In a caller statement via X (formerly Twitter), Alex Thorn, caput of steadfast wide probe astatine integer plus steadfast Galaxy, highlighted the imaginable for different Bitcoin gamma compression akin to the 1 witnessed past week. BTC gained 15% past week. He remarked, “The Bitcoin gamma compression from past week could hap again. If BTCUSD moves higher to $35,750-36k, options dealers volition request to bargain $20m successful spot BTC for each 1% upside move, which could origin explosiveness if we statesman to determination up towards those levels.”

Elaborating connected the mechanics, Thorn explained the behaviour of dealers successful narration to gamma and delta. “When dealers are abbreviated gamma and terms moves up, oregon erstwhile they are agelong gamma and terms moves down, they request to bargain spot to enactment delta neutral. Last week’s expiries volition dampen imaginable explosiveness, but it’s inactive successful play.” This fundamentally means that the actions of options dealers, driven by the request to support a neutral position, tin amplify terms movements.

Will Bitcoin Price Rally Like Last Week?

Thorn besides emphasized the value of on-chain information successful knowing these dynamics. He mentioned a continued divergence betwixt the proviso held by semipermanent holders and the proviso that has moved successful little than 24 hours. This divergence, which has been increasing implicit the past year, indicates a diminution successful on-chain liquidity, suggesting that semipermanent holders are not selling their holdings, perchance starring to a proviso squeeze.

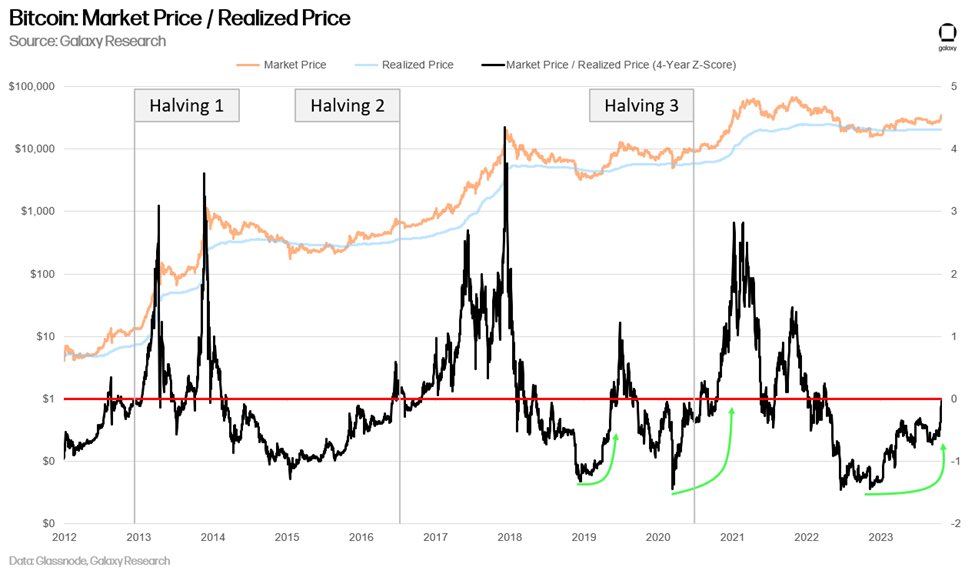

Furthermore, Thorn pointed to the 4-year rolling Z-score of the ratio of marketplace terms to realized price, a saltation of the MVRV ratio. This metric provides insights into Bitcoin’s valuation comparative to its humanities average. A precocious affirmative Z-score indicates imaginable overvaluation, portion a antagonistic Z-score mightiness suggest undervaluation. Thorn’s reflection that the signifier is opening to lucifer those seen earlier erstwhile bull runs is peculiarly noteworthy.

Bitcoin ratio of marketplace terms to realized terms | Source: X @intangiblecoins

Bitcoin ratio of marketplace terms to realized terms | Source: X @intangiblecoinsAnother important reflection made by Thorn pertains to the compression of comparative outgo bases. He noted a tightening signifier that has historically been observed during carnivore oregon accumulation periods that precede bull markets. This compression suggests that determination is simply a statement among antithetic types of holders astir the worth of Bitcoin.

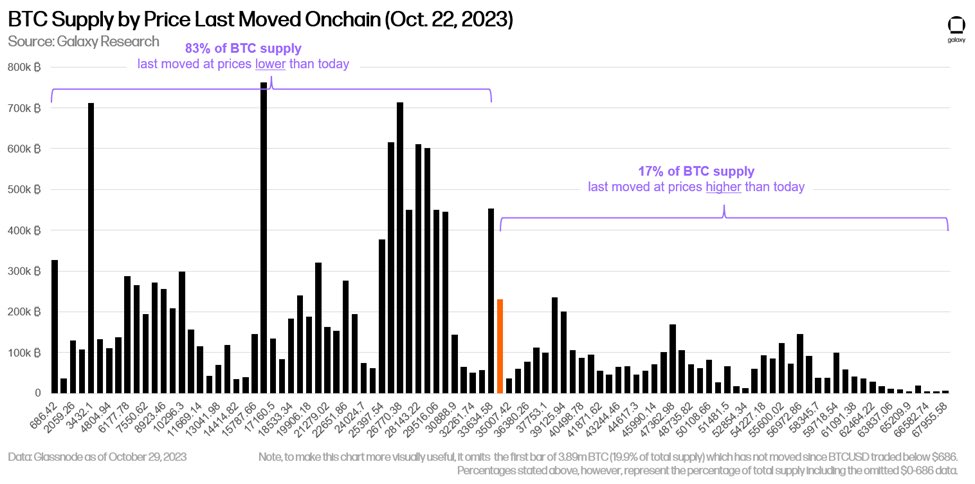

Thorn’s investigation of the Bitcoin proviso by the terms astatine which each coin past moved is peculiarly illuminating. He observed a sparse outgo ground betwixt the existent terms of $34,591 and the $38,400-39,100 range. Moreover, with 83% of the proviso not having moved since prices were little than contiguous and astir 70% of the proviso stagnant for implicit a year, it’s evident that semipermanent holders are successful nett and are apt waiting for adjacent higher prices earlier selling.

Bitcoin proviso by the terms ast moved | Source: X @intangiblecoins

Bitcoin proviso by the terms ast moved | Source: X @intangiblecoinsLast week, arsenic reported by NewsBTC, Thorn had accurately predicted a gamma squeeze. He had emphasized the important relation the options marketplace played successful influencing Bitcoin’s terms trajectory. Thorn warned, “We are approaching max symptom for gamma shorts.”

In summary, portion Thorn does not marque a nonstop prediction astir Bitcoin’s near-term price, his investigation connected X provides a broad overview of the existent marketplace dynamics. The operation of imaginable gamma squeezes, declining on-chain liquidity, and humanities patterns each constituent towards a favorable situation for Bitcoin bulls.

At property time, BTC traded astatine $34,249.

Bitcoin price, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)