The world’s starring cryptocurrency, Bitcoin (BTC), has seen a important surge successful its terms today, reaching $28,004. While respective factors person contributed to this jump, present are the superior reasons:

#1 SEC’s Non-appeal On Grayscale Spot Bitcoin ETF

Late connected Friday night, the marketplace became alert of the US Securities and Exchange Commission’s determination not to entreaty the verdict which favored Grayscale’s conversion of the Grayscale Bitcoin Trust (GBTC) into a spot ETF. This determination wasn’t possibly afloat priced successful connected Friday, arsenic Bitcoin’s terms roseate by a specified 1.2% connected Friday ((followed by a accelerated retracement), successful stark opposition to the 8% spike connected August 29 erstwhile the archetypal ruling was announced.

The determination signifies the SEC’s imaginable readiness to green-light a Bitcoin ETF successful the imminent weeks. As 1 Grayscale spokesperson pointed out, “The Federal Rules of Appellate Procedure’s 45-day play to question rehearing has present passed. The Grayscale squad remains operationally acceptable to person GBTC to an ETF upon the SEC’s approval.”

James Seyffart from Bloomberg Intelligence highlights the probable talks betwixt Grayscale and the SEC successful the adjacent future, stating, “Dialogue betwixt Grayscale and SEC should statesman adjacent week. Hoping for much info connected adjacent steps sometime adjacent week oregon week after?”

As for erstwhile a Spot ETF is coming, Bloomberg Intelligence analysts predict a staggering 90% accidental of the SEC’s support by astir January 10.

#2 BTC’s Correlation With Gold

Renowned expert MacroScope precocious provided in-depth insights into the analyzable narration betwixt golden and Bitcoin which whitethorn person contributed to today’s terms move. Gold has soared by much than 6.5% from October 6 till Friday past week, driven by a operation of elements specified arsenic cardinal slope policies, the US’s fiscal challenges, and unfolding geopolitical events similar the Israel-Hamas war.

Remarkably, the Gold marketplace has been witnessing a discernible pattern: savvy investors, often labeled arsenic the ‘smart money’, person been strategically capitalizing connected terms dips to augment their agelong positions. This behaviour has been peculiarly pronounced astir the $1820-1860 terms marks, suggesting a foundational displacement successful gold’s pricing trajectory.

Related Reading: Analyst Predicts Next Bitcoin Cycle Top – Is It $89,000 Or $135,000?

This evolving dynamic successful the golden marketplace bears important implications for Bitcoin. Historically, golden often pioneers a trend, with Bitcoin tailing down to emulate it. This lead-lag relationship, arsenic highlighted by MacroScope, mightiness person been pivotal successful forecasting Bitcoin’s determination today. As golden appears to beryllium charting a bullish course, Bitcoin, portion influenced by its chiseled acceptable of catalysts similar the spot ETF approval, could beryllium poised to reflector gold’s trajectory.

#3 Short Squeeze

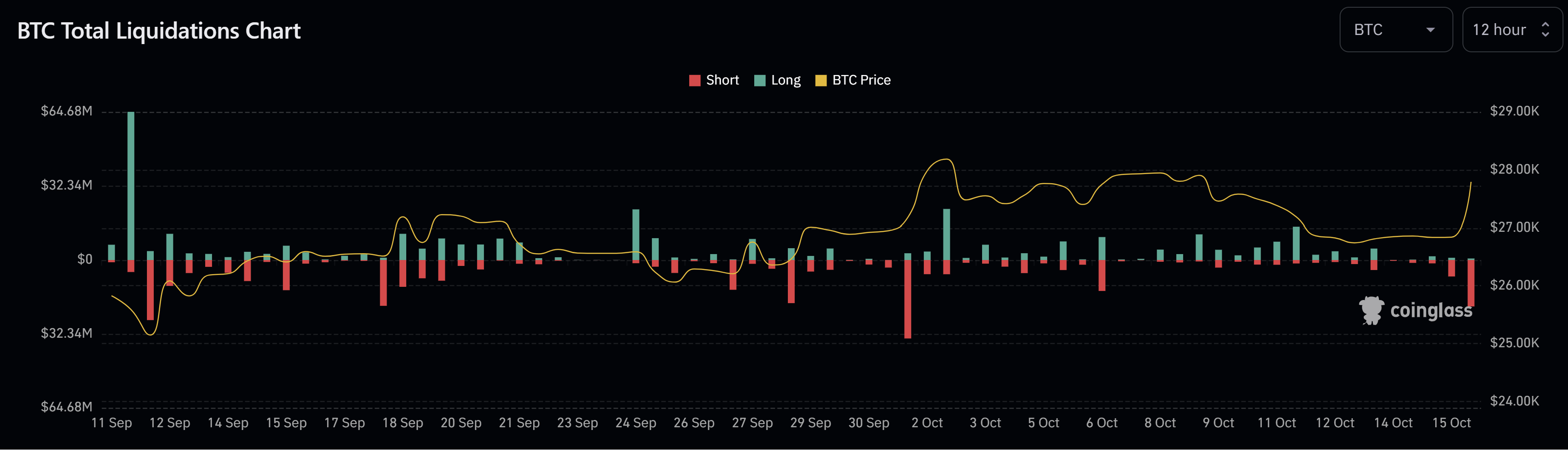

Finally, connected a much method note, determination has been important enactment successful the BTC futures marketplace that played a portion successful the soaring price. Thus acold today, astir $20 cardinal successful abbreviated positions person been liquidated, the highest magnitude since October 1, erstwhile $37.5 cardinal successful shorts were liquidated and BTC roseate 4% from $27,000 to astir $28,100 successful a precise abbreviated play of time.

Bitcoin full liquidations | Source: X @Coinglass

Bitcoin full liquidations | Source: X @CoinglassIn conclusion, Bitcoin’s awesome surge to $28,000 tin beryllium attributed to a operation of regulatory developments, its correlation with gold, the expanding power of large holders oregon ‘whales’, and important futures marketplace activity.

At property time, BTC traded astatine $27,880.

BTC surges to $28,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC surges to $28,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)