The Bitcoin terms has rallied accelerated successful the past fewer days arsenic a effect of the BlackRock news. The large question is whether the bulls tin proceed to propulsion the terms upwards, oregon whether they are dilatory moving retired of steam. With this successful mind, determination is presently a striking similarity successful the 1-day illustration of BTC to the rally successful mid-March 2023.

Back then, the BTC terms experienced a setback of implicit 22% aft reaching a one-year precocious astatine $25,200. News from the macro and crypto situation were highly bearish aft USDC mislaid its peg to the US dollar and a renewed banking situation loomed. However, arsenic a effect of rumors of a Silicon Valley Bank (SVB) bailout, BTC kicked disconnected a 46% surge. Remarkably, this occurred successful a double-pump with a one-day breather.

Bitcoin terms up for a 2nd limb up?, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms up for a 2nd limb up?, 1-day illustration | Source: BTCUSD connected TradingView.comFast-forward to today, Bitcoin whitethorn beryllium successful that presumption again. As the Bitcoin terms dipped beneath $25,000 connected June 14, the quality were ultra bearish (Tether FUD, SEC lawsuits, and more). Once again, however, BTC was saved by bullish news: BlackRock’s filing for a Bitcoin spot ETF.

Since the news, BTC has risen by implicit 20%. Yesterday, the terms took a breather. The million-dollar question: Will the 2nd portion of the pump travel today, arsenic successful March, oregon has Bitcoin already experienced the treble pump (see yellowish circles). In this case, June 18 could person been the equivalent to the one-day breather of the March rally.

Data Supports Bitcoin Bulls, But Caution Is Warranted

According to the analysts astatine Greeks.live, BTC options whitethorn go important today. A full of 31,000 BTC options expire contiguous with a put-call ratio of 0.73, a maximum symptom constituent of $27,000 and a notional worth of $930 million. Stimulated by the emergence of BTC, the worth of BTC options positions accrued by astir 50% this week.

“The existent BTC and ETH each large word IV inversion is obvious, present cross-currency IV arbitrage is precise cost-effective, BTC IV semipermanent higher than the ETH is not sustainable,” the analysts note.

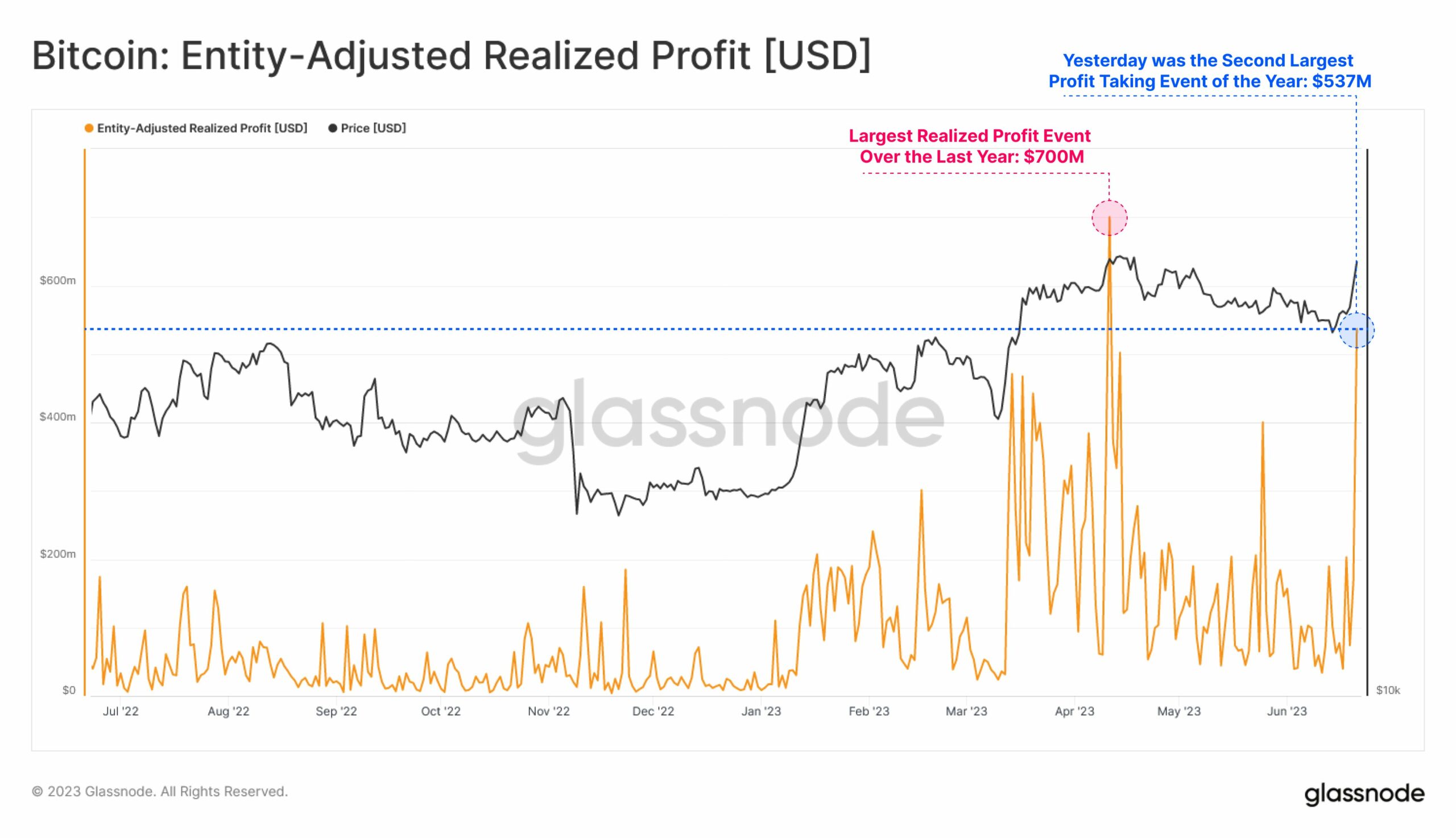

Meanwhile, the on-chain experts from Glassnode stated yesterday that aft the caller rally successful the Bitcoin price, marketplace participants took a non-trivial nett of $537 million, the second-largest profit-taking successful the past year.

