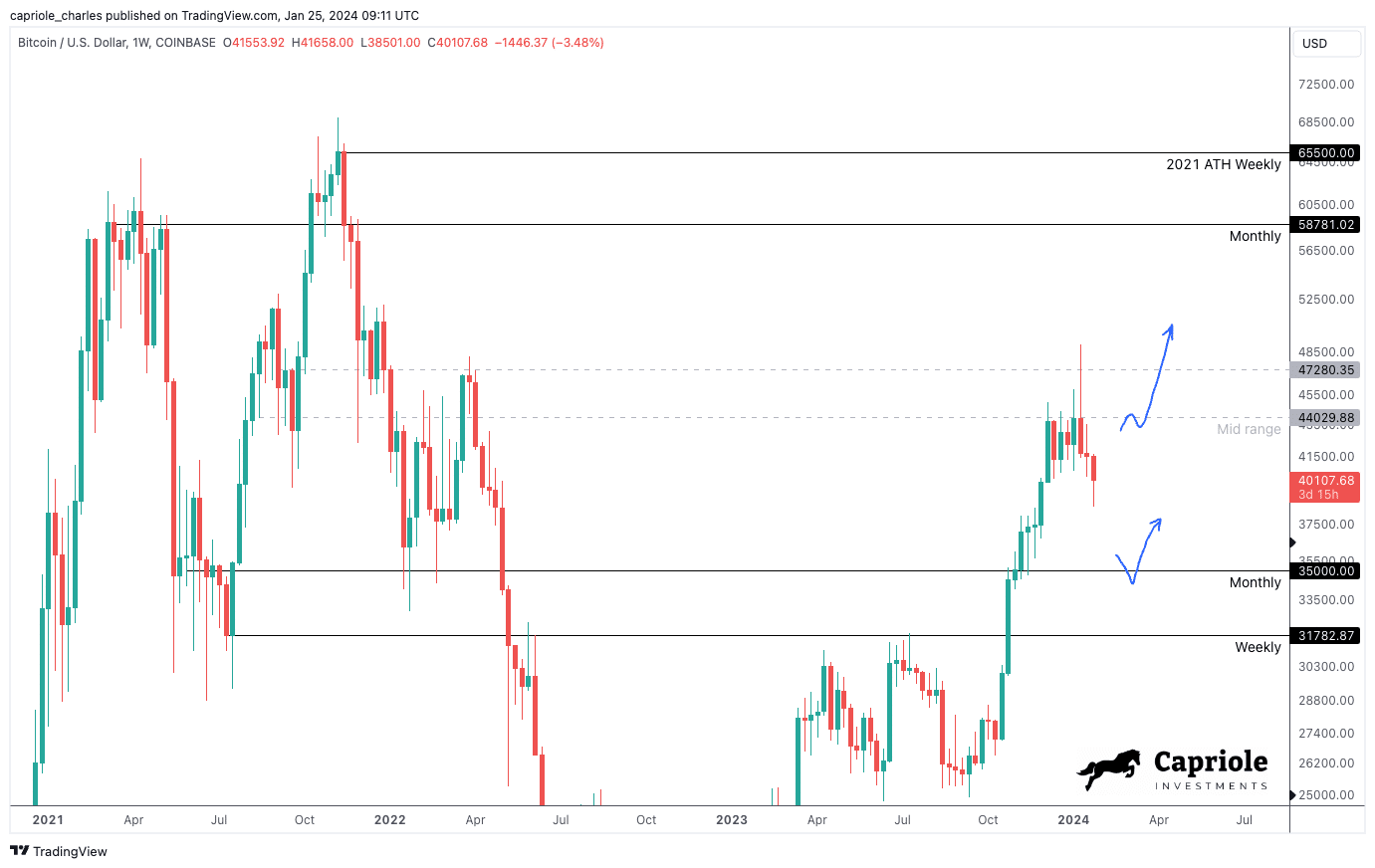

In his precocious timeframe technicals (HTF) analysis, Edwards observed a beardown rejection astatine mid-range absorption during the ETF launch. He pointed out, “The nearest HTF enactment astatine $35K would apt correspond a large accidental to get agelong for the 2024 Halving twelvemonth (if we are fortunate capable to get there).” Edwards besides mentioned, “Alternatively, a beardown adjacent supra $44K volition apt spot the inclination proceed to scope highs ($60K).”

