With anticipation astir Bitcoin ETFs from giants similar BlackRock, Fidelity, and Invesco, and an expected halving successful April 2024, forecasts for Bitcoin’s terms adjacent twelvemonth amusement a important range. From JPMorgan to Standard Chartered Bank, present are the astir notable estimates for 2024:

Pantera Capital: $150,000

In their August “Blockchain Letter”, Pantera Capital, led by Dan Morehead, predicts a imaginable emergence to $147,843 station the 2024 halving. Employing the stock-to-flow (S2F) ratio, they judge the terms exemplary suggests the valuation of Bitcoin against its scarcity volition go much pronounced.

Specifically, Pantera Capital stated, “The 2020 halving reduced the proviso of caller bitcoins by 43% comparative to the erstwhile halving. It had a 23% arsenic large an interaction connected price.” With past arsenic a reference, this could bespeak a hike from $35k earlier the halving to $148k after. However, not each Bitcoin supporters are connected board, having witnessed failed predictions based connected this exemplary successful the caller past.

Standard Chartered Bank: $120,000

In a caller probe study from July, Standard Chartered Bank offered a bullish outlook connected Bitcoin’s imaginable trajectory. The British multinational slope present expects Bitcoin’s worth to ascend to $50,000 by the extremity of the existent year, with the imaginable to soar arsenic precocious arsenic $120,000 by the adjacent of 2024. This revised forecast from Standard Chartered marks an summation from their erstwhile April prediction, wherever they projected a apical of $100,000 for Bitcoin.

The upward revision successful the bank’s forecast is underpinned by respective determining factors. Notably, 1 superior crushed cited for the imaginable terms escalation is the ongoing banking-sector crisis. Additionally, the study sheds airy connected the rising profitability for Bitcoin miners arsenic a pivotal origin influencing the terms trajectory. Geoff Kendrick, the caput of FX and integer assets research, emphasizes the instrumental relation of miners. He notes, “The rationale present is that, successful summation to maintaining the Bitcoin ledger, miners play a cardinal relation successful determining the nett proviso of recently mined BTC.”

JPMorgan: $45,000 Per Bitcoin

JPMorgan, 1 of the world’s starring concern banks, anticipates a much restrained maturation for Bitcoin, predicting a emergence to $45,000. This forecast is influenced by the surging golden prices. Historically, Bitcoin and golden person shown correlation successful their terms movements, and with the golden terms precocious surpassing the $2,000 people per ounce, it has bolstered JPMorgan’s blimpish outlook connected Bitcoin.

In a elaborate enactment from May, JPMorgan strategists explained, “With the golden terms rising supra $2,000, the worth of golden held for concern purposes extracurricular cardinal banks stands astatine astir [$3 trillion]. Consequently, this suggests a Bitcoin terms of $45,000, based connected the premise that BTC volition execute a lasting akin to golden among backstage investors.”

Matrixport: $125,000 By End-2024

In July, Matrixport, a salient crypto services provider, predicted that Bitcoin’s terms could surge to arsenic precocious arsenic $125,000 by the adjacent of 2024. This optimistic outlook was based connected humanities terms patterns and a important signal: Bitcoin’s caller breach of $31,000 successful mid-July, marking its highest level successful implicit a year. Historically, specified milestones person signaled the extremity of carnivore markets and the opening of robust bull markets.

By comparing these patterns with humanities information from 2015, 2019, and 2020, Matrixport estimated imaginable gains of up to 123% wrong 12 months and 310% wrong eighteen months. This translates to imaginable Bitcoin prices of $65,539 and $125,731 wrong those respective timeframes.

Tim Draper: $250,000

Tim Draper, a salient task capitalist, maintains a highly bullish outlook connected Bitcoin. While his erstwhile prediction for Bitcoin to scope $250,000 by June 2023 didn’t materialize, helium remains optimistic astir the cryptocurrency’s semipermanent potential. In a July interrogation connected Bloomberg TV, Draper attributed caller regulatory actions successful the United States, specified arsenic those against Coinbase and Binance, to BTC’s short-term downtrend.

Despite these challenges, Draper continues to judge successful Bitcoin’s transformative powerfulness and sees it perchance reaching $250,000, albeit present perchance by 2024 oregon 2025. His assurance successful Bitcoin’s quality to revolutionize concern and clasp its semipermanent worth remains unwavering.

Berenberg: $56,630 At Bitcoin Halving

The German concern slope Berenberg revised its prediction successful July, pointing toward $56,630 by April 2024. This upward accommodation was supported by improved marketplace sentiment attributed to the anticipation of the Bitcoin halving lawsuit expected successful April 2024 and the increasing involvement exhibited by salient organization players.

Berenberg’s squad of analysts, led by the insightful Mark Palmer, emphasizes their anticipation of important appreciation successful Bitcoin’s worth successful the coming months. This projection is driven by 2 cardinal factors: the highly anticipated Bitcoin halving lawsuit and the increasing enthusiasm displayed by important institutions.

Highlighting their assurance successful the market, Berenberg besides reaffirmed its bargain standing connected the banal of Microstrategy. The slope has revised its stock terms people for Microstrategy from $430 to $510, driven by a higher valuation of the company’s BTC holdings and an improved outlook for its bundle business.

