Key takeaways:

Bitcoin’s terms intimately tracks planetary liquidity growth, with liquidity explaining up to 90% of its terms movements, according to Raoul Pal.

In the agelong term, planetary liquidity continues to expand, driven by the expanding indebtedness levels successful galore countries.

On a shorter timeframe, planetary liquidity follows a cyclical pattern, with Michael Howell projecting the existent rhythm to highest by mid-2026.

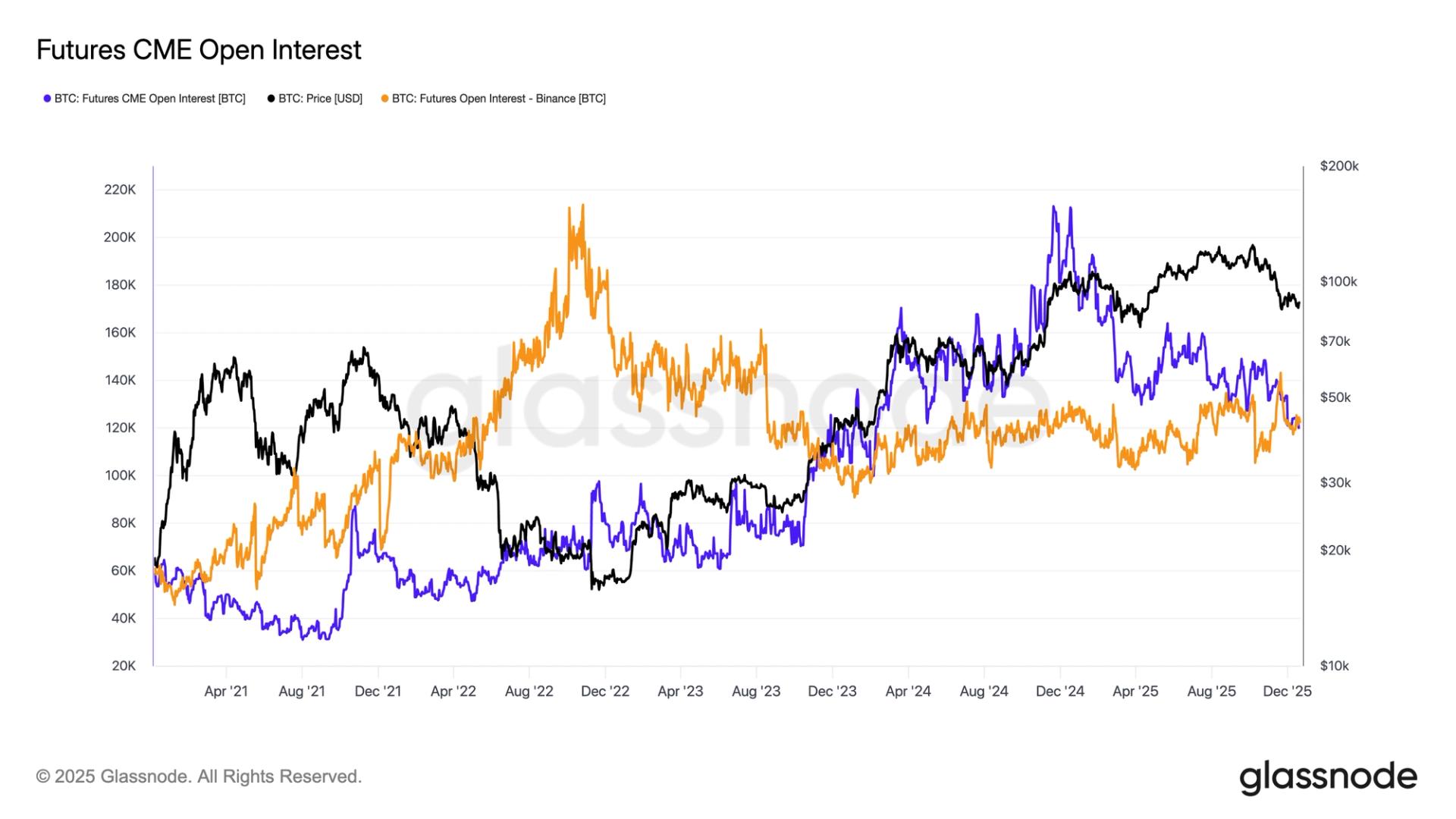

Bitcoin (BTC) terms is notoriously delicate to planetary liquidity. Some analysts spell arsenic acold arsenic calling their correlation near-perfect, with a lag of astir 3 months. This narration is fueling the existent bullish communicative arsenic BTC terms soars backmost supra $100,000, but however agelong tin this inclination last?

