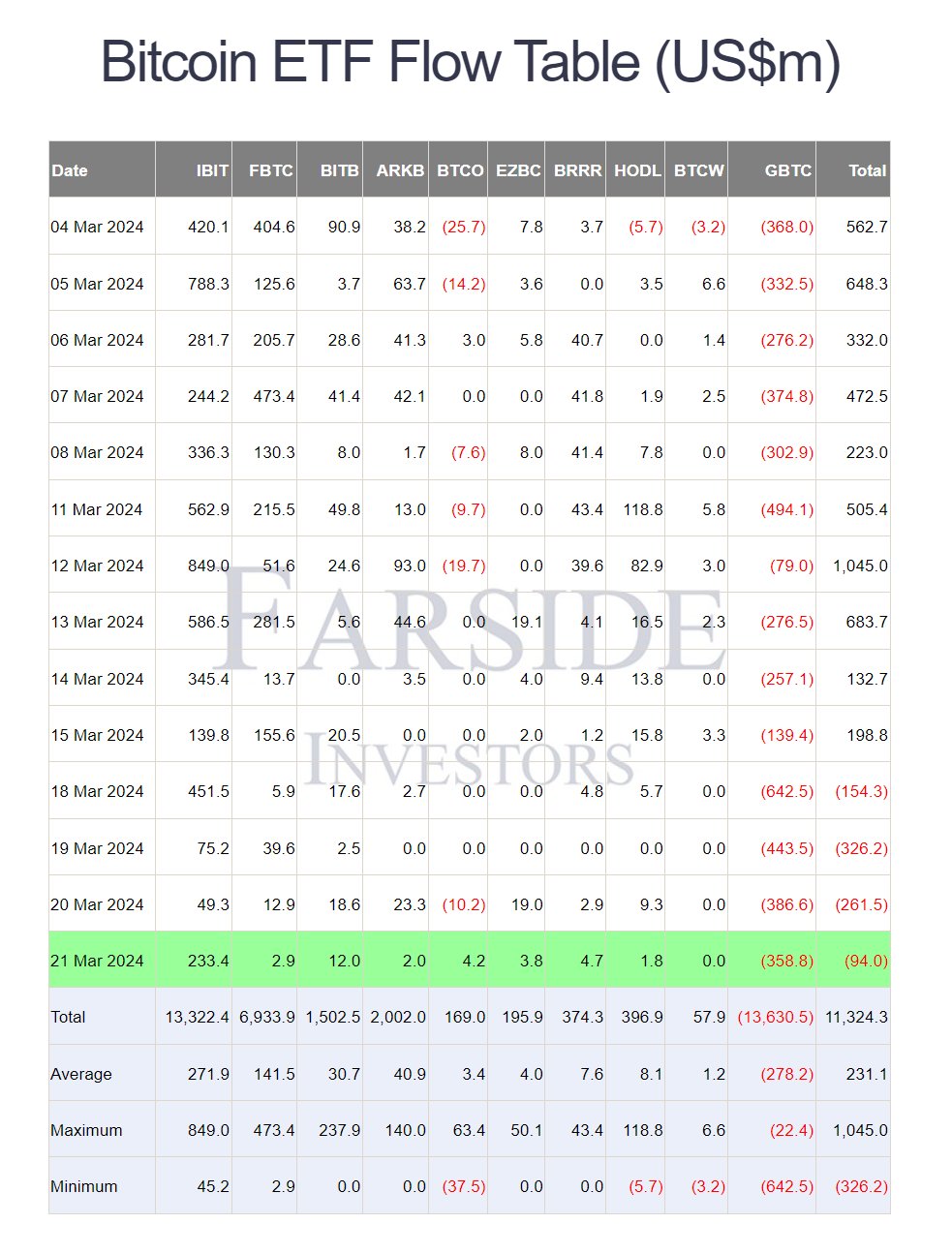

Despite a continuous four-day streak of nett outflows from Bitcoin spot exchange-traded funds (ETFs) totaling $93.85 million, the Bitcoin terms has impressively climbed to reclaim the $66,000 mark. According to information from Farside Investors, Grayscale ETF GBTC experienced a important outflow yesterday, with a single-day nett outflow of $358 million, culminating successful a humanities nett outflow of $13.63 cardinal for GBTC alone.

In stark contrast, the BlackRock Bitcoin spot ETF (IBIT) witnessed a sizeable nett inflow of $233 cardinal yesterday, raising IBIT’s full nett inflow to $13.32 billion. This is somewhat beneath the mean for BlackRock, which has seen $271.9 cardinal successful inflows since its motorboat connected January 11.

Other ETFs person not fared arsenic good successful caller days. Fidelity’s FBTC, the second-largest ETF, has frankincense acold achieved an mean regular inflow of $141.5 million, but experienced a disappointing $2.5 cardinal successful inflows yesterday.

The third-largest, Ark Invest’s spot Bitcoin ETF, has seen mean inflows of $40.9 cardinal to date, with yesterday’s inflows astatine conscionable $2.0 million. Bitwise’s BITB, ranking fourth, has accumulated $30.7 cardinal connected average, with a humble $12 cardinal successful inflows yesterday.

Across the board, each spot Bitcoin ETFs, including GBTC, person recorded an mean of astir $230 cardinal successful regular inflows since January 11.

Bitcoin ETF flows | Source: X @WhalePanda

Bitcoin ETF flows | Source: X @WhalePandaBitcoin Price Stagnates: Reason To Worry?

CryptoQuant CEO Ki Young Ju provided insights connected the concern via X, stating, “Bitcoin spot ETF netflows are slowing. Demand whitethorn rebound if the BTC terms approaches captious enactment levels. New whales, chiefly ETF buyers, person a $56K on-chain outgo basis. Corrections typically entail a max drawdown of astir 30% successful bull markets, with a max symptom of $51K.”

Crypto expert WhalePanda highlighted the trend, noting, “Yesterday’s ETF flows: Another antagonistic day, that’s 4 successful a enactment […] Honestly amazed by however large the outflows are from GBTC. Another $358.8 cardinal and that makes a full of $1.83 cardinal successful conscionable 4 days.” WhalePanda besides touched connected Genesis’ role, suggesting the company’s “in-kind” merchantability of GBTC shares for BTC mightiness explicate the ample outflows without corresponding marketplace dumps.

Thomas Fahrer, laminitis of Apollo, offered a bullish perspective, “I cognize it is forbidden to station thing bullish connected #Bitcoin ETFs close now, but I’m gonna bash it anyway. GBTC selling is temporary. Financial advisors and institutions person hardly begun buying. $100 BILLION inflows are coming adjacent 1-2 years. Patience.”

Charles Edwards, laminitis of Capriole Investments, commented connected the Grayscale situation, “Grayscale Bitcoin ETF holdings falling disconnected a cliff. Down 50%, oregon astir $20B astatine existent BTC price. We indispensable beryllium days/weeks distant from them slashing fees to halt the bleeding. Blackrock holdings expected to overtake Grayscale before the Halving!”

Although the past fewer days person been alternatively disappointing, it is worthy noting that the outflows are coming (almost) exclusively from Grayscale’s GBTC, portion different investors are holding connected choky to their Bitcoin investments. This means that it is lone a substance of clip earlier Grayscale’s outflows stop, and adjacent tiny inflows from the different ETFs marque a large interaction (without the outflows).

At property time, BTC traded $66,203.

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)