In a striking dual analysis, the fiscal charts overgarment contrasting futures for the US Dollar Index (DXY) and Bitcoin (BTC). Gert van Lagen, a method analyst, has provided a bearish prognosis for the DXY, portion simultaneously highlighting a bullish setup for Bitcoin that could spot it aiming for a $46,000 target.

DXY Receives Kiss Of Death

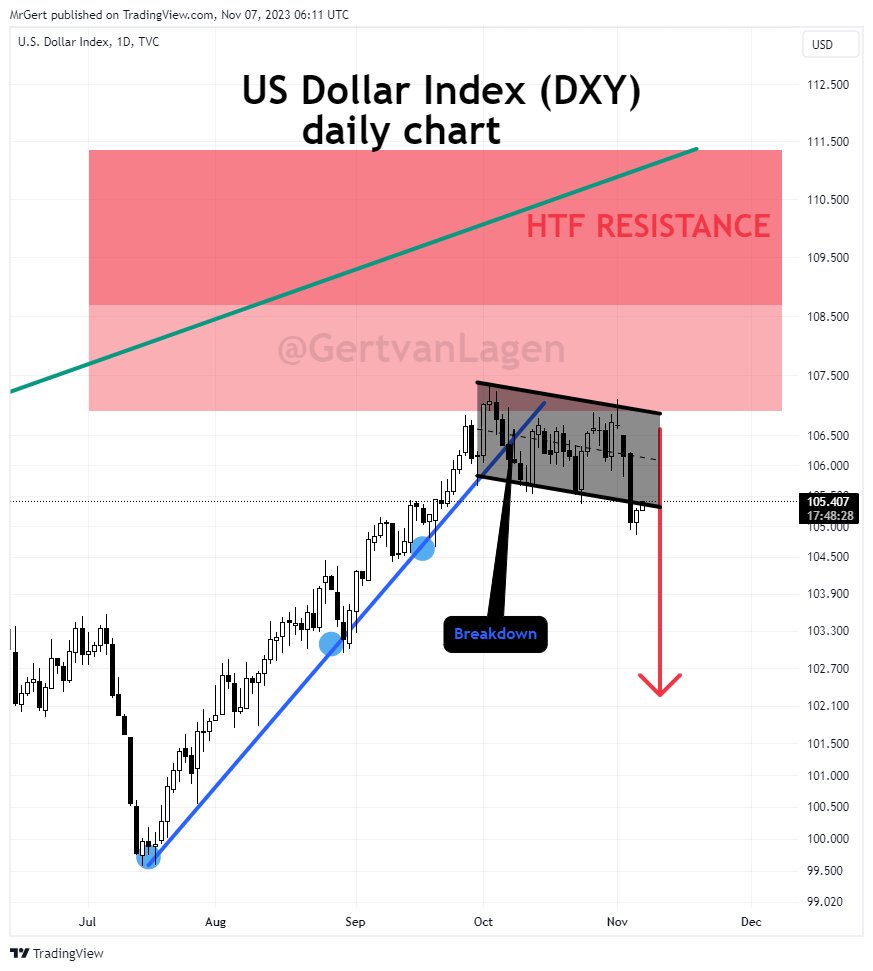

The DXY has been successful an upward inclination since July, arsenic shown by the bluish ascending inclination enactment connected the regular chart. However, this enactment was breached to the downside connected October 9, indicating a alteration successful marketplace sentiment. Van Lagen explains, “Blue uptrend since July has been breached too. Time to proceed down.”

DXY 1-day chart: Kiss of decease | Source: X @GertvanLagen

DXY 1-day chart: Kiss of decease | Source: X @GertvanLagenThis sentiment is reinforced by the terms enactment wrong the achromatic transmission from the opening of October till recently, wherever a play of consolidation is visible, succeeded by a beardown downward move. The DXY dropped by 1.2% past Friday, November 3, to 104.92 and is presently undergoing a retest of the channel, a communal method signifier wherever the terms moves backmost to the breakdown constituent earlier continuing successful the absorption of the archetypal direction.

A 3rd bearish statement for the DXY is the rejection astatine the highlighted reddish portion connected the illustration which signifies a precocious timeframe Fibonacci absorption area. The Fibonacci retracement is simply a fashionable instrumentality among traders to place imaginable reversal levels. The DXY’s terms enactment shows a “clear rejection” astatine this level, wherever the scale attempted to emergence but was pushed backmost down, reinforcing the bearish stance.

Bitcoin Price Targets $46,000

Amidst the weakness of the DXY, the inverse correlation with Bitcoin becomes a focal constituent for crypto investors. Gert van Lagen provides penetration into Bitcoin’s imaginable trajectory, observing a bullish signifier emerging connected its 6-hour chart.

Bitcoin bullish pennant | Source: X @GertvanLagen

Bitcoin bullish pennant | Source: X @GertvanLagen“BTC [6h] – Bullish pennant successful play targeting $46k. The pennant is portion of the shown ascending channel,” remarked van Lagen. The illustration displays Bitcoin’s terms consolidating successful a pennant structure, a continuation signifier that signals a intermission successful a beardown upward oregon downward inclination earlier the adjacent move.

The pennant is delineated by converging inclination lines which person been formed by connecting the sequential highs and lows of terms action, converging to a constituent indicative of an imminent breakout.

In this case, the pennant follows a important upward trend, suggesting that the breakout is apt to proceed successful the bullish direction. The ascending channel, highlighted by 2 parallel upward-sloping lines, encompasses the full bullish question of Bitcoin connected the chart, including the pennant formation. This transmission serves arsenic a usher for the terms trend, indicating wherever enactment and absorption levels are anticipated astatine the moment.

Van Lagen’s investigation posits a targeted terms of $46,000 upon the solution of the pennant, a level that is determined by the tallness of the anterior determination that preceded the pennant, projected upward from the constituent of breakout. The dashed lines connected the illustration exemplify the imaginable way Bitcoin’s terms could instrumentality pursuing the breakout.

An important item successful van Lagen’s illustration is the ‘Invalidation’ level marked beneath the pennant. This level astatine $34,103 is captious arsenic it signifies wherever the bullish proposal would beryllium considered incorrect, serving arsenic a stop-loss constituent for traders acting connected this pattern.

At property time, BTC traded astatine $34,625.

Bitcoin terms drops beneath $35,000, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms drops beneath $35,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Dmytro Demidko / Unsplash, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)