Bitcoin has shattered erstwhile records, soaring past the $100,000 milestone for the archetypal clip ever to scope an all-time precocious of $104,088 precocious Wednesday successful New York. The flagship cryptocurrency had dipped to $94,587 connected Wednesday but staged a singular comeback. Several cardinal factors contributed to this unprecedented surge:

#1 Fed Chair Powell Compares Bitcoin To Gold

In a important acknowledgment from the accepted fiscal sector, Federal Reserve Chair Jerome Powell discussed Bitcoin during the New York Times DealBook Summit. When questioned astir the cognition of Bitcoin arsenic a awesome of religion oregon deficiency thereof successful the US dollar and the Federal Reserve, Powell offered a nuanced perspective.

“I don’t deliberation that’s however radical deliberation astir it,” Powell remarked. “People usage Bitcoin arsenic a speculative asset, right? It’s similar gold. It’s conscionable similar gold, lone it’s virtual. It’s digital. People are not utilizing it arsenic a signifier of outgo oregon arsenic a store of value. It’s highly volatile. It’s not a rival for the dollar; it’s truly a rival for gold.”

This examination to gold, a accepted store of value, was astir apt seen by galore arsenic different beardown legitimization of Bitcoin successful the fiscal ecosystem.

If your cardinal slope owns gold, but rejects integer gold… they’re done. How did betting against digitalization enactment for kodak, blockbuster, sears, yellowish pages, quality papers, taxis, postal service, libraries, question agents, etc?

It’s the astir evident commercialized successful past https://t.co/tdJp8XCTjO

— David Bailey🇵🇷 $0.85mm/btc is the level (@DavidFBailey) December 4, 2024

#2 Russia’s Putin Signals Openness To Bitcoin

Adding to the momentum, Russian President Vladimir Putin made comments during the Russia Calling forum that galore construe arsenic an endorsement of Bitcoin.

“Who tin prohibition Bitcoin? Nobody,” Putin stated. “And who tin prohibit the usage of different physics means of payment? Nobody. Because these are caller technologies. And nary substance what happens to the dollar, these tools volition make 1 mode oregon different due to the fact that everyone volition strive to trim costs and summation reliability.”

The backdrop to Putin’s comments includes speculation astir a forthcoming “Bitcoin Space Race” betwixt planetary superpowers. President-elect Donald Trump, during his predetermination run and astatine the Bitcoin 2024 league successful Nashville, pledged to found a Strategic Bitcoin Reserve successful the United States. He adjacent suggested that portion of the US indebtedness could beryllium “paid off” with Bitcoin.

David Bailey, CEO of BTC Inc and advisor to Trump’s team, emphasized the urgency of this inaugural connected X: “The Bitcoin Space Race is here. […] It couldn’t beryllium much wide what’s happening. It indispensable beryllium a nationalist precedence to basal up the Strategic Bitcoin Reserve successful the archetypal 100 days of the Trump admin. We request an assertive program to turn USA’s proportional ownership of the Bitcoin supply.”

It couldn’t beryllium much wide what’s happening.

It indispensable beryllium a nationalist precedence to basal up the Strategic Bitcoin Reserve successful the archetypal 100 days of the Trump admin. We request an assertive program to turn USA’s proportional ownership of the Bitcoin supply. https://t.co/a85wLNoXSS

— David Bailey🇵🇷 $0.85mm/btc is the level (@DavidFBailey) December 4, 2024

#3 Strong Spot Demand And Institutional Interest

The surge was underpinned by robust spot marketplace enactment and important organization participation. During the ascent, unfastened involvement successful Bitcoin futures skyrocketed by much than $4 billion, according to data by Coinalyze. Funding rates besides reached unprecedented levels, surpassing peaks seen 2 weeks agone erstwhile Bitcoin archetypal deed $99,500.

Importantly, the rally was driven by spot markets and not lone derivative speculation, indicating a steadfast and sustained demand. The infamous “Great Sell Wall” astatine $100,000, which had antecedently resisted upward movement, was decisively breached connected the 2nd attempt.

Market analysts are speculating that large players similar Michael Saylor whitethorn person been down the important buying pressure. Notably, MARA Holdings, Inc., the largest publically traded Bitcoin mining institution by marketplace capitalization, precocious raised $850 cardinal done an offering of zero-coupon convertible elder notes owed 2031. While unconfirmed, determination is simply a beardown anticipation that MARA utilized these funds to accumulate Bitcoin during the terms run-up.

