The Bitcoin terms has surged past the $71,000 people today. Over the past 5 days, Bitcoin’s terms has rallied by much than 8.5%, climbing from $65,600 to arsenic precocious arsenic $71,118 connected October 29. In the past 24 hours alone, the BTC terms has accrued by 3.8%. This upward momentum tin beryllium attributed to 4 cardinal factors:

#1 Bitcoin ETFs Attract Massive Inflows

The surge successful Bitcoin’s terms is intimately linked to important inflows into Bitcoin Exchange-Traded Funds (ETFs). Yesterday witnessed monolithic ETF flows totaling $479.4 million. BlackRock led the inflows with $315.2 million, followed by Fidelity astatine $44.1 million, Ark with $59.8 million, and Bitwise astatine $38.7 million. These important investments coincided with Bitcoin’s terms question from $68,000 to implicit $71,000.

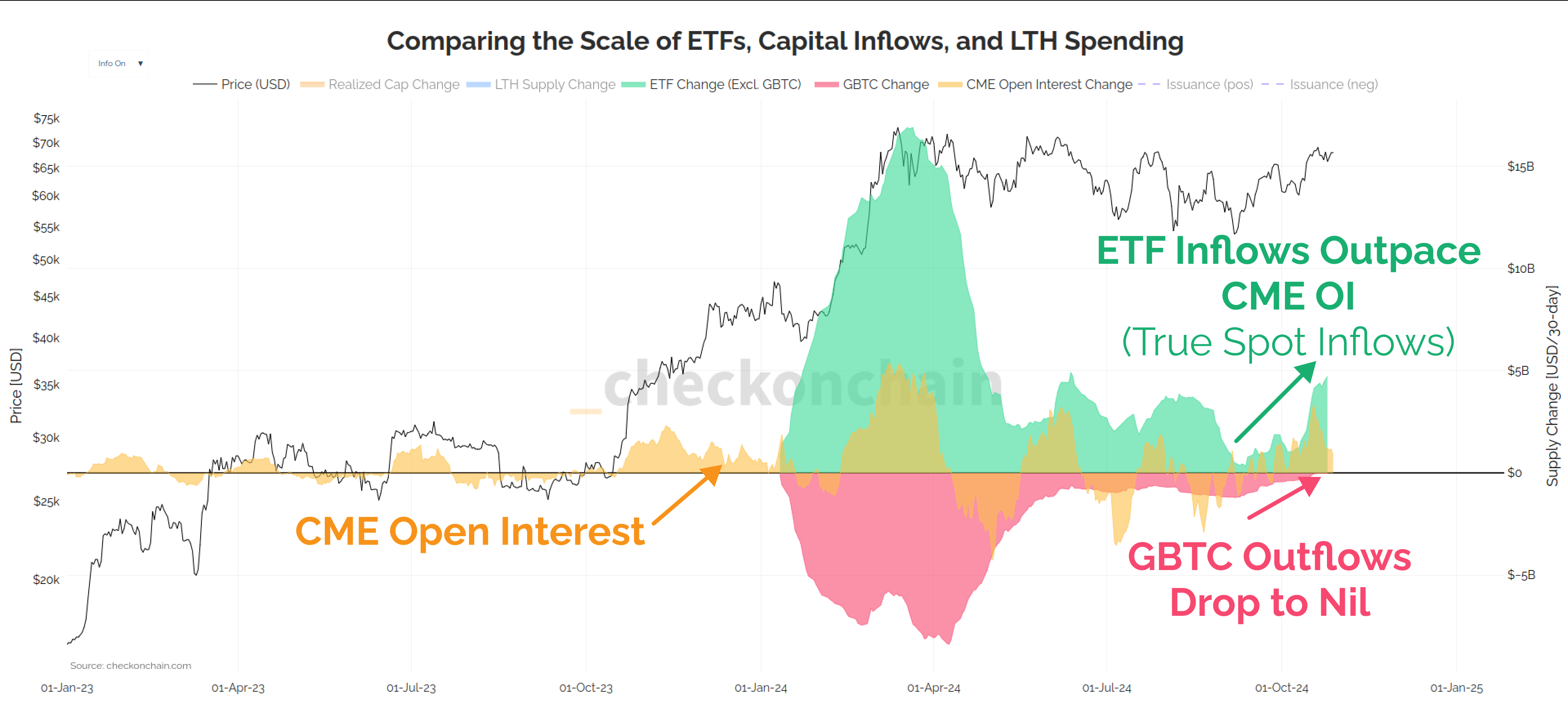

Leading on-chain expert James “Checkmate” Check highlighted a divergence betwixt Bitcoin ETF inflows and CME Open Interest. He noted “We person a divergence betwixt Bitcoin ETF Inflows and CME Open Interest. ETF Inflows are ticking meaningfully higher, CME Open Interest is up, but not arsenic overmuch GBTC outflows are besides minimal. We’re seeing existent directional ETF inflows, and little truthful currency and transportation trades.”

