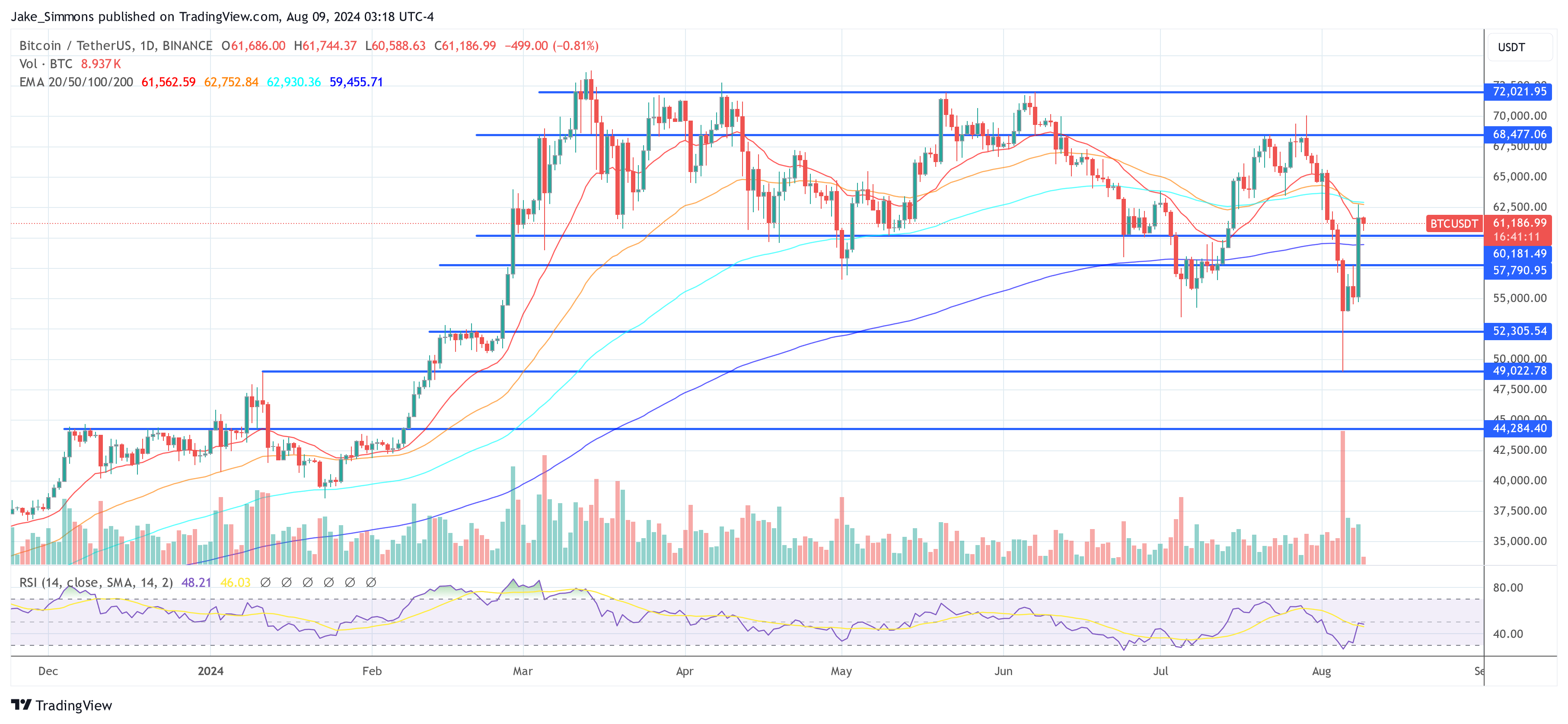

The Bitcoin terms records a large rally successful caller days. After plummeting to a debased of $49,000 connected Monday, the BTC terms soared arsenic precocious arsenic $62,700 during the Asian trading league today. Thus, BTC has surged 24% from its Monday low. Over the past 24 hours alone, BTC has risen by 7%. These are the cardinal reasons:

#1 Fading US Recession Fears Fuel Bitcoin Rally

Macro economics are the clear driver of the terms determination arsenic equities person rallied on with Bitcoin. Notably, the July unemployment complaint successful the United States accrued to 4.3%, the highest successful the past 4 months. This triggered concerns astir a imaginable recession, arsenic per the Sahm Rule. This economical indicator suggests that a recession mightiness beryllium starting if the three-month moving mean of the nationalist unemployment complaint rises by 0.50 percent points oregon much comparative to its lowest constituent successful the erstwhile 12 months.