Bitcoin terms investigation | Source: Capriole Investments

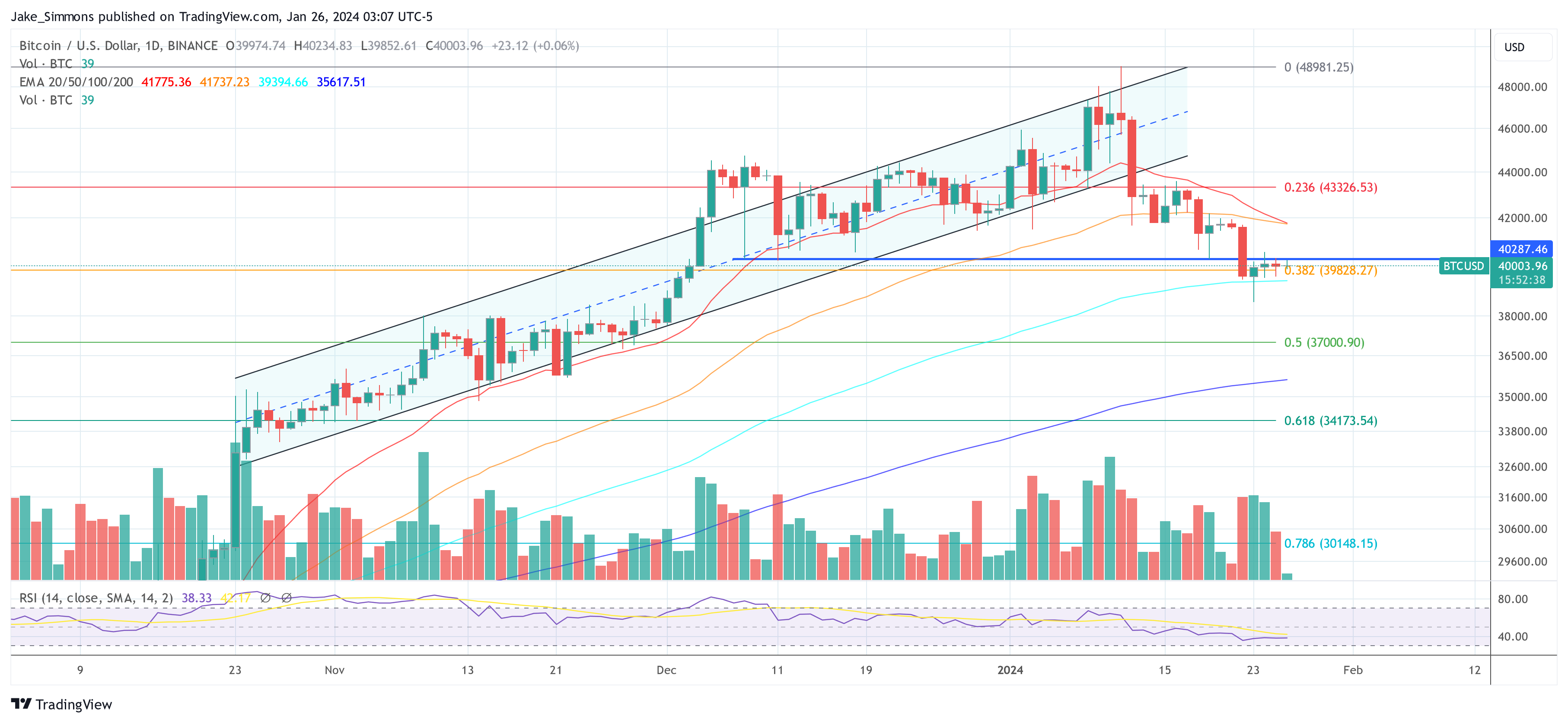

Bitcoin terms investigation | Source: Capriole InvestmentsFor debased timeframe technicals (LTF), helium dissected the December/January consolidation and the $44K “fakeout” during the ETF launch. Edwards explained, “Fakeouts often resoluteness successful terms movements to the different broadside of the range, arsenic we saw.” He added:

Therefore, the astir absorbing terms constituent locally is $41K. A regular adjacent supra $41K would apt correspond a downtrend fakeout and a swift instrumentality to scope precocious astatine $44K (+). If we simply wick into $41K and commencement trending backmost down, that would beryllium a large risk-off trigger for a imaginable determination little toward $35K HTF support.

Fundamentals: The Role Of On-Chain Data

Edwards underscored the value of fundamentals and on-chain information successful knowing marketplace dynamics. He introduced Capriole’s Bitcoin Macro Index, stating, “This Index includes implicit 50 of the astir almighty Bitcoin on-chain, macro marketplace and equities metrics combined into a azygous instrumentality learning model. This is simply a axenic fundamentals-only worth investing attack to Bitcoin. Price isn’t an input.”

According to him, fundamentals person entered a play of slowdown which aligned with the adjacent apical astatine the ETF launch. “That cardinal slowdown continues contiguous with terms down -20% from the highs successful January truthful far,” Edwards remarked.

Chart Of The Week

The hedge money manager besides introduced the Advance-Decline (AD) Line arsenic a illustration of the week. He explained, “The AD Line is calculated arsenic the cumulative sum done clip of each day’s number of advances little declines.” Edwards highlighted its relevance, stating, “Today we are seeing the archetypal specified breakout since 2016.”

He drew parallels betwixt the AD Line’s breakout and Bitcoin’s humanities performance, noting, “During these periods successful 2013 and 2016, Bitcoin was besides successful a drawdown from all-time-highs (like today) and began 2 of its largest cyclical rallies successful history.”

The Opportunity Of The Year

In conclusion, Edwards offered a nuanced outlook. He cautioned, “Bitcoin astatine $39-40K is not a screaming bargain today.” However, helium projected, “The accidental of the twelvemonth apt awaits successful the $32-35K region, which if we are fortunate capable to see, volition astir apt beryllium the past clip we ever spot it.”

Edwards concluded with a forward-looking perspective, stating, “Pending that, we await patiently for a momentum breakout of $41K (aggressive) and $44K (conservative) for resumption of the nutrient of the superior 2024 trend. Up.”

At property time, BTC traded astatine $40,003.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)