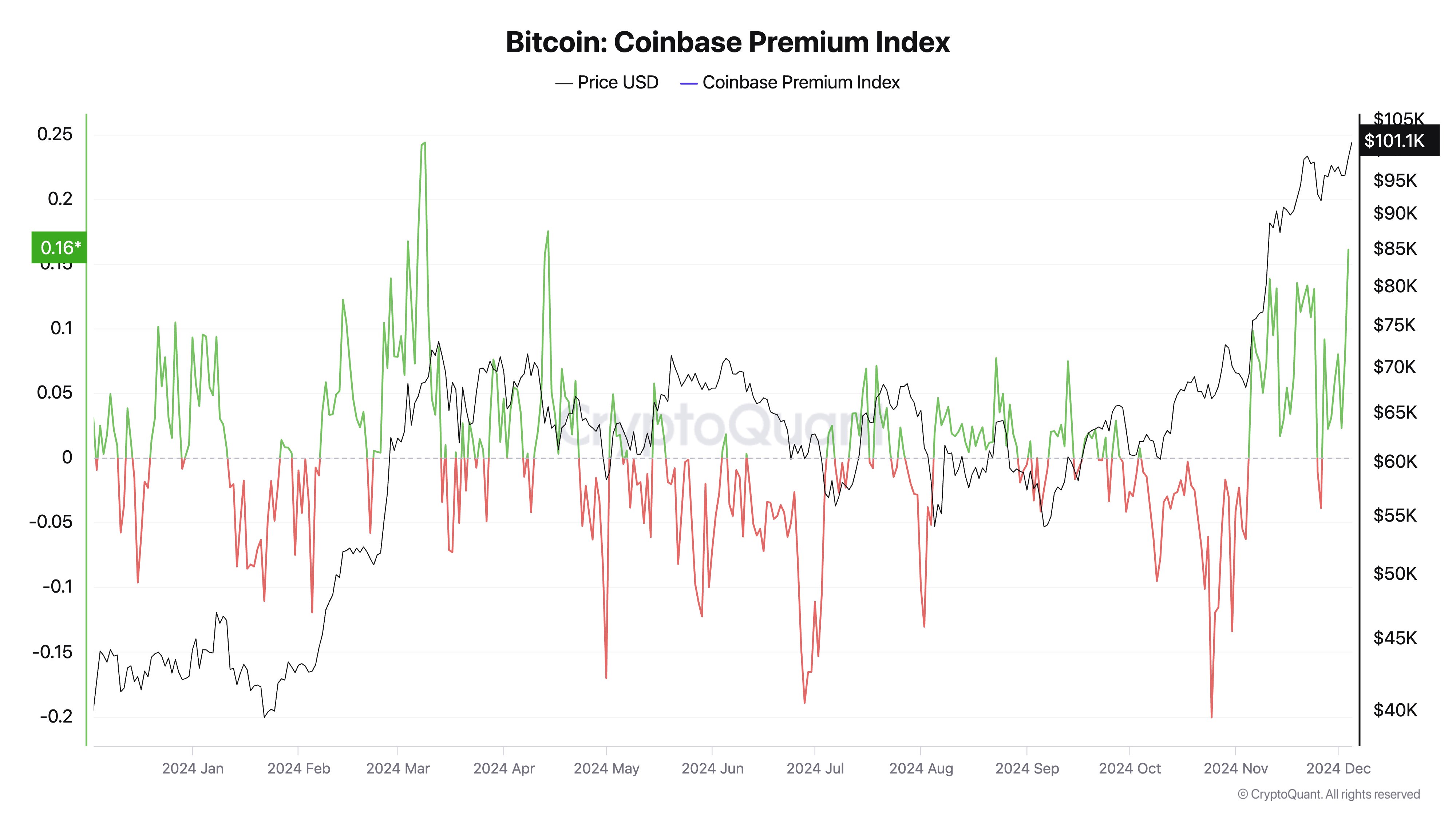

Supporting this notion, CryptoQuant reported: “Bitcoin passes $100k arsenic organization request drives the market. The Coinbase Premium Index highlights sustained buying unit from US investors.”

Bitcoin Coinbase Premium | Source: X @cryptoquant_com

Bitcoin Coinbase Premium | Source: X @cryptoquant_com#4 Retail Market In Disbelief

Despite the bullish momentum, retail traders look to beryllium successful a authorities of disbelief. On-chain analytics steadfast Santiment observed that portion whale accumulation continues to strengthen, retail sentiment remains cautious.

Santiment noted: “With whale accumulation continuing to look strong, the lone origin holding backmost $100K BTC past being made is retail traders’ excitement.” The steadfast highlighted that the commencement of December saw expanding skepticism and expectations of a important terms retracement pursuing November’s historical gains. However, the existent societal media scenery reflects “hesitance and uncertainty from traders,” with a ratio of antagonistic to affirmative commentary.

“With galore indications implicit the years that crypto markets determination the other absorption of the crowd’s expectations, we should consciousness encouraged by our chap traders’ FUD and precocious profit-taking,” Santiment added. “There whitethorn beryllium a spot much of a conflict betwixt bulls and bears astatine this level, but we could spot the long-awaited milestone travel to fruition precise soon arsenic agelong arsenic cardinal stakeholders proceed their postulation of much and much BTC.”

At property time, BTC traded astatine $102,681.

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)