The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

In a erstwhile issue, we highlighted that based connected the level of realized losses, unrealized losses and capitulation trends successful the past, we had yet to spot a carnivore lawsuit capitulation play out:

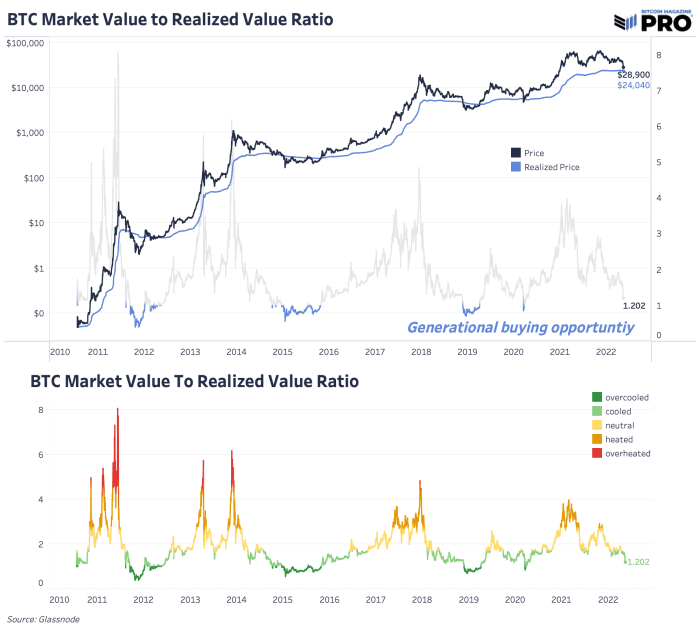

“The cardinal on-chain terms areas to ticker are inactive those that marque up the outgo basis. Currently the market’s realized terms is astir $24,000 portion semipermanent holders realized terms is astir $17,000. As short-term holders recognize losses, short-term holders realized terms has dropped to astir $48,000. If we’re to get the semipermanent holder marketplace capitulation we’ve seen successful the past, there’s perchance much downside to come.”

Today, arsenic bitcoin hovers supra a captious $28,000 terms and method level, we’ve yet to spot large capitulation play retired successful the broader equities marketplace arsenic bitcoin reaches its all-time highest equity marketplace correlations. The bitcoin bottommost volition apt travel with a broader risk-on plus bottommost and volition beryllium connected the reversal of tightening fiscal conditions and fleeting liquidity.

The bitcoin marketplace worth to realized worth ratio indicates a cooled, but not yet overcooled play indicative of marketplace capitulation bottoms.

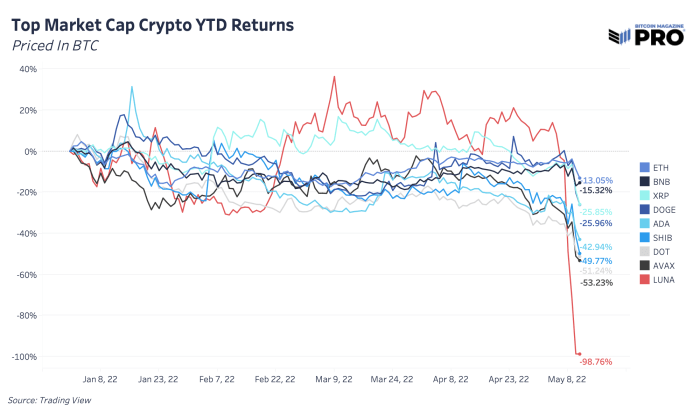

Capitulation-like sell-offs crossed broader cryptocurrencies, successful BTC terms, played retired implicit the past fewer days with Luna losing 98.76%. High-beta investments comparative to bitcoin are getting crushed year-to-date and particularly this week arsenic second-order effects of the Terra (UST) blowup ripple done the market. Whether it’s a repricing of protocol risks, forced selling, liquidations and/or harm power from UST and LUNA exposure, the full marketplace is selling disconnected overmuch worse than bitcoin.

Although bitcoin was deed successful the larger sell-off crossed the market, each different crypto assets were deed overmuch harder, arsenic shown by the illustration supra which is utilizing BTC arsenic the benchmark. It is besides worthy noting that if 2022 brings an extended play of consolidation/bear marketplace terms action, the afloat diluted marketplace headdress of galore altcoins is overmuch larger arsenic a percent of marketplace headdress contiguous (i.e., further inflation/dilution of the asset). Monetary properties substance implicit the agelong run, which is wherefore we stay laser-focused connected the prospects of bitcoin and take to disregard different “projects” successful the crypto space.

Subscribe to entree the afloat Bitcoin Magazine Pro newsletter.

3 years ago

3 years ago

English (US)

English (US)