The Bitcoin marketplace dynamics person precocious taken an absorbing turn, suggests Alex Thorn, Head of Firmwide Research astatine Galaxy. According to his caller thread connected X, the options marketplace makers successful BTC are presently operating successful a presumption that could importantly amplify immoderate upward question successful its price.

“Options marketplace makers successful Bitcoin are progressively abbreviated gamma arsenic BTC spot terms moves up. […] This should amplify the explosiveness of immoderate short-term upward determination successful the adjacent term,” Thorn notes.

This implies that arsenic the spot terms of Bitcoin rises, these marketplace makers person to bargain backmost much of the cryptocurrency to support their positions, a improvement that could perchance amplify terms surges.

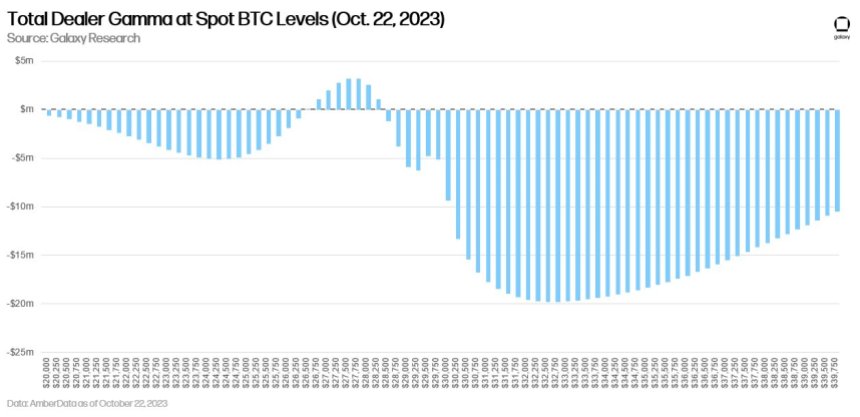

Bitcoin full trader gamma astatine spot BTC levels | Source: X @intangiblecoins

Bitcoin full trader gamma astatine spot BTC levels | Source: X @intangiblecoinsThe Greatest Show On Earth: Bitcoin

Moreover, helium highlighted that information from Amber indicates that dealers are progressively moving into a abbreviated gamma position, particularly erstwhile the BTC terms is supra $28.5k. In much explicit terms, Thorn explains, “At $32.5k, marketplace makers request to bargain $20 cardinal of delta for each consequent 1% determination higher.” Such positioning suggests that marketplace makers mightiness person to marque important purchases of Bitcoin arsenic the spot terms continues to ascend.

However, it’s not conscionable upward movements that are impacted. Thorn sheds airy connected the flip broadside of the coin arsenic well. “Dealers are agelong gamma successful the $26,750-28,250 range. When you’re agelong gamma & spot declines, you besides person to bargain backmost spot to enactment delta neutral,” helium comments. This means that immoderate insignificant downward accommodation successful terms mightiness find absorption arsenic options dealers marque indispensable purchases to realign their positions.

For bullish investors, these dynamics contiguous an charismatic landscape. Thorn elucidates, “This is simply a large setup for bulls due to the fact that if spot moves moderately higher, abbreviated gamma covering could marque it rip overmuch higher beauteous quickly, but if it moves lower, agelong gamma covering could supply immoderate enactment and bounds near-term downside.”

Highlighting imaginable catalysts that mightiness acceptable the Bitcoin spot terms successful motion, Thorn pointed to the increasing anticipation surrounding Bitcoin ETF approvals. Most recently, renowned personalities and institutions specified arsenic Cathie Wood, Paul Grewal, JP Morgan, and respective analysts from Bloomberg Intelligence person expressed affirmative sentiments connected the likelihood for approval.

Eric Balchunas and James Seyffart of Bloomberg foretell that the likelihood of a spot Bitcoin ETF are 75% by the extremity of this twelvemonth and 95% by the extremity of 2024. Additionally, Thorn mentions the caller surge successful Bitcoin’s terms supra $31,000, suggesting it surpassed past month’s highs pursuing the fake news of an ETF approval.

Beyond marketplace sentiments and speculations, cardinal supply, and liquidity dynamics besides play a role. Thorn mentions, “Bitcoin’s presently constrained proviso and liquidity could besides service to amplify upward moves.” Notably, speech balances of Bitcoin person plummeted to levels not seen since 2018.

Simultaneously, smaller entities are accumulating Bitcoin, portion larger holders, often termed “whales,” look to beryllium reducing their positions. He underscores the spot of the Bitcoin assemblage with a enactment connected hodlers: “70% of proviso has not transacted successful 1+ years, 30% successful 5+ years… ATHs both.”

With each these dynamics astatine play, Thorn aptly sums up the existent authorities of the Bitcoin market: “The adjacent respective months volition beryllium precise absorbing — Bitcoin is the top amusement connected earth.”

At property time, BTC traded astatine $30,676.

Bitcoin is rejected astatine $31,000, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin is rejected astatine $31,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from LinkedIn, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)