Bitcoin: Entity adjusted-realized nett | Source: Twitter @glassnode

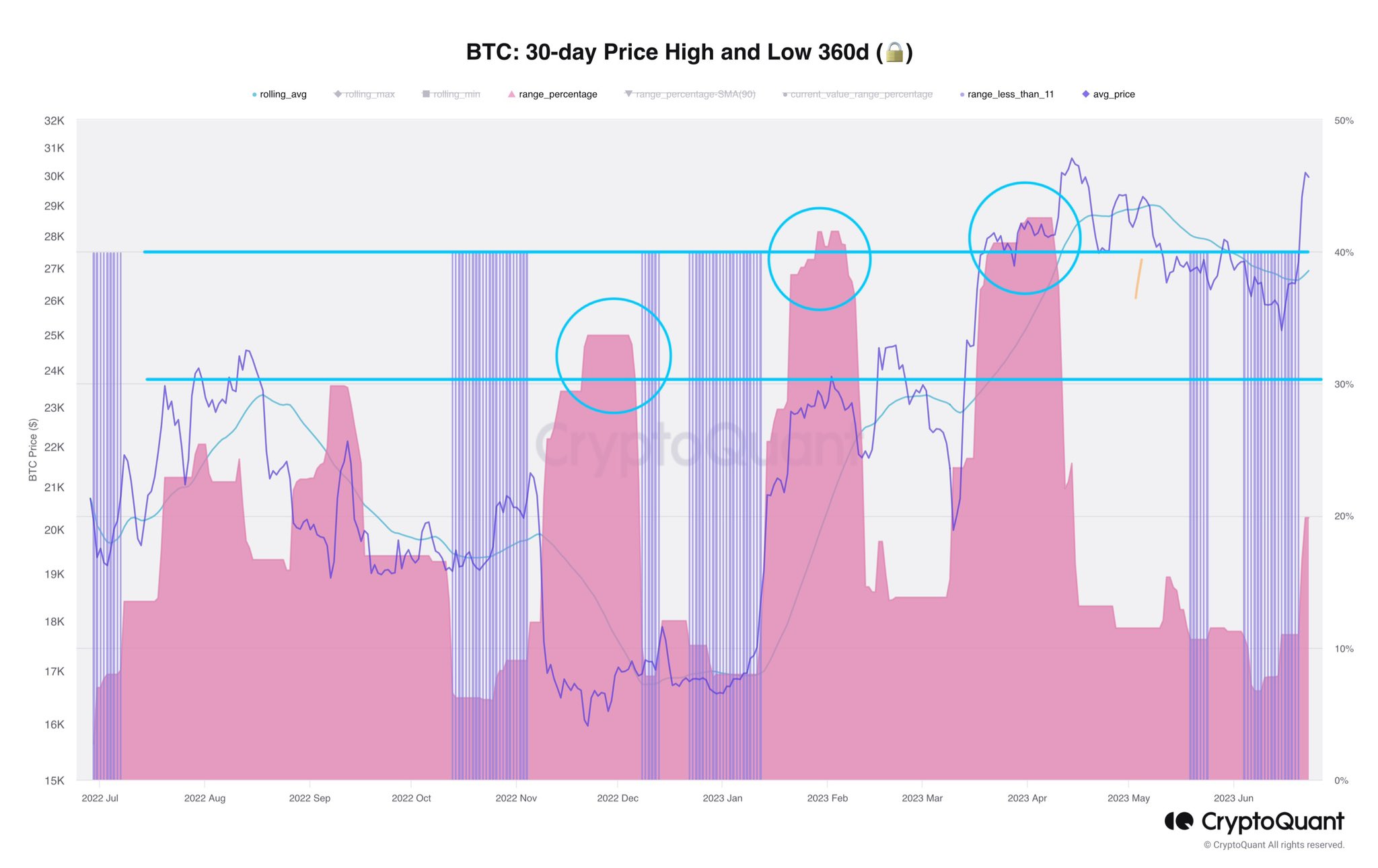

Bitcoin: Entity adjusted-realized nett | Source: Twitter @glassnodeHowever, different on-chain information presented by expert Axel Adler Jr shows that determination is inactive imaginable for a 2nd limb up. As Adler writes, periods of debased volatility (blue peaks) person historically been followed by accelerated terms movements (pink). These rallies person been bigger than the 1 BTC experienced implicit the past fewer days. Adler remarked:

Over the past year, specified fluctuations person reached up to 30-40%. We are presently experiencing different pinkish spike!

Bitcoin volatility | Source: Twitter @AxelAdlerJr

Bitcoin volatility | Source: Twitter @AxelAdlerJrCrypto trader @DaanCrypto besides sees much upside imaginable looking astatine the spot premium: “Bitcoin spot premium already back. Usually not however tops look like. The $31K yearly precocious is the main country of interest.”

Featured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)