In a beardown turnaround from yesterday’s flash crash, the Bitcoin (BTC) terms has staged a recovery, breaching the $43,000 mark. This surge comes aft yesterday’s aggravated volatility, wherever the cryptocurrency elephantine witnessed an implicit 11% flash crash pursuing a arguable report from Matrixport.

The study suggested a imaginable rejection by the US Securities and Exchange Commission (SEC) of the much-anticipated spot Exchange Traded Funds (ETFs), triggering the second-largest liquidation of agelong positions successful the past year. Bitcoin’s terms plummeted to arsenic debased arsenic $41,500.

However, Bitcoin is contiguous stabilizing supra $43,000, influenced by a operation of factors. Notably, respective experts person disputed the Matrixport report’s validity. Adding to the affirmative sentiment, a important SEC related update has caught the market’s attention.

Bitcoin ETF Tomorrow?

According to a report by Fox Business, SEC unit attorneys from the Division of Trading and Markets were engaging successful important discussions with representatives from large exchanges specified arsenic the New York Stock Exchange, Nasdaq, and the Chicago Board Options Exchange connected Wednesday. This engagement is important arsenic it pertains to the support of respective Bitcoin ETF applications.

The meetings are seen arsenic a affirmative motion that the SEC is nearing support of immoderate oregon each of the twelve applications by large wealth managers and crypto firms for the product. An anonymous root acquainted with these developments stated, “While the last determination has not been made, sources adjacent to the proceedings accidental the SEC could statesman notifying issuers of support connected Friday with trading opening arsenic aboriginal arsenic adjacent week.”

Bloomberg ETF expert James Seyffart commented connected Eleanor Terrett’s study from Fox Business via X, stating: “My presumption is successful enactment with Eleanor Terrett’s reporting. I deliberation the SEC could statesman signaling to issuers to expect approvals tho I’m inactive expecting authoritative approvals Jan 8 – 10. I besides deliberation the spread betwixt support orders and existent trading volition beryllium measured successful days — not weeks.”

Echoing Seyffart’s views, Eric Balchunas, his workfellow astatine Bloomberg, commented, “Things you prob don’t bash if you going to contradict oregon delay. Hearing akin btw, and wherefore why erstwhile we spot updated (final) 19b-4s rotation successful that is motion support imminent arsenic SEC has been doing backmost and distant w issuers offline to cleanable their 19b-4s vs doing galore refilings a la S-1s.”

Scott Johnsson, a concern lawyer astatine Davis Polk, weighed in connected Balchunas’ statement: “In each past ETF wave, the SEC did not bash this. Why? Because (1) this takes up a ton of SEC resources and (2) makes it MUCH harder to successfully past judicial scrutiny (and aft Grayscale, this is similar drafting humor from a stone). If you mean to deny, you conscionable deny.”

BTC Price Remains Ultra Bullish

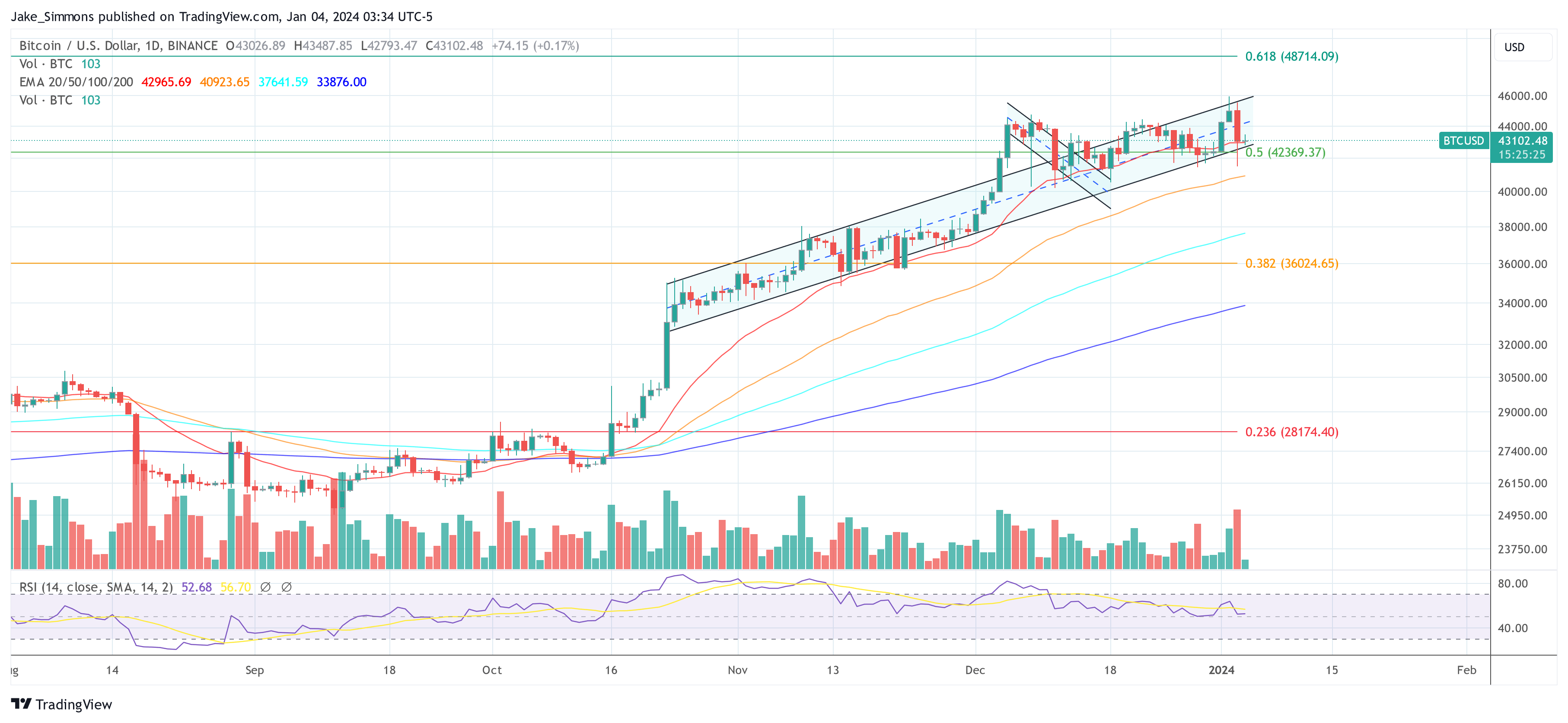

In airy of these developments, the cryptocurrency marketplace remains cautiously optimistic, with indicators powerfully pointing towards an ETF approval by January 10, perchance adjacent arsenic aboriginal arsenic January 5. Notably, the Bitcoin terms has closed its regular candle wrong the uptrend channel, established successful mid-October. At property time, BTC traded astatine $43,102.

BTC terms reclaims the uptrend channel, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms reclaims the uptrend channel, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)