After the Bitcoin terms deed a caller yearly precocious of $32,410 past Friday, June 23, the terms rally has stalled for the clip being. While the semipermanent outlook looks highly bullish owed to assorted Bitcoin spot ETF applications, determination are presently a fewer reasons successful the short-term which forestall a continuation for now.

Today, Wednesday, June 28, respective antagonistic quality are weighing connected the market’s sentiment. First and foremost, the depegging of the 4th largest stablecoin by marketplace cap, TrueUSD (TUSD), whitethorn person unsettled investors. As Bitcoinist reported earlier today, the latest revelations surrounding Prime Trust person raised caller doubts that TUSD is afloat backed with reserves.

Remarkably, TUSD is the astir important trading brace (BTC/TUSD) successful the full market, with astir 15% and $2.6 cardinal successful trading measurement connected Binance successful the past 24 hours. The rumors could person a antagonistic impact, arsenic shown by erstwhile stablecoin depeggings by USDT and USDC.

🚨 TUSD depegging: New crypto play unfolding?

1/@adamscochran raises respective reddish flags:

– Auditor who attested $TUSD audits (in Prime Trust) is the rebranded aged FTX US auditor

– Oracle terms is obtained from a azygous entity

– Bank partners are unknown

— Jake Simmons (@realJakeSimmons) June 28, 2023

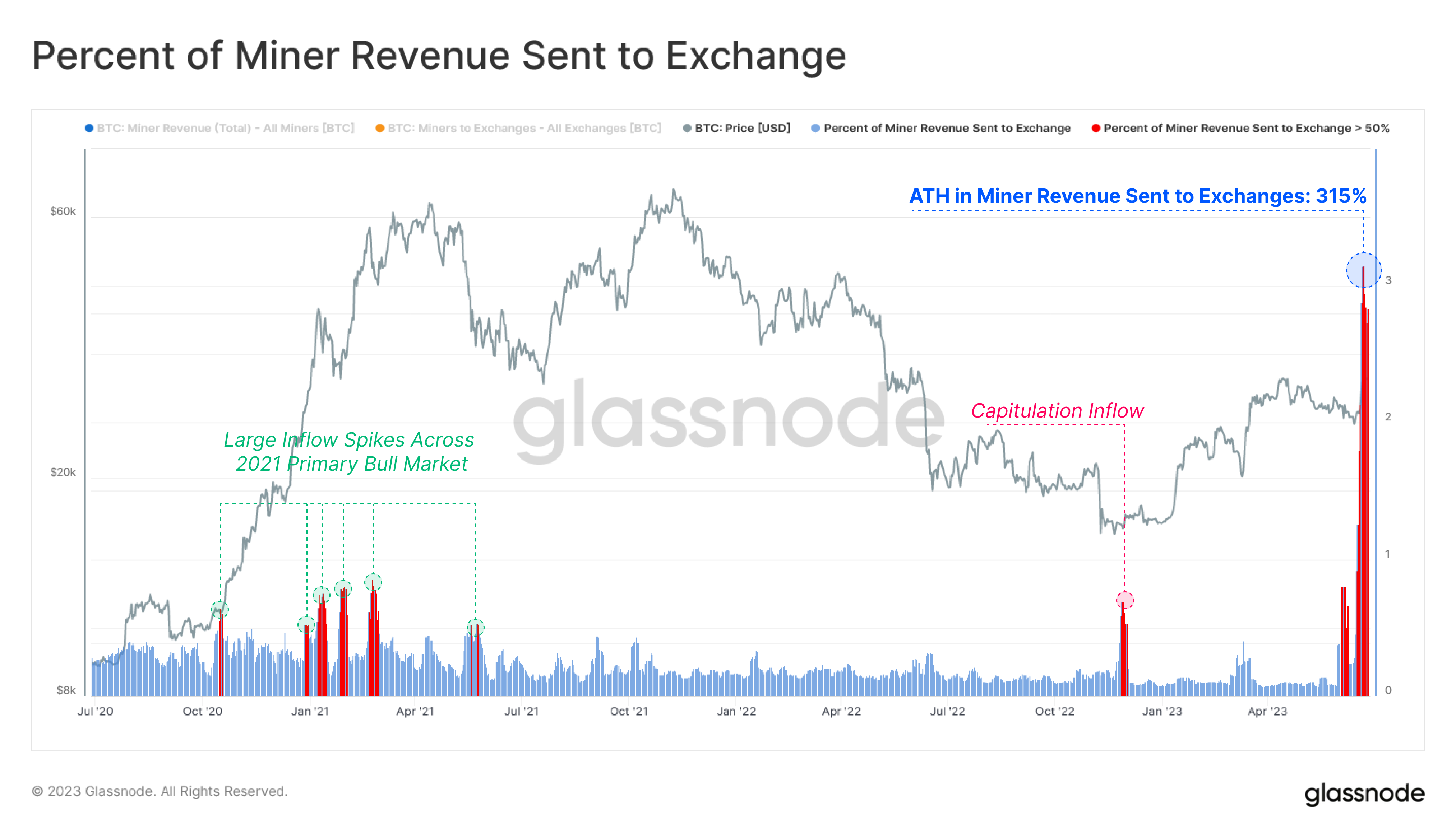

Another origin that is astir apt having a antagonistic interaction connected the Bitcoin terms is the behaviour of Bitcoin miners. As Glassnode reports today, Bitcoin miners are presently experiencing highly precocious enactment with exchanges, sending an all-time precocious of $128 cardinal successful BTC to exchanges, representing 315% of their regular revenue.

Percent of Bitcoin miners gross sent to exchanges | Source: Glassnode

Percent of Bitcoin miners gross sent to exchanges | Source: GlassnodeIn an investigation today, CryptoQuant writes that miners person sent implicit $1 cardinal successful BTC to exchanges since June 15. About 33,860 BTC were sent to derivatives exchanges, though the bulk flowed backmost into their ain wallets. Miners saw a simplification successful their reserves of astir 8,000 BTC. Remarkably, lone a tiny information was sent to spot trading exchanges.