Liquidity is Bitcoin's soundless terms driver

Raoul Pal, the laminitis of Global Macro Investor, precocious gave a code connected the beardown correlation betwixt Bitcoin and planetary M2 liquidity. In a recap posted by Paul Guerra, Pal’s connection refers to: contempt looming concerns—recession risks, geopolitical tensions, and different planetary stressors—rising liquidity arsenic the ascendant unit down plus terms action.

According to Pal, expanding liquidity backs up to 90% of Bitcoin’s terms enactment and arsenic overmuch arsenic 97% of the Nasdaq’s performance. Indeed, a illustration comparing planetary M2 (with a 12-week lead) and Bitcoin’s terms shows an astir uncanny alignment.

Pal besides frames the contented successful idiosyncratic concern terms. He says there's an 11% "hidden tax" connected each of us, composed of 8% currency debasement and 3% planetary inflation. He notes,

“If you’re not earning much than 11%/yr, you’re getting poorer by definition.”Bitcoin has returned an mean of 130% annually since 2012, contempt melodramatic drawdowns. That makes it 1 of the astir asymmetric bets of the past decade—and it’s outperformed the Nasdaq by implicit 99%.

What drives planetary liquidity?

At its core, planetary liquidity is fueled by expanding the wealth supply. As autarkic capitalist Lyn Alden puts it,

“Fiat currency systems are chiefly based connected ever-growing indebtedness levels. The wealth proviso continuously grows successful each state for this reason.”This offers a high-level presumption of planetary liquidity and suggests its semipermanent enlargement is structural. However, this maturation isn't linear. Over shorter clip frames, it fluctuates based connected circumstantial drivers. Michael Howell, writer of “Capital Wars,” identifies 3 main drivers presently impacting planetary liquidity: the US Federal Reserve, the People’s Bank of China (PBoC), and banks lending done collateral markets.

Howell besides points to indirect influences that enactment with a lag of 6 to 15 months. These see the satellite concern cycle, lipid prices, dollar strength, and enslaved marketplace volatility. A anemic planetary system and a softening dollar typically boost liquidity. But rising enslaved volatility tightens collateral proviso and chokes lending, undermining liquidity.

Related: New bull cycle? Bitcoin's instrumentality to $100K hints astatine ‘significant terms move’

How agelong volition planetary liquidity rise?

Michael Howell believes that planetary liquidity moves successful astir five-year cycles, and is present connected the mode to its section peak. He projects the existent rhythm to mature by mid-2026, reaching an scale level of astir 70 (below the post-COVID scale of 90). That would people a turning point, with a consequent downturn being a apt outcome.

The caller maturation successful planetary liquidity stems from the rapidly weakening satellite economy, which is apt to punctual further easing by cardinal banks. The People’s Bank of China has already begun injecting liquidity into the system. The Fed present faces a pugnacious choice: proceed warring ostentation oregon pivot to enactment an progressively fragile fiscal system. At its May 7 meeting, rates were held steady, but the pressure connected Chair Jerome Powell is mounting, particularly from US President Donald Trump.

At the aforesaid time, economical uncertainty is driving up US Treasury yields and fueling enslaved marketplace volatility, some indicators of collateral scarcity and tightening recognition conditions. Over time, these pressures are apt to go headwinds for liquidity expansion. Meanwhile, a looming recession is expected to weaken capitalist hazard appetite, further draining liquidity from the system.

Even if a downturn lies up successful 2026, planetary liquidity inactive has country to run, astatine slightest done 2025. And that matters for Bitcoin.

Howell notes,

“The apt inevitable argumentation effect of ‘more liquidity’ is simply a large aboriginal omen. It establishes the upward way of persistent monetary ostentation that yet underpins hedges specified arsenic gold, prime equities, premier residential existent estate, and Bitcoin.”Interestingly, Howell’s liquidity rhythm astir aligns with Bitcoin’s four-year halving cycle. The erstwhile points to a imaginable highest successful precocious 2025, and the second successful aboriginal 2026. If past rhymes again, that convergence could acceptable the signifier for a large terms move.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

7 months ago

7 months ago

English (US)

English (US)