After a short-lived rally supra $28,000 this week pursuing Grayscale’s landmark tribunal lawsuit triumph against the US Securities and Exchange Commission (SEC) implicit the conversion of GBTC into a spot ETF, the terms of BTC has erstwhile again settled astir the $26,000 mark. This comes aft yesterdays’ SEC’s determination to postpone each Bitcoin spot ETF decisions for 45 days.

Renowned crypto analyst, Rekt Capital, has weighed successful connected the concern with a bid of tweets that supply penetration into Bitcoin’s imaginable trajectory for the upcoming month. As the expert remarks, Bitcoin has registered a bearish monthly candle adjacent for the period of August owed to yesterdays’ terms plunge.

Bitcoin Price Prediction For September 2023

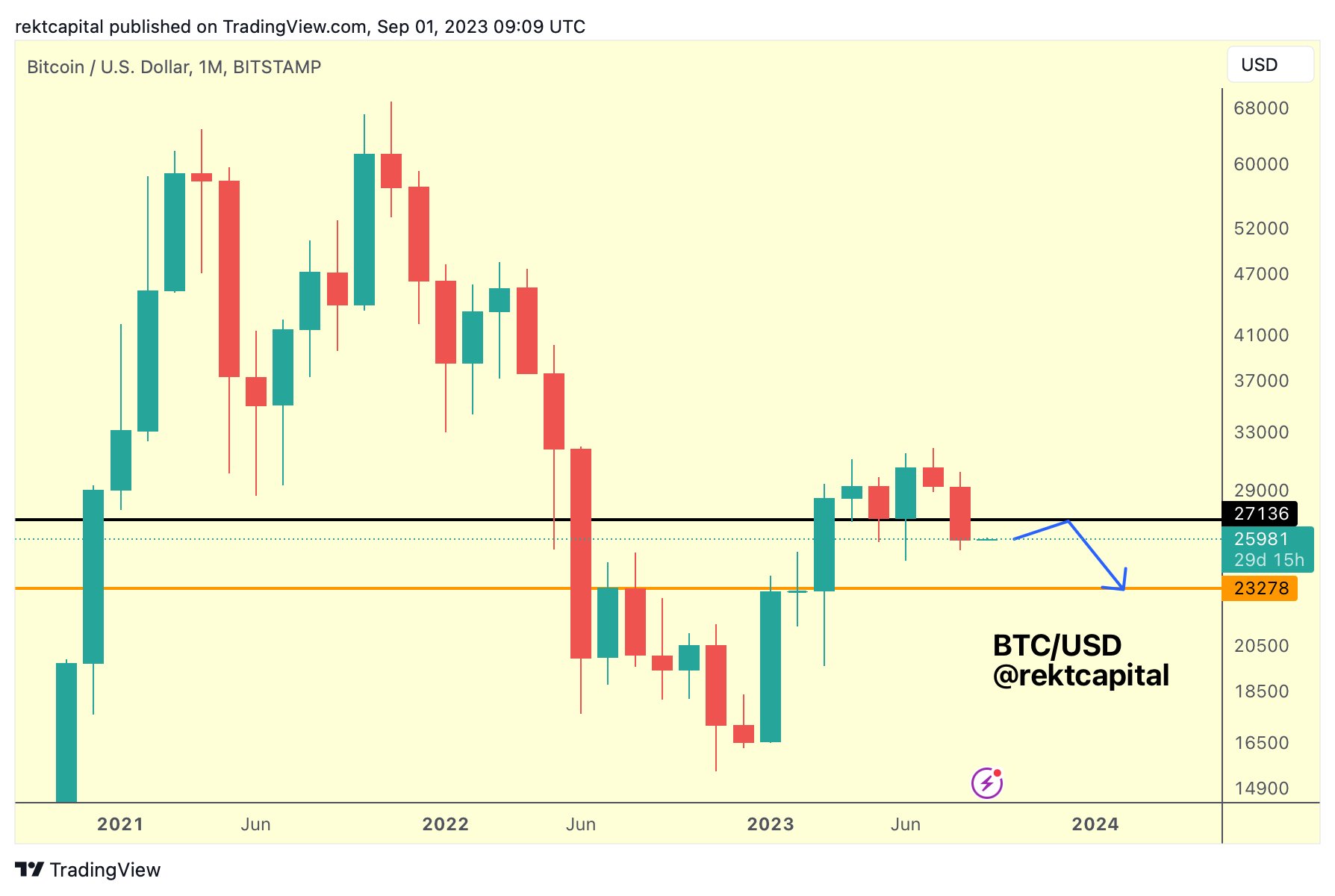

In a bid of tweets, Rekt Capital explained, “BTC closed beneath ~$27,150, confirming it arsenic mislaid support. It’s imaginable BTC could rebound into ~$27,150, possibly adjacent upside wick beyond it this September. But that would apt beryllium a alleviation rally to corroborate ~$27,150 arsenic caller absorption earlier dropping into the $23,000 region.

Bitcoin bearish monthly adjacent | Source: Twitter @rektcapital

Bitcoin bearish monthly adjacent | Source: Twitter @rektcapitalHistorically, September has not been peculiarly benignant to Bitcoin, with the period signaling the slightest fig of positive-returning months astatine conscionable two, and presently being connected a 6-year negative-returning streak.

Rekt Capital delves deeper into this trend, stating, “A often recurring downside magnitude for BTC successful the period September is -7%. If BTC were to driblet -7% from existent terms levels this month, terms would retrace to ~$24,000.”

However, according to the investigation by the analyst, the adjacent large monthly level is sitting astatine ~$23,400. This suggests that terms possibly does not halt astatine -7% if BTC can’t summation caller momentum. Instead, BTC could perchance downside wick -10% successful full to scope that adjacent large monthly level.