The archetypal panic was exacerbated by a jobs study that fell abbreviated of expectations, with lone 114,000 caller jobs compared to the anticipated 175,000. However, the communicative shifted dramatically yesterday with the latest merchandise of jobless claims data. A important driblet to 233,000, down by 17,000, marked the largest diminution successful astir a year, soothing jittery markets.

Mohamed A. El-Erian, President of Queens College Cambridge and main economical advisor astatine Allianz, explained via X that the planetary fiscal markets reacted to the information merchandise and interpreted it arsenic “a alleviation aft past week’s unemployment and maturation scare.” However, helium besides warned that “that this high-frequency information bid is inherently noisy.”

US play jobless claims came successful astatine 233,000, down from a revised 250,000 — a alleviation aft past week’s unemployment and maturation scare.

The details of this information merchandise volition beryllium taxable to a higher level of scrutiny with a presumption to assessing breadth and different distributional aspects.… https://t.co/fBqaJVs3sM

— Mohamed A. El-Erian (@elerianm) August 8, 2024

Macro expert Alex Krüger further elaborated that “the marketplace clang triggered by past week’s unemployment & payrolls information has present afloat reversed, aft today’s play jobless claims data. Price enactment and caller jobs information corroborate what I suspected: that the full equities marketplace had a crypto benignant levered flush-out, driven mostly by positioning, communicative and wide hysteria, and not arsenic overmuch by fundamentals.”

Krüger besides cautioned against overemphasis connected azygous information points: “There’s a crushed the Fed makes accent connected making nary decisions connected azygous information points. Payrolls information tin beryllium precise noisy. Yet past Friday overmuch of the marketplace went connected a brainsick rampage calling for a argumentation mistake and exigency complaint cuts.”

#2 Short Liquidations Amplify BTC Surge

The volatility successful Bitcoin’s terms besides catalyzed a important fig of abbreviated liquidations. In the past 24 hours alone, 52,413 traders were liquidated, with full crypto liquidations reaching $222.02 million, according to Coinglass data. For Bitcoin specifically, implicit $90 cardinal successful abbreviated positions were liquidated, marking it arsenic the third-highest short-liquidation lawsuit successful the past 5 months.

