The beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Net Liquidity And Moving Averages

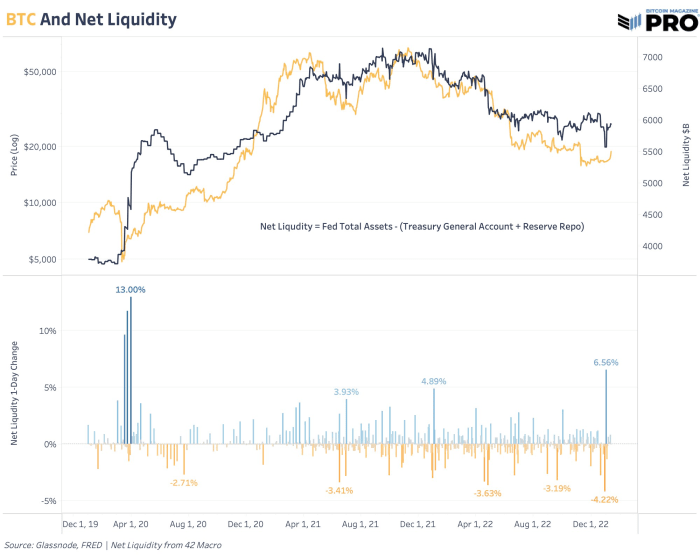

One of the astir utile models successful tracking the cyclical tops for some the S&P 500 Index and bitcoin since March 2020 has proven to beryllium nett liquidity, an archetypal exemplary by 42 Macro. Net liquidity tracks the changes successful Federal Reserve full assets, the U.S. Treasury wide relationship equilibrium and the reverse repo facility. A little nett liquidity translates to little superior disposable to deploy successful markets. We find it utile arsenic a cardinal macro indicator to measure existent liquidity conditions and however bitcoin trades successful the market.

Bitcoin has acted arsenic a liquidity sponge passim its beingness and contracting liquidity successful each markets has had a important interaction connected the bitcoin terms and trajectory. Ultimately, that’s 1 of the main drivers of our halfway semipermanent thesis that bitcoin’s maturation depends connected an situation of perpetual monetary debasement and expanding liquidity to enactment against existent levels of unsustainable sovereign indebtedness and deflationary forces. In the short-term, it’s not wide erstwhile wide liquidity volition summation again en masse. That’s the trillion dollar question and the taxable of speech connected which everyone is speculating. Net liquidity provides a presumption into that trajectory arsenic a measurement that’s updated play with caller data.

Bitcoin is seeing immoderate of its largest comparative spot since January 2021, but it besides comes astatine a clip erstwhile we’re seeing a important regular uptick successful nett liquidity aft a play of historically debased volatility. The uptick is driven by a overmuch little reverse repo equilibrium since the commencement of the year. With the Fed’s presumption of “higher for longer,” a projected presumption of Core CPI astatine 3.5% for 2023 and continued equilibrium expanse runoff, we volition apt spot nett liquidity diminution — barring a spontaneous oregon exigency argumentation reversal.

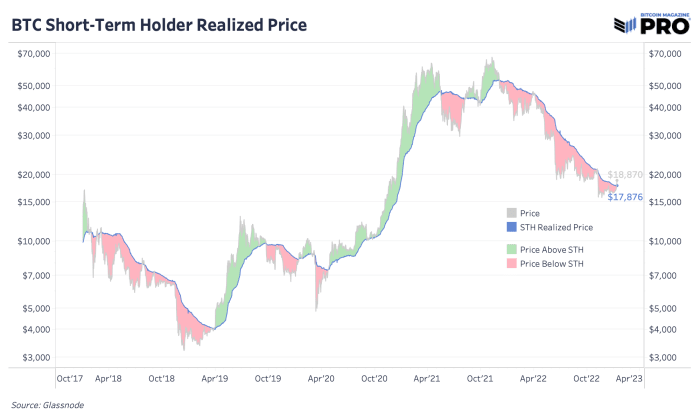

Price has breached supra the short-term holder realized price. That’s happened lone a fewer times successful this carnivore marketplace and these events were short-lived. As this terms reflects the mean on-chain outgo ground of the much caller buyers, it volition beryllium cardinal to spot if these marketplace participants are looking to merchantability present astatine outgo oregon if they volition enactment to proceed with the momentum.

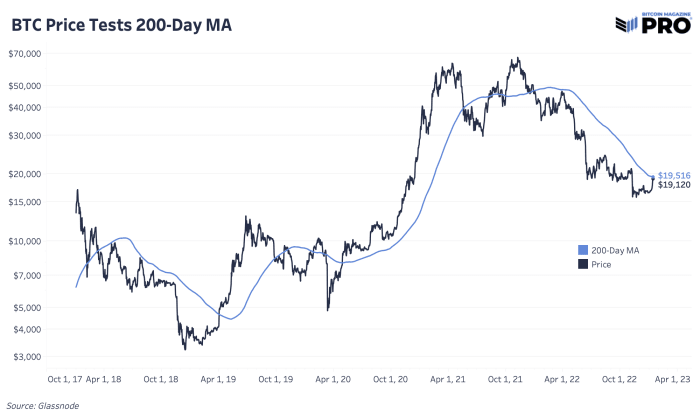

The 200-day moving mean whitethorn look somewhat arbitrary, but the specified information that galore method traders and momentum- and trend-based investors show this level gives it significance. A cleanable interruption supra could mean continued spot for bitcoin successful the coming days and weeks ahead.

The terms enactment to commencement the caller twelvemonth has been rather the promising motion for bitcoin bulls. Similarly, implicit the past week, shorts arsenic a percent of futures liquidations has reached its highest level successful the past of the data. While shorts person been decimated arsenic of late, it’s apt that this contiguous upside could beryllium capped.

While determination is simply a agelong mode to spell successful presumption of surpassing erstwhile bull marketplace heights, the year-to-date show has been hopeful pursuing a twelvemonth wherever the manufacture practically imploded.

Overall, this is simply a promising commencement to 2023.

Like this content? Subscribe now to person PRO articles straight successful your inbox.

2 years ago

2 years ago

English (US)

English (US)