Blockware Solutions: $400,000

Blockware Intelligence, successful an analysis from August titled “2024 Halving Analysis: Understanding Market Cycles and Opportunities Created by the Halving,” delved into the intriguing anticipation of Bitcoin’s terms reaching $400,000 during the adjacent halving epoch, anticipated successful 2024/25.

A cardinal origin identified successful the probe is the relation of the halving successful shaping Bitcoin’s marketplace cycles. The study asserts that miners, liable for a important information of merchantability pressure, person recently minted BTC, overmuch of which they indispensable merchantability to screen operational costs. However, the halving events service to weed retired inefficient miners, starring to reduced merchantability pressure.

With proviso diminishing owed to halvings, the probe emphasizes that request becomes the superior determinant of BTC’s marketplace price. Historical information indicates that a surge successful request typically follows halving events. Market participants, equipped with an knowing of the supply-side dynamics introduced by halvings, hole to deploy superior astatine the archetypal signs of upward momentum, perchance starring to important terms appreciation. This surge successful request is peculiarly evident successful existent on-chain data, validating the affirmative sentiment surrounding halving events.

Beyond these notable forecasts, determination are a plethora of different terms predictions for BTC, ranging from Cathie Wood’s (ARK Invest) ambitious $1 cardinal projection to Mike Novogratz’s (Galaxy Digital) $500,000, Tom Lee’s (Fundstrat Global) $180,000, Robert Kiyosaki’s (Rich Dad Company) $100,000, Adam Back’s $100,000, and Arthur Hayes’ $70,000 prediction, underscoring the divers perspectives connected Bitcoin’s aboriginal value.

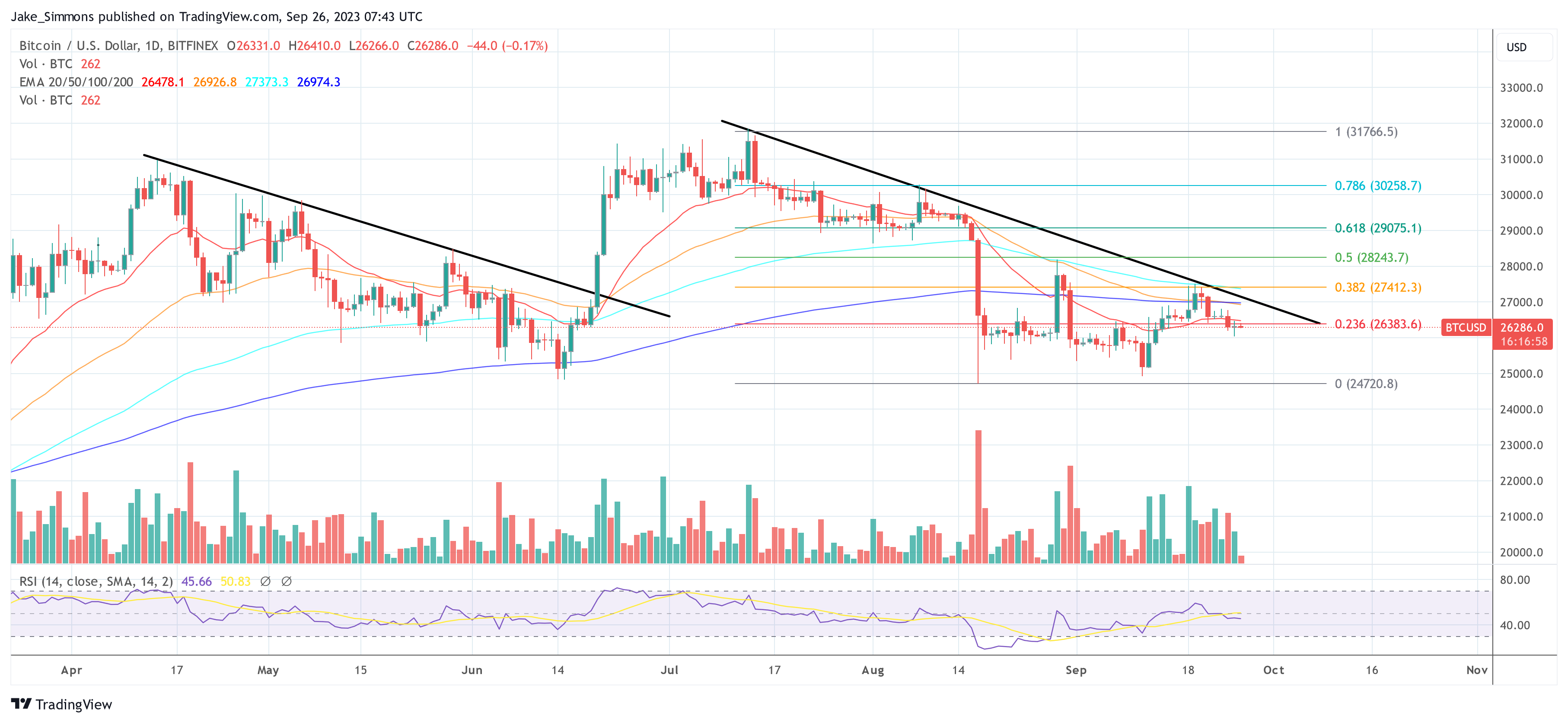

At property time, Bitcoin traded astatine $26,286.

BTC beneath 23.6% Fib, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC beneath 23.6% Fib, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)