The Bitcoin (BTC) terms has experienced a important downturn implicit the past 24 hours, falling beneath the captious $70,000 threshold. After reaching a highest of $73,620 connected Tuesday, the cryptocurrency has declined by astir 5.7%, hitting a debased of $68,830 connected Friday. Analysts constituent to respective cardinal factors down this decline:

#1 Risk-Off Sentiment Ahead of US Election

The timing of Bitcoin’s terms driblet coincides with a narrowing pb for erstwhile President Donald Trump implicit Democratic campaigner Vice President Kamala Harris successful prediction markets specified arsenic Polymarket and Kalshi, wherever users stake connected predetermination outcomes. Bitcoin has been considered a “Trump hedge” owed to the erstwhile president’s beardown advocacy for the cryptocurrency sector.

Donald Trump has projected establishing a “strategic Bitcoin reserve” successful the United States if re-elected. Speaking astatine the Bitcoin 2024 Conference, helium outlined plans to clasp each Bitcoin presently held oregon acquired by the US authorities arsenic portion of this reserve. This inaugural is simply a halfway constituent of his run to fortify the US arsenic a leader, aiming to marque the state the “crypto superior of the planet.”

Earlier successful the week, erstwhile Trump’s pb implicit Harris was much substantial, Bitcoin neared its all-time precocious of $73,777. The shrinking of Trump’s pb appears to person prompted investors to follow a risk-off stance, contributing to the terms decline.

Crypto expert HornHairs noted that derisking earlier elections has precedent. “Derisking into the predetermination 5-6 days earlier it takes spot happened successful some 2020 and 2016. Price past went connected to ne'er retest the lows acceptable the week earlier the predetermination ever again. Be cautious what you merchantability here,” helium remarked via X.

#2 S&P 500 Loses 3-Month Trendline

The correlation betwixt Bitcoin and accepted fiscal markets whitethorn person besides influenced BTC’s terms movement. The S&P 500 has fallen to its lowest level since October 9, perchance affecting capitalist sentiment successful the crypto space.

Analysts from The Kobeissi Letter observed that contempt large tech companies similar Apple reporting beardown earnings, their banal prices person declined. “Yet different tech elephantine to bushed net but commercialized lower,” they noted, adding that exertion stocks faced wide selling adjacent arsenic Meta, Amazon, and Apple exceeded net expectations. They added, It appears that markets are de-risking up of the predetermination adjacent week. Brace for volatility.”

Crypto trader Marco Johanning highlighted concerns astir the S&P 500 losing its three-month trendline. “Given that the S&P 500 mislaid the 3-months trendline yesterday, it looks much similar a imaginable selloff earlier the US predetermination connected Tuesday and little prices successful the abbreviated term. The cleanable bounce level is the 7-month trendline (blue). I don’t privation to spot prices beneath the POC/key level astir 63k (red),” helium wrote via X.

#3 Leverage Flush Out

A important unwinding of leveraged positions successful the markets has besides contributed to Bitcoin’s terms decline. The marketplace correction appears to beryllium a steadfast effect to an overextension driven by leverage.

Renowned crypto expert Miles Deutscher noted: “This pullback is mean (and expected). Market was looking overextended the past fewer days, and mostly driven by leverage. Still not buying dense arsenic it isn’t a afloat cascade yet—will hold for 1 of those days astir the election. Not a atrocious DCA time for definite coins tho.”

Austin Reid, Global Head of Revenue & Business astatine crypto premier brokerage steadfast FalconX, pointed retired that the crypto derivatives marketplace was “on fire” up of the election, with futures unfastened involvement for BTC, ETH, and SOL crossing the $50 cardinal people for the archetypal time.