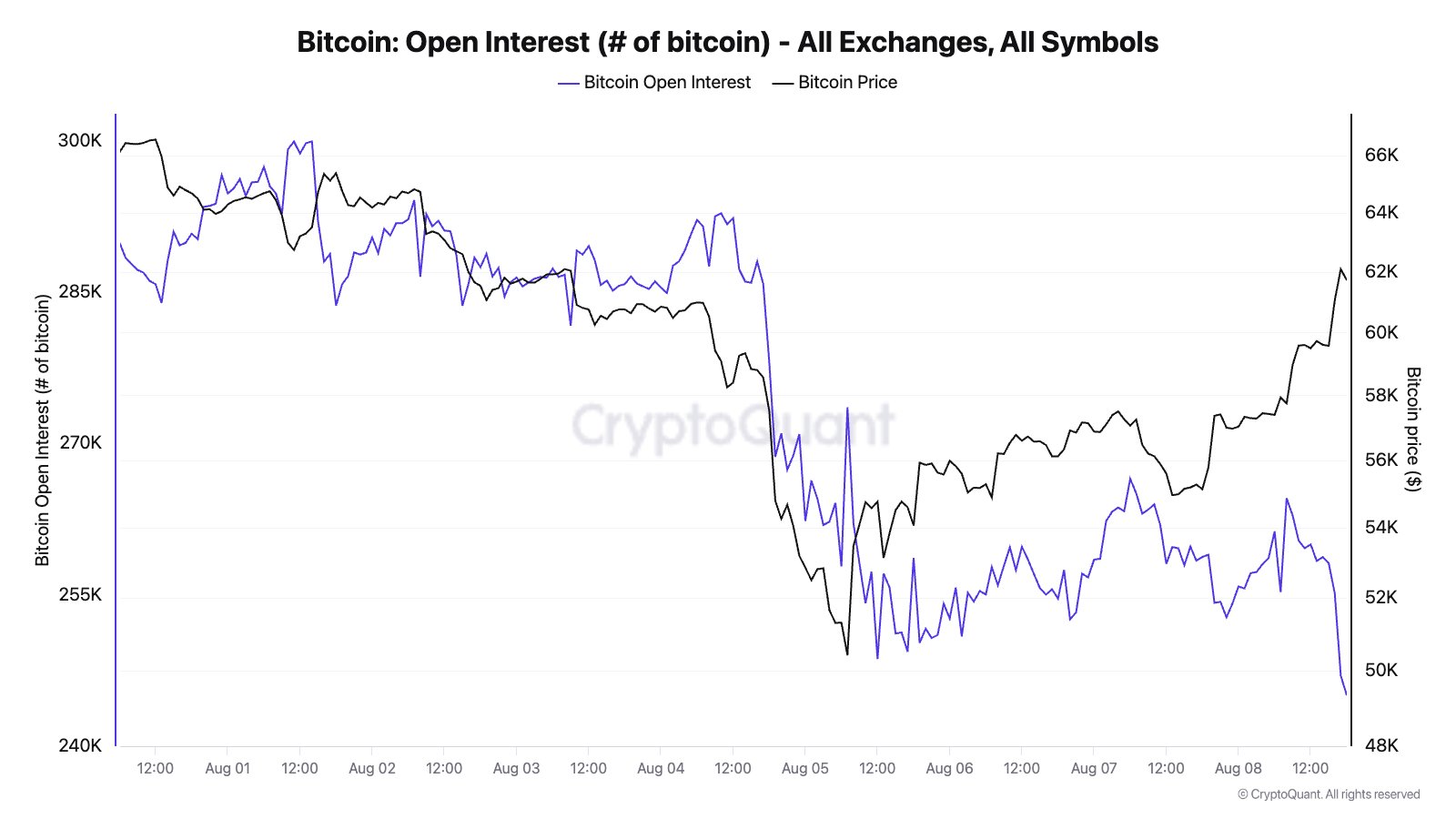

Julio Moreno, Head of Research astatine CryptoQuant, clarified the interaction of these liquidations connected the market: “This Bitcoin bounce has been mostly shorts covering positions successful the futures market. Open involvement down, prices up.”

Bitcoin unfastened involvement | Source: X @jjcmoreno

Bitcoin unfastened involvement | Source: X @jjcmoreno#3 MicroStrategy Buying?

As the Bitcoin terms climbed higher, determination was a notable surge successful request from the spot market. Crypto expert Kiarash Hossainpour speculated, “You heard it present first: I could ideate this brainsick precocious nighttime marketplace bargain coming from nary different than Saylor. The feline conscionable announced different $2 cardinal bargain the different day. Who other buys successful the illiquid hours aft the US adjacent connected a Thursday night? Exactly, nobody.”

MicroStrategy, nether the enactment of Michael Saylor, announced past week plans to summation its Bitcoin holdings significantly, preparing to rise $2 cardinal done a caller at-the-market equity offering arsenic reported successful its Q2 2024 net report. The institution stated: “We proceed to intimately negociate our equity capital, and are filing a registration connection for a caller $2 cardinal at-the-market equity offering program.”

At property time, BTC traded astatine $61,186.

Bitcoin rises backmost supra $60,000, 1-week illustration | Source: BTCUSDT connected TradingView.com

Bitcoin rises backmost supra $60,000, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)