According to the on-chain experts, this could bespeak that miners are utilizing their recently minted coins arsenic collateral successful derivatives trading. A bully illustration of this benignant of trading is alleged “hedging,” wherever bets are made successful the other absorption to the marketplace consensus.

Bitcoin Consolidates, More Reasons

Also weighing connected marketplace sentiment could beryllium the record-breaking magnitude of BTC options expiring connected Friday, June 30. Traders could instrumentality a wait-and-see attack successful the run-up. However, Greeks.Live analysts comment that institutions specified arsenic Fidelity and BlackRock proceed to thrust the affirmative developments; the measurement of BTC artifact calls present accounts for much than a 3rd of the full volume.

“Both BTC and ETH are presently importantly supra their maxpain points, but owed to the weakness successful ETH prices, a ample fig of marketplace makers person continued to merchantability ETH calls, portion buyers person concentrated much connected BTC, which has caused ETH IV to beryllium importantly little than BTC,” the analysts say.

The marketplace whitethorn besides beryllium connected a wait-and-see attack up of Friday’s merchandise of the PCE (Personal Consumption Expenditure) scale numbers. “After a akin PCE study spurred BTC from $26k to $28k, we hold with bated breath. A affirmative PCE result tin spark a bullish uptrend successful BTC,” the co-founders of Glassnode (@Negentropic_) write.

Last but not least, it should beryllium noted that Bitcoin terms is facing an highly important absorption country $31,000 and consolidation is normal. After past week’s accelerated rise, the regular RSI is inactive conscionable beneath the overbought country astatine 66.3.

As expert @52Skew points out, BTC remains successful a choky consolidation, with terms fluctuating betwixt proviso and request blocks. “4H / 1D EMAs catching up to terms & successful cardinal $29K area,” the expert notes via Twitter and surmises, referring to Binance Open interest, “Pretty overmuch inactive the same, chop chop. Eventually determination volition beryllium liquidity drawback imo; which volition astir apt pb to a trap.”

At property time, the Bitcoin terms remained successful its choky consolidation range.

BTC terms successful choky consolidation, 1-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms successful choky consolidation, 1-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)