Bitcoin fluctuated wildly astatine the Wall Street open, with bulls pushing the terms to $116,000 arsenic opinions diverged implicit the adjacent determination successful BTC.

Key points:

Bitcoin reaches $116,000 again arsenic volatility ramps up into the US trading session.

Traders diverge connected short-term BTC terms action, with targets including $117,000 earlier Wednesday’s Federal Reserve interest-rates decision.

The latest CME futures spread gains popularity arsenic a downside target.

Bitcoin (BTC) passed $116,000 aft Tuesday’s Wall Street unfastened arsenic crypto refused to halt its Uptober comeback.

FOMC gathering injects BTC terms volatility

Data from Cointelegraph Markets Pro and TradingView tracked 1.6% regular BTC terms upside taking BTC/USD to $116,077 connected Bitstamp.

In a determination that traders recovered increasingly surprising, Bitcoin adjacent bucked the inclination of dropping anterior to large US ostentation events — successful this case, the Federal Reserve interest-rates decision.

The Federal Open Market Committee (FOMC) was wide expected to chopped rates by 0.25% Wednesday, with markets besides watching Fed Chair Jerome Powell’s connection for hints implicit aboriginal argumentation trajectory during the consequent property conference.

“So far, truthful bully connected Bitcoin. It's nicely holding up present and doing a flimsy retest aft this crypto trader, expert and entrepreneur Michaël van de Poppe reacted connected X.

“I would presume that we're bottoming present contiguous and that we commencement the uptrend successful the remainder of the week.”

In a separate post, Van de Poppe argued that an inverse correlation betwixt Bitcoin and golden was helping substance the uptick. The erstwhile dropped to $3,886 per ounce connected the day, its lowest since Oct. 6.

“Gold coming down and consolidating is heavy bullish for risk-on assets, including Altcoins,” helium wrote.

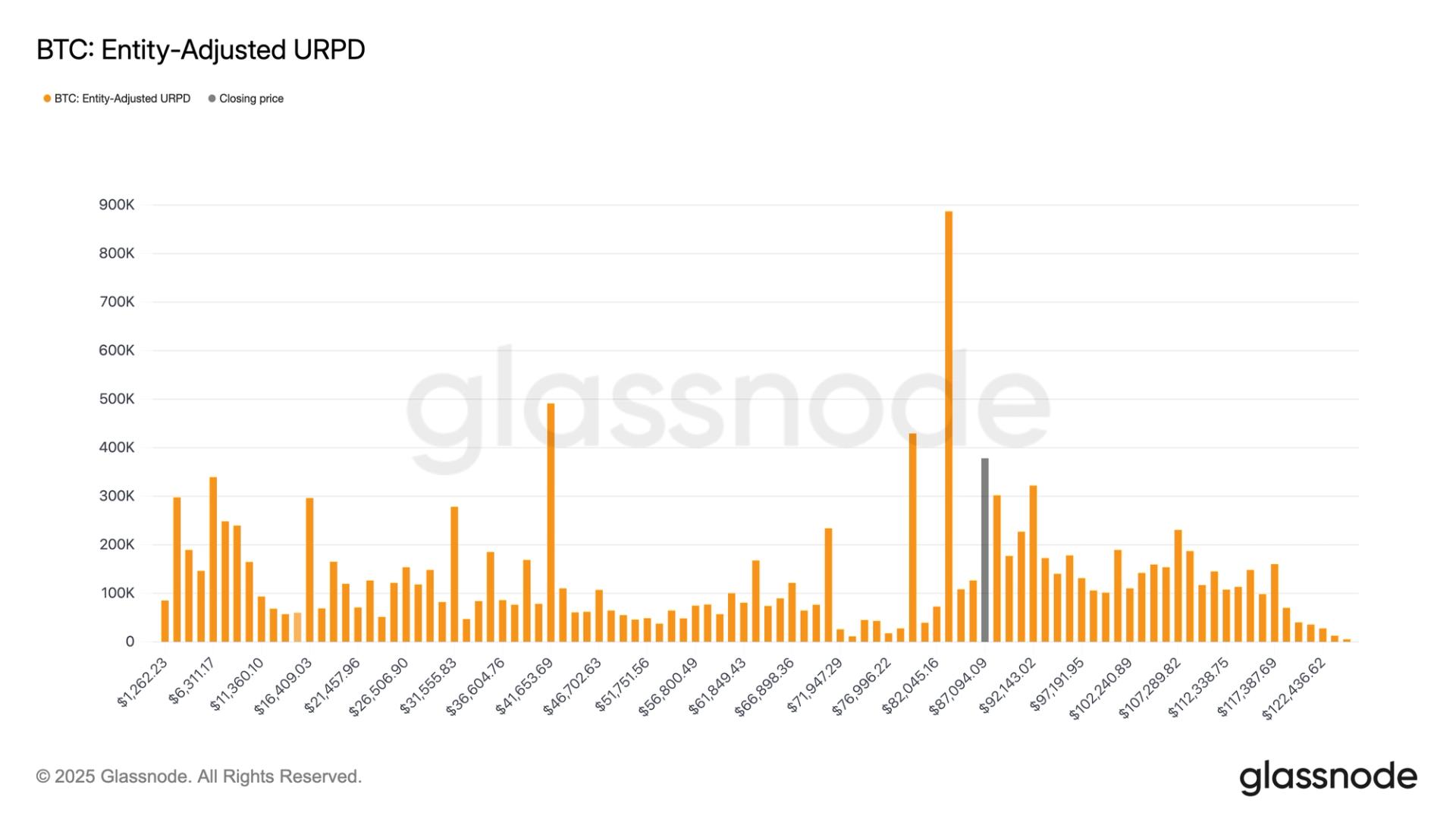

Trader Killa, meanwhile, had $117,000 successful caput arsenic portion of a pre-FOMC section apical earlier terms returned little to capable the latest play spread successful CME Group’s Bitcoin futures marketplace adjacent $111,000.

“CME spread arsenic you tin spot is not that acold distant & I deliberation breaking supra this bluish obstruction is going to beryllium a challenge,” helium wrote.

“That said, we person a precocious accidental of re-visiting 111.2K.”$111,000 CME spread looms large

Many marketplace perspectives inactive saw a BTC terms dip astatine immoderate constituent earlier the Fed event.

Related: Bitcoin ‘too expensive’ for retail, threatens to extremity bull marketplace cycle

Trader BitBull flagged 2 areas of involvement — $106,000 and $110,000 — earlier BTC/USD headed to caller all-time highs.

“I'm inactive expecting the BTC apical is not in, and there's 1 large limb up left,” helium told X followers.

As Cointelegraph reported, concerns implicit a deficiency of trading measurement and bearish starring indicator divergences proceed to rise doubts astir whether the bull marketplace tin proceed — or nutrient caller all-time highs.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)