Bitcoin transportation commercialized | Source: X @_Checkmatey_

Bitcoin transportation commercialized | Source: X @_Checkmatey_The divergence suggests that investors are favoring nonstop vulnerability to Bitcoin done ETFs alternatively than engaging successful currency and transportation trades involving futures contracts. The transportation commercialized strategy successful the discourse of US spot Bitcoin ETFs and CME futures involves buying the ETF (tracking the spot terms of Bitcoin) and simultaneously shorting Bitcoin futures connected the CME.

This attack aims to capitalize connected terms differences erstwhile futures commercialized astatine a premium to the spot terms (contango). The notable displacement toward ETFs indicates a bullish sentiment among investors, anticipating further terms appreciation.

#2 The “Trump Trade”

Political developments are besides influencing Bitcoin’s caller rally. Singapore-based QCP Capital commented connected the interaction of erstwhile President Donald Trump’s interrogation connected the Joe Rogan Experience podcast, which has gained implicit 32 cardinal views and driven his Polymarket likelihood supra 66%. Despite “crypto” being touted arsenic the “Trump Trade,” Bitcoin’s correlation with Trump’s imaginable predetermination triumph seems to substance the Bitcoin terms rally.

QCP Capital besides noted that Bitcoin is up lone 8% this “Uptober,” compared to an mean of 21% successful erstwhile Octobers. They stated, “If spot holds astatine these levels, this October would people Bitcoin’s fourth-worst show successful the past decade.” With full BTC perpetual futures unfastened involvement crossed exchanges lasting astatine $27 billion—approaching this year’s peak—a breakout supra $70,000 could trigger caller all-time highs, particularly with much leveraged longs joining in.

#3 Shorts Squeeze Amplifies Price Surge

Market information indicates a important shorts compression contributing to Bitcoin’s terms spike. According to Coinglass, successful the past 24 hours, 65,622 traders were liquidated, with full liquidations crossed the full crypto marketplace amounting to $228.51 million. Of this, $169.47 cardinal were abbreviated liquidations. Specifically for Bitcoin, $83.61 cardinal successful shorts were liquidated. The largest azygous liquidation bid occurred connected Binance’s BTCUSDT pair, valued astatine $18 million.

The important liquidation of abbreviated positions suggests that galore traders were betting connected a terms diminution and were forced to adjacent their positions arsenic the marketplace moved against them. This wide unwinding of shorts tin accelerate upward terms movements arsenic traders bargain backmost into the marketplace to screen their positions.

#4 Whales Increase Buying Activity

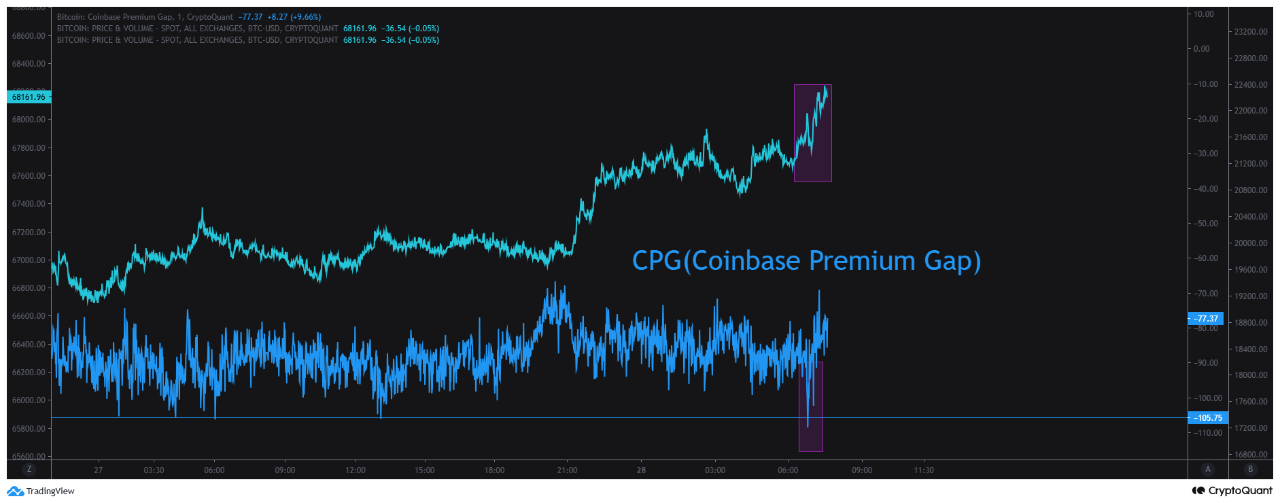

Large-scale investors, often referred to arsenic “whales,” are playing a pivotal relation successful the existent rally. CryptoQuant expert Mignolet observed that Bitcoin’s rally continues, led by enactment connected the Binance exchange. He pointed retired that Binance whales began important engagement successful the marketplace 2 weeks agone during Asian trading hours, and caller declines successful the Coinbase Premium Gap (CPG) alongside terms increases are “a wide motion of Binance whales’ intervention.

