During the archetypal week of July, bitcoin prices person risen to their highest level since mid-June, coming arsenic U.S. Non-Farm Payrolls handsomely bushed expectations. However, arsenic we caput into the remaining weeks of the month, questions inactive linger connected if this momentum tin beryllium maintained, contempt the existent uncertainty successful the market.

Bitcoin’s Current Market Status

Looking backmost astatine June, bitcoin (BTC) started the period trading astir the $30,000 mark, nevertheless precisely 4 weeks agone today, prices fell significantly, with markets inactive yet to retrieve from this drop.

Between June 8th – 18th, BTC/USD went from a highest of $31,600, to a level of $17,612, coming arsenic ostentation successful the U.S. continued to emergence astatine historical levels.

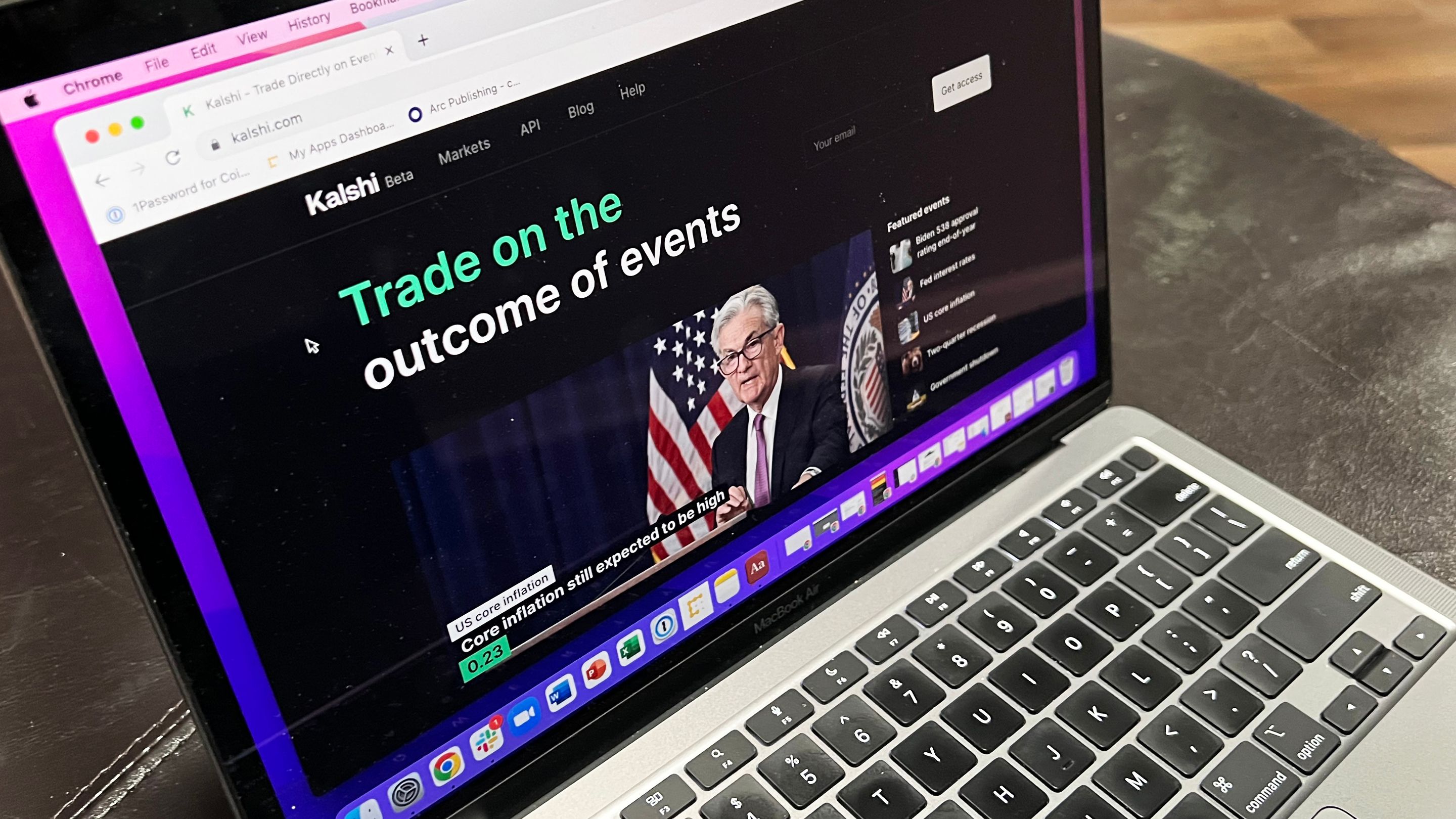

This forced the Federal Reserve to erstwhile again hike rates, expanding them by arsenic overmuch arsenic 75 ground points successful hopes of curving spending.

The hike somewhat helped boost marketplace confidence, with traders opting to bargain June’s dip, however, for the astir part, prices person been trading beneath $21,000.

However, pursuing 5 consecutive days of gains, BTC is trading adjacent to the $21,800 level, which is marginally little than today’s high, which was nearer to a cardinal absorption point.

Although determination was an earlier breakout, prices are present beneath this hurdle, with volatility erstwhile again higher, leaving galore traders uncertain astir however the remainder of the period volition cookware out.

Stories of terrible multi-million-dollar liquidations, alleged insolvencies, and bankruptcies person crypto traders connected edge.

The upcoming Fed complaint hike and much crypto firms experiencing antagonistic vulnerability to insolvent crypto entities proceed to adhd fearfulness to the marketplace sentiment.

Bitcoin’s July Outlook

This mendacious breakout came astatine the absorption level of $22,070, which has historically been a constituent of uncertainty.

As a effect of this, bulls opted to unafraid profits, alternatively than effort to propulsion prices of the starring crypto token higher.

Looking astatine the illustration below, this coincides with the comparative spot scale (RSI) indicator trading adjacent to a absorption level of its ain astatine 48.30.

Bulls are apt waiting for the momentum indicator to determination past this constituent earlier reentering with immoderate existent amusement of force.

If they do, they volition apt usage the remaining weeks of the period to get person to the $30,000 region, recovering immoderate of the losses of the past fewer weeks.

Many expect the Fed to erstwhile again summation involvement rates by different 75 ground points, and should this happen, positive ostentation begins to slow, past investors whitethorn spot existent lows arsenic an opportune constituent of entry.

However, with terms spot mostly trading nether this existent ceiling for the past 3 months, bears volition besides beryllium waiting to participate the fray, targeting a determination backmost beneath $19,000 this month.

What bash you deliberation astir bitcoin’s terms enactment successful caller times and the July outlook for the starring crypto asset? Do you expect bitcoin to emergence higher oregon driblet little from here? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)