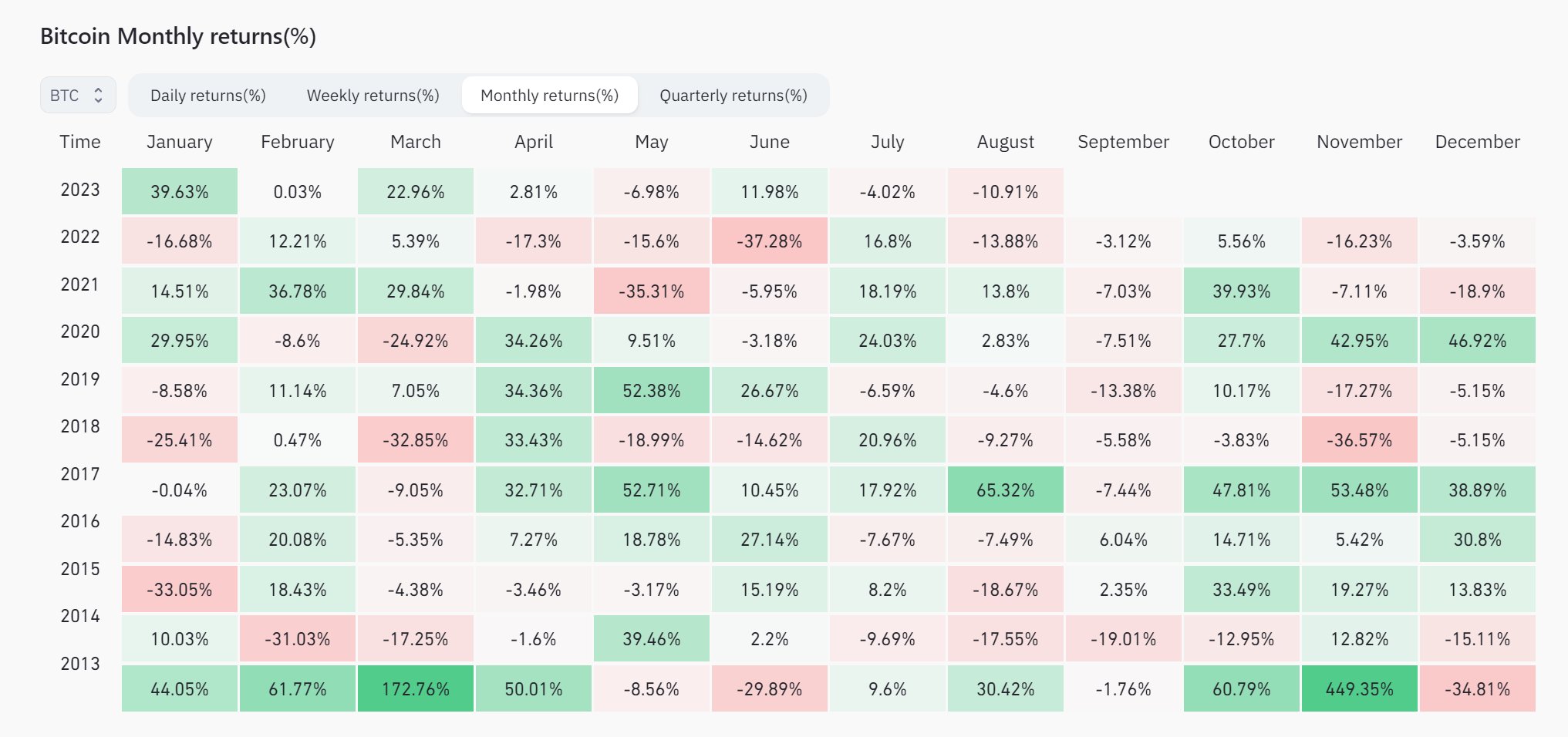

The expert further elaborated connected the humanities show of Bitcoin successful September, noting, “September – affirmative oregon antagonistic month? Typically, we thin to spot a antagonistic period for BTC successful September. However, for the astir portion BTC sees single-digit drawdown successful Septembers. 8 retired of 10 of the past Septembers person experienced downside. Only 2 months saw small, single-digit gains successful the period of September (+2% successful 2015 and +6% successful 2016).”

Bitcoin monthly returns | Source: Twitter @rektcapital

Bitcoin monthly returns | Source: Twitter @rektcapitalWorst Case Scenario

Drawing parallels with erstwhile years, Rekt Capital highlighted that the astir recurring drawdown successful September has been a -7% dip, arsenic observed successful 2017, 2020, and 2021. However, helium besides pointed retired that Bitcoin lone saw double-digit retracement successful 2019 (-13%) and successful 2014 (-19%). The latter, being a carnivore marketplace year, mightiness not beryllium the champion examination for 2023, which is shaping up to beryllium a bottoming retired year, akin to 2019 oregon 2015.

Addressing the looming question of different imaginable clang successful September, the expert opined, “In 2019 BTC saw a -13% retrace but we besides request to support successful caput that BTC conscionable saw 1 of its worst-ever August drawdowns astatine -16%. It’s improbable that Bitcoin would acquisition terrible back-to-back drawdown some successful August and present successful September arsenic well.”

Concluding his analysis, Rekt Capital shared his idiosyncratic forecast, “I deliberation a drawdown of astir -7% to -10% September could reasonably hap from existent levels. This would spot terms driblet to ~$24,000 – $23,000.”

Remarkably, determination is improbable to beryllium a Bitcoin spot ETF determination successful September, which whitethorn beryllium the biggest catalyst for the marketplace astatine the moment. The adjacent deadlines for filings by Bitwise, BlackRock, Fidelity and the others is October 16 and 17. Only an enactment by the SEC aft the lost suit against Grayscale could supply a astonishment event. However, determination are presently nary deadlines oregon statements from the SEC if and erstwhile they volition transportation retired the ruling.

At property time, BTC traded astatine $26,104.

Bitcoin retraces to pre-Grayscale judgement level, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin retraces to pre-Grayscale judgement level, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Finextra Research, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)