In their latest marketplace update, QCP Capital, a crypto plus trading steadfast headquartered successful Singapore, has dissected the caller Bitcoin terms movements, attributing the rally to macroeconomic factors alternatively than the much-anticipated support of a spot ETF. To recall, the Bitcoin surged from $34,500 to astir $36,000 connected Wednesday.

The Main Reason For The Bitcoin Price Rally

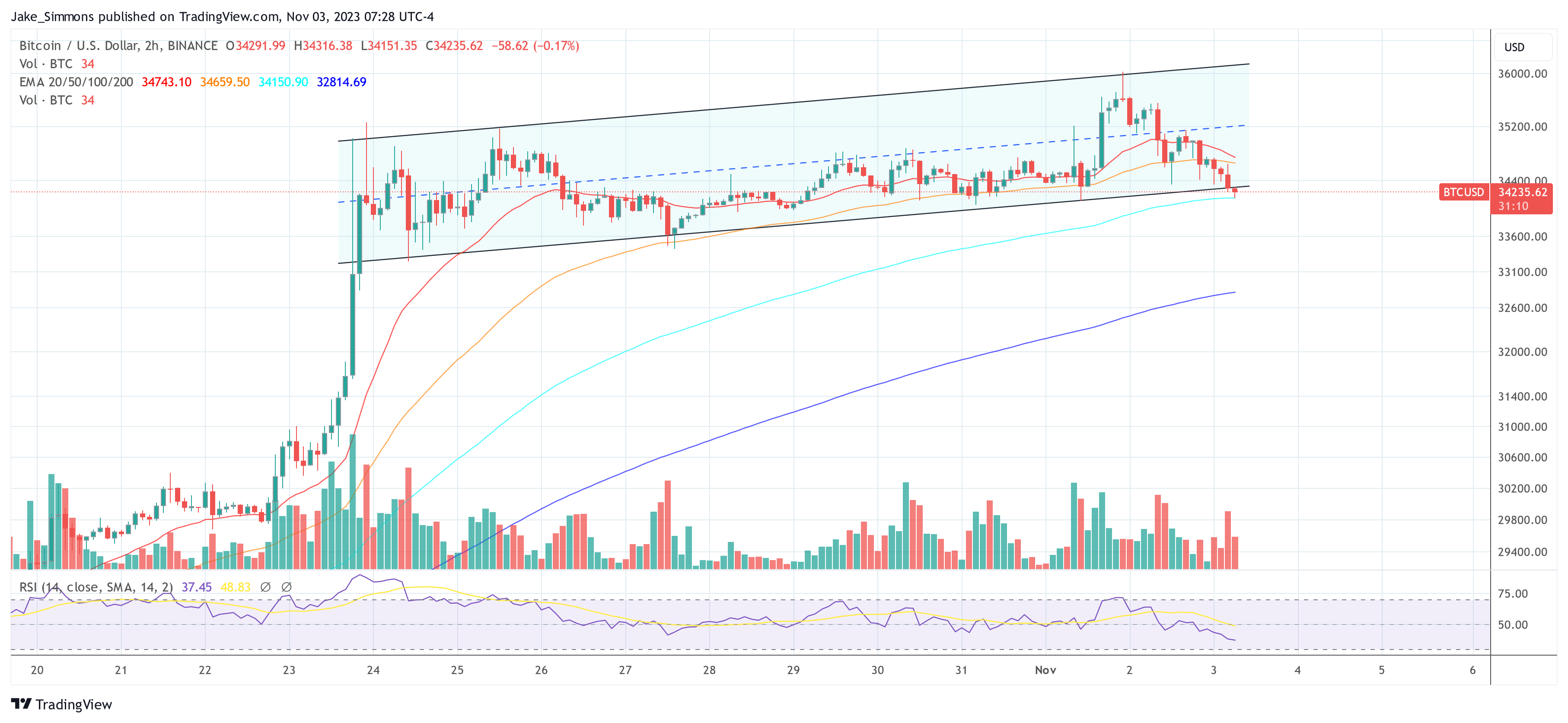

The firm’s method investigation highlighted that Bitcoin reached the 38.2% Fibonacci retracement level astatine $35,912 and touched the precocious transmission trendline earlier retreating, a determination that was keenly observed by marketplace participants.

Bitcoin terms | Source: QCP

Bitcoin terms | Source: QCPQCP Capital’s study states, “This latest rally, however, was little astir spot ETF developments and much astir macro forces.” These macro forces were identified pursuing a dovish stance from the Federal Open Market Committee (FOMC) and a smaller than expected Treasury Q1 proviso estimate, which led to a important driblet successful enslaved yields. This, successful turn, has had a bullish effect connected hazard assets, including Bitcoin and the broader crypto market.

However, the steadfast besides had a connection of caution, saying, “Whether this marks the commencement of a caller planetary equity and enslaved uptrend remains to beryllium seen, arsenic the macro representation fundamentally remains unchanged, extracurricular a correction of overly bearish enslaved sentiment.”

The steadfast besides noted the Bitcoin derivatives market, wherever “perp funding, and word forwards, implied volatility and hazard reversals crossed the curve proceed to stay oregon widen further astatine utmost elevated levels.” This suggests a marketplace bracing for a important move, with derivative traders positioned for a imaginable upside breakout that hinges connected the support of a spot ETF.

Looking astatine the broader fiscal landscape, the enslaved marketplace has been experiencing notable fluctuations. Recently, the 30-year Treasury output has reached different 16-year high, climbing supra 5%. This level of output has not been seen since 2007, and it represents a emergence of implicit 4 percent points successful conscionable 3 years. Such movements successful the enslaved marketplace are captious for the Bitcoin and crypto marketplace arsenic they impact the hazard sentiment among investors.

However, Bitcoin is presently following the illustration of golden arsenic a harmless haven asset. ”The marketplace is starting to terms successful the Fed’s overtightening and weakening economics. Combined with geopolitical tensions + war, the request for QE successful the aboriginal is expanding rapidly. This is causing security assets (Gold, Bitcoin) to perfectly rip successful unison,” Carpriole Investment’s Charles Edwards remarked recently.

In summary, QCP Capital’s insights into Bitcoin marketplace dynamics versus existent enslaved marketplace trends suggest that portion the Bitcoin marketplace is influenced by a assortment of factors, including speculation astir exchange-traded money approval, macroeconomic indicators specified arsenic enslaved yields play a larger relation successful determining marketplace sentiment and terms enactment than different pundits believe.

At property time, Bitcoin was trading astatine $34,235 and astatine hazard of breaking retired of the established uptrend transmission to the downside. If that happens, debased terms levels could travel next.

Bitcoin price, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)