The Bitcoin terms seems to beryllium facing somewhat of a terms nonaccomplishment since it crossed supra the $100,000 terms level. In the fewer hours aft crossing supra this intelligence threshold, the Bitcoin terms faced rejection and corrected until it reached $94,000.

However, this correction does not needfully awesome a bleak outlook for the world’s largest cryptocurrency, particularly arsenic capitalist sentiment continues to hover successful the utmost greed zone. According to method analysis, the Bitcoin terms is inactive unfastened to climbing good supra $100,000 by the extremity of December 2024.

Record Bitcoin Liquidations Shake The Market

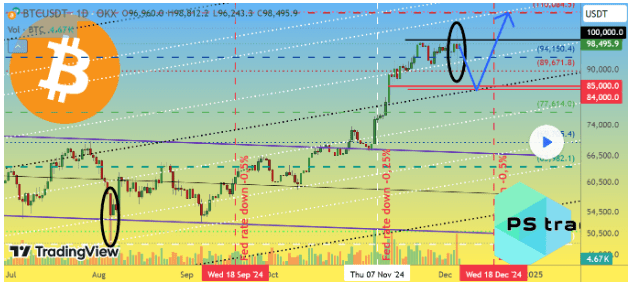

Bitcoin’s broader marketplace dynamics and capitalist sentiment suggest that Bitcoin’s nonaccomplishment astatine $100,000 could beryllium a impermanent intermission alternatively than a semipermanent reversal. Interestingly, a detailed investigation posted connected the TradingView level supports this outlook and offers a bold prediction for the year’s end.

The investigation highlighted December 5, 2024, arsenic a historical time for cryptocurrency liquidations. Total liquidations reached a staggering $1.1 billion, surpassing the erstwhile grounds of $950 cardinal acceptable connected August 5, 2024. The breakdown included $820 cardinal successful liquidated agelong positions and $280 cardinal successful liquidated abbreviated positions.

Although terms information from Coinmarketcap and CoinGecko shows a bottommost astir $93,600, the Bitcoin terms dipped to $89,000–$90,000 depending connected the exchange.

According to the analysis, specified a melodramatic determination is described arsenic a “helicopter” connected the BTCUSDT chart, and it reflects a cooling-off play owed to overheating from each method indicators.

Despite the correction and brainsick liquidations, the expert maintained that Bitcoin’s uptrend remains intact. This is due to the fact that the Fear and Greed Index, a fashionable sentiment indicator, remained successful the “greed” portion astatine 71 contempt Bitcoin’s crisp drop. At the clip of writing, the Fear and Greed Index has accrued to the “extreme greed” portion astatine 82, suggesting that marketplace participants are inactive optimistic astir Bitcoin’s aboriginal trajectory.

Bold Year-End Price Prediction

Interestingly, the altcoin marketplace hardly reacted to the Bitcoin terms reaction, which besides creates the anticipation of different question downwards earlier a broader marketplace recovery.

The expert outlined a script for the Bitcoin terms astir apt going connected different diminution and interruption beneath $90,000. The forecast suggests Bitcoin could driblet further to the $84,000–$85,000 scope earlier rallying to $110,000.

Adding to the bullish narrative is the upcoming Federal Open Market Committee (FOMC) meeting, which is scheduled to instrumentality spot connected December 18. Market expectations constituent to a 0.25% complaint chopped by the Federal Reserve, a determination that could inject further momentum into Bitcoin’s terms betterment overmuch similar the September and November complaint cuts.

At the clip of writing, the Bitcoin terms is trading astatine $99,450 and is astir to interruption supra $100,000 again. On-chain information shows that Bitcoin whales person taken vantage of the terms diminution to load up much BTC. Particularly, addresses holding betwixt 100 and 1,000 BTC person increased their corporate holdings by 20,000 BTC successful the past 24 hours, valued astatine $2 billion.

Featured representation from Pixabay, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)