Coinbase Premium Gap | Source: Cryptoquant

Coinbase Premium Gap | Source: CryptoquantMignolet emphasized that this should not beryllium interpreted arsenic a diminution successful US demand, but an adjacent stronger buying unit from Binance. Over the past 2 weeks, request for US Bitcoin spot ETFs has surged, with a nett inflow of astir 47,000 Bitcoin. Since astir ETF products usage Coinbase, movements successful CPG information are intimately tied to ETF demand. He concluded, “The existent Bitcoin terms is being driven by Binance whales, with sustained inflows of US capital.”

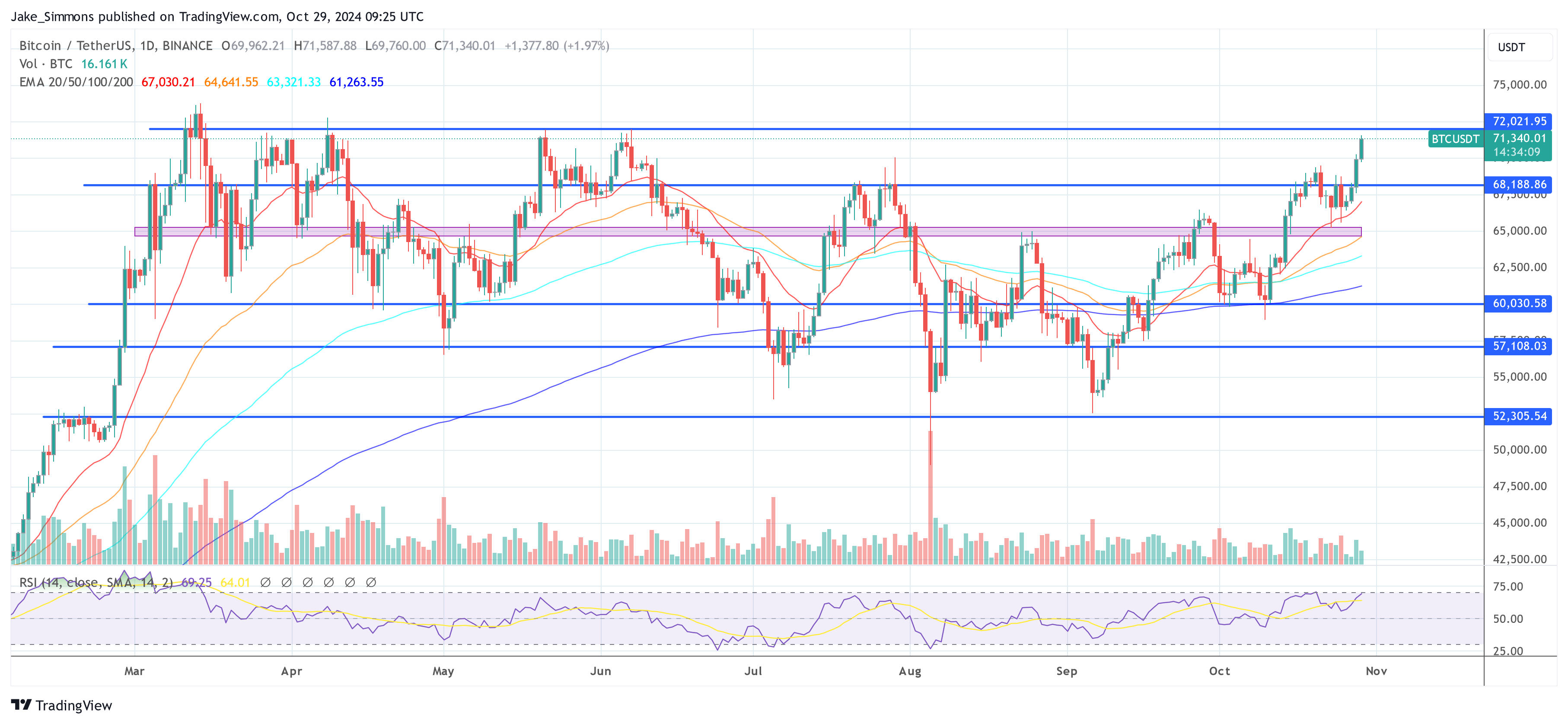

At property time, BTC traded astatine $71,340.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

7 months ago

7 months ago

English (US)

English (US)