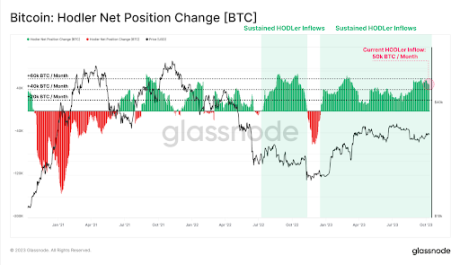

A caller report from Glassnode, an on-chain analytical firm, has buttressed recent information indicating Bitcoin holders are adding to their holdings. These semipermanent Bitcoin investors, often known arsenic “HODLers,” don’t look to beryllium phased by the caller volatility successful Bitcoin’s price.

According to on-chain data, semipermanent holders person been rapidly amassing Bitcoin, adding much than 50,000 BTC each period to their holdings.

Monthly Accumulation Of BTC Worth $1.35 Billion

Bitcoin is presently showing signs of slowing down, arsenic its terms conscionable dipped beneath $27,000. It would look that short-term speculators are mostly to blasted for the persistent selling pressure, arsenic information shows whale investors are seeing this accidental to bargain much BTC astatine a discount alternatively than unafraid profits.

According to Glassnode’s HODLer Net Position Change metric, semipermanent holders are purchasing an mean of 50,000 BTC worthy $1.35 cardinal astatine the existent terms of Bitcoin each month.

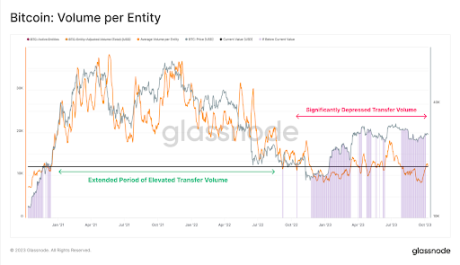

Another metric, the Long-Term Holder Supply, which measures the magnitude of BTC’s marketplace headdress with holders, besides reached an all-time precocious of 14.859 cardinal BTC. This means 76.1% of the full circulating proviso has not moved successful the past 5 months. Consequently, 94.8% of the full Bitcoin proviso has not moved successful the past month.

To backmost up this information of accrued accumulation, fashionable crypto expert Ali Martinez shared illustration information from Santiment showing Bitcoin whales person purchased astir 20,000 BTC since the opening of October, worthy astir $550 million.

At this rate, the fig of BTC vaulted by holders is poised to walk 50,000 successful October. This accrued accumulation suggests that semipermanent holders stay assured successful Bitcoin’s semipermanent imaginable and spot this terms correction arsenic temporary.

#Bitcoin whales person purchased astir 20,000 $BTC since the opening of October, worthy astir $550 million! pic.twitter.com/47ZePiaIII

— Ali (@ali_charts) October 10, 2023

Bitcoin Supply Tightens

According to Glassnode, lone 11.5% of BTC’s circulating proviso changed hands successful the past 3 months, indicating a prolonged inactive play of on-chain activity. That determination are less transactions suggests that investors are unwilling to merchantability astatine the existent terms arsenic the manufacture awaits approval of spot Bitcoin ETFs.

If this existent inclination holds, past the existent downtrend could beryllium short-lived, particularly if sentiment among smaller traders besides turns toward buying. A predominantly clasp mentality would springiness the plus clip to retrieve and found important enactment that serves arsenic a bounce-off constituent for different rally.

Bitcoin is presently trading astatine $26,766 and is down by 1.31% successful a 24-hour timeframe arsenic it approaches the adjacent large support adjacent the $26,500 level. If capable ample players accumulate astatine these little prices, it whitethorn found a terms level arsenic bulls propulsion the terms backmost up.

As crypto expert James Straten points out, Bitcoin could leap 50% arsenic portion of the correlation between the Grayscale Bitcoin Trust and the terms of BTC.

Featured representation from Shutterstock, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)