The post Bitcoin Price Regains Momentum—Can Bulls Push BTC Above Bearish Pressure? appeared first on Coinpedia Fintech News

The Bitcoin price is jiggling around $93,000 after marking an intraday low below $92,000, which has prevented the bulls from being dominant. Currently, the token is flashing mixed signals, with the price action becoming more and more defensive. On the other hand, the derivatives have also cooled down, suggesting traders are de-risking ahead of major macro events instead of rushing for the exit. With the CPI and GDP prints in focus, the upcoming BTC price action could be extremely important.

What is the Chart Pointing At?

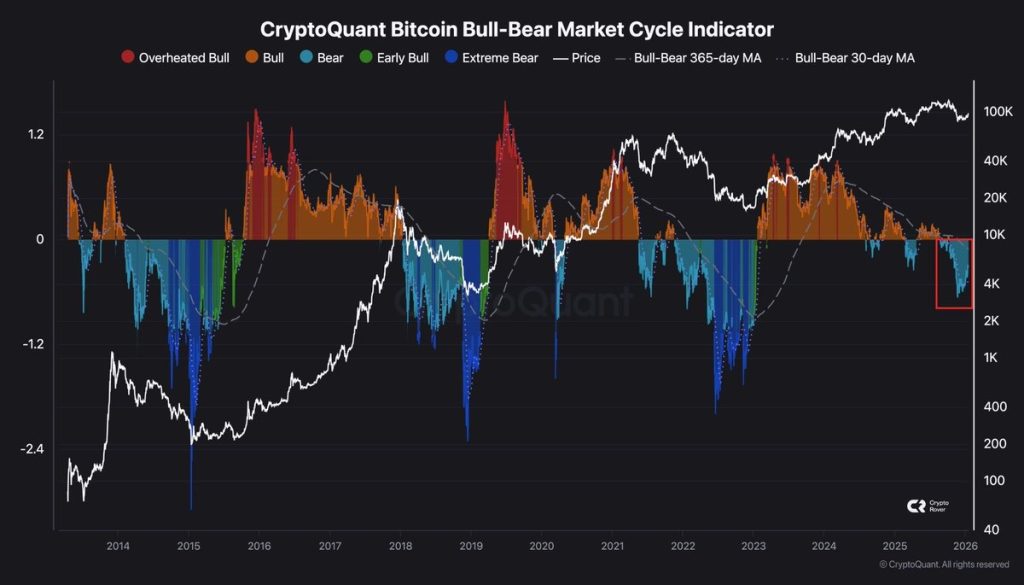

The CryptoQuant Bitcoin Bull-Bear Market Cycle Indicator is essentially a momentum “weather map” for Bitcoin’s longer cycle. When the signal prints in warmer colours (bull/overheated bull), it typically reflects stronger risk appetite and trend strength. When it fades into the blue “bear” zones, it suggests the market is cooling and that upside momentum is weakening.

Right now, the indicator has slipped into the blue bear region, which historically tends to appear during pullbacks, consolidation phases, or early-stage downturns. However, the key point is that this tool is not a switch that flips from bull to bear overnight. It’s better read as a warning that conditions are softening, not proof that the entire cycle has ended.

The chart highlights past periods where the indicator dipped into bearish territory without immediately triggering a prolonged bear market. This looks more like a mid-cycle reset where the momentum has cooled, but there is no clear sign. Hence, the traders need to wait and watch the support closely as a breakdown may only trigger a bear market.

What’s Next for the BTC Price—Will it Hold the Support at $90K?

Bitcoin’s next move hinges on the $90K support zone. If BTC holds that level on a closing basis and macro data doesn’t flip markets decisively risk-off, the current CryptoQuant “bear zone” read is more likely a mid-cycle cooldown, not a full trend breakdown. In that case, a rebound could first target the $95K area, followed by a push back toward the $100K psychological mark, with $106K–$110K possible if momentum fully returns. However, a clean close below $90K would shift the bias bearish and open downside targets near $88K, $85K, and potentially $80K.

2 hours ago

2 hours ago

English (US)

English (US)