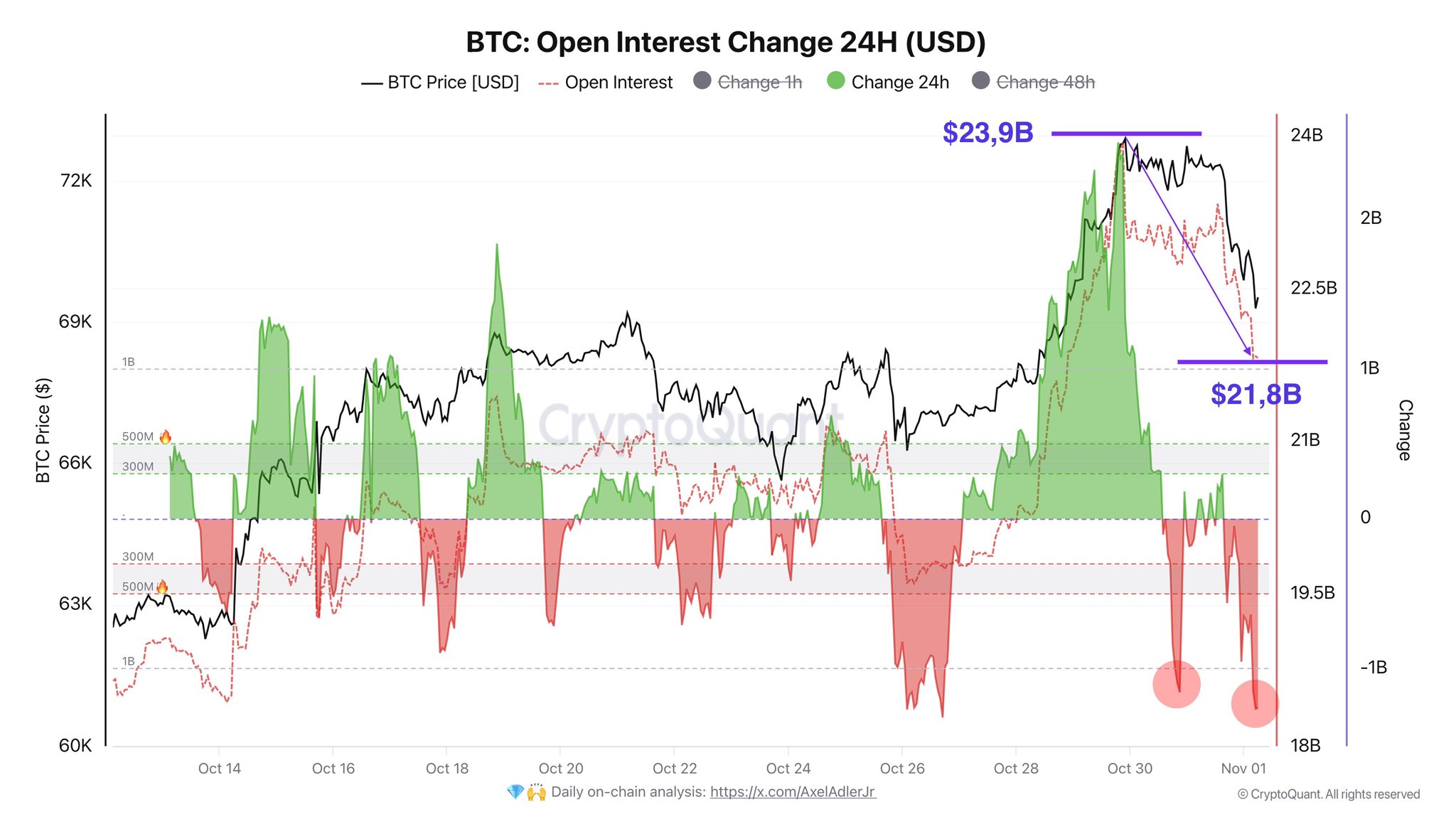

On-chain expert Axel Adler Jr reported that unfastened involvement was reduced by $2.1 billion, implying a important leverage flush out.

Bitcoin leverage flush retired | Source: X @AxelAdlerJr

Bitcoin leverage flush retired | Source: X @AxelAdlerJrAccording to data from Coinglass, implicit the past 24 hours, 93,864 traders were liquidated, with full liquidations amounting to $286.73 million. The largest azygous liquidation bid occurred connected Binance’s BTCUSDT pair, valued astatine $11.26 million. For Bitcoin alone, $81.38 cardinal successful agelong positions were liquidated—the largest magnitude since October 1.

At property time, BTC traded astatine $69,446.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

7 months ago

7 months ago

English (US)

English (US)