Bitcoin experienced a tumultuous time yesterday, with its terms concisely touching $53,000 earlier plummeting to a debased of $50,820. Amid this terms volatility, an unexpected improvement caught the oculus of marketplace analysts: a melodramatic surge successful trading volumes for definite Bitcoin ETFs.

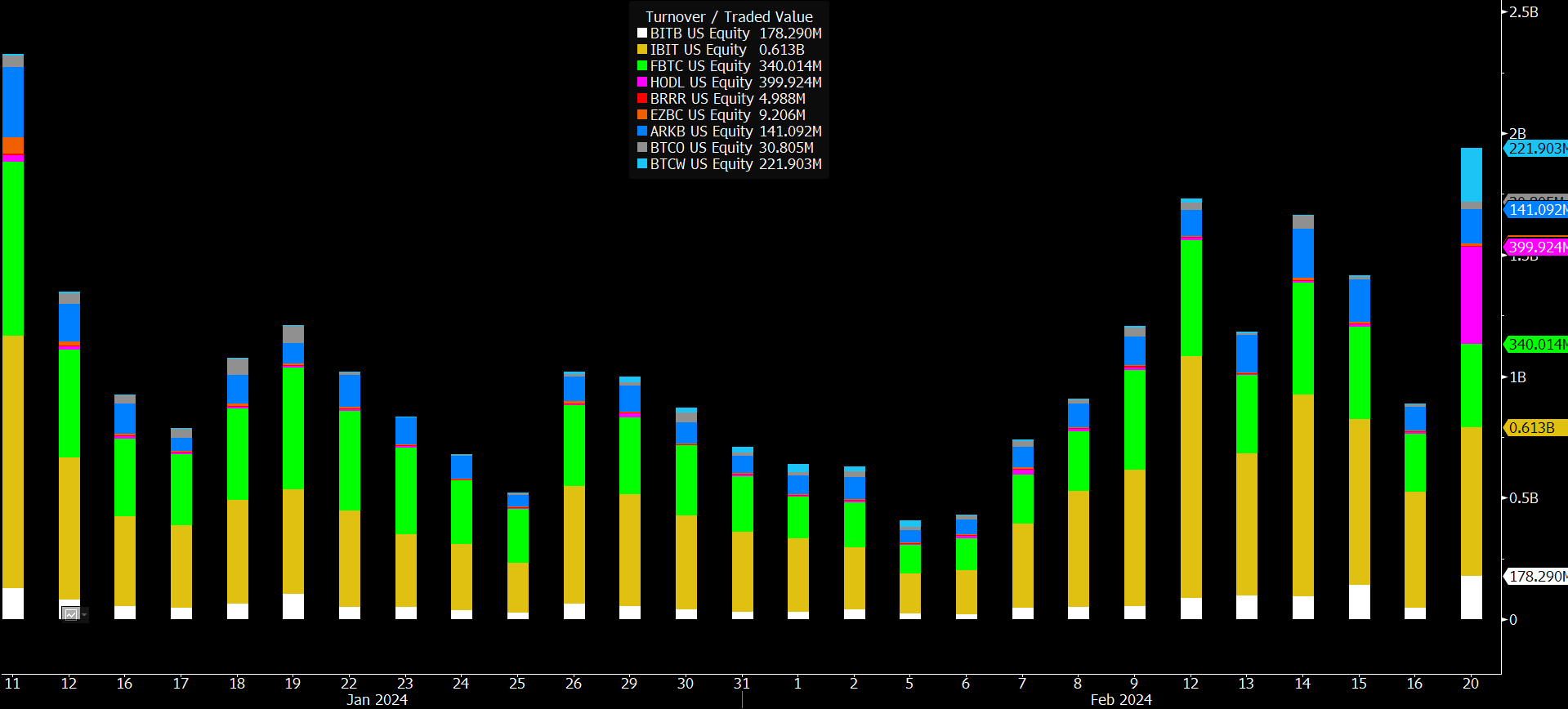

Bloomberg’s Eric Balchunas provided a detailed account of this anomaly connected X, peculiarly focusing connected the VanEck Bitcoin ETF (HODL) and its astonishing summation successful trading volume. He remarked, “HODL is going chaotic contiguous with $258m successful measurement already, a 14x leap implicit its regular average, and it’s not 1 large investor… but alternatively 32,000 idiosyncratic trades, which is 60x its avg.”

This level of enactment was not lone unexpected but besides unprecedented, sparking wide speculation and investigation wrong the fiscal community. The antithetic trading measurement wasn’t isolated to HODL alone. Wisdom Tree’s Bitcoin ETF (BTCW) and BlackRock’s Bitcoin ETF (IBIT) besides saw important upticks successful trading activity, albeit to varying degrees.

Balchunas pointed out, “BTCW besides popping off, $154m trades, 12x its avg and 25x its assets via 23,000 indiv trades.” However, helium noted that the measurement summation successful IBIT, portion elevated, did not scope the “extraordinary levels” observed successful HODL and BTCW.

What’s Behind The Sudden Spike In Bitcoin ETF Volumes?

Addressing theories that the ETF measurement surge was driving Bitcoin’s terms drop, Balchunas offered a rebuttal, “To the ‘bruh measurement indispensable beryllium selling bc btc is dumping’ crowd: a) that makes nary consciousness fixed however small these ETFs had successful existing aum/shareholders b) positive you ne'er spot ton of outflows successful marque caller ETF that is successful rally mode c) determination are truthful galore different holders of btc too ETFs! d) however tin you telephone it ‘dumping’ erstwhile it is down 1% aft 20% rally successful 2 weeks?”

However, the root of this abrupt and explosive summation successful trading measurement remains a mystery, with Balchunas speculating, “Still haven’t figured retired what happened. No 1 knows. Given however abrupt and explosive the summation successful fig of trades was… I’m wondering if immoderate Reddit oregon TikTok influencer benignant recommended them to their followers. Feels retail army-ish.”

He besides considered the anticipation of marketplace makers trading among each different but recovered it an improbable mentation fixed the liquidity of different Bitcoin ETFs similar IBIT and BITO.

The trading time concluded with “The Nine” achieving a record-breaking measurement day, acknowledgment to important contributions from HODL, BTCW, and BITB, which each shattered their erstwhile records. Balchunas highlighted the value of this trading volume, stating, “For discourse $2b successful trading would enactment them successful Top 10ish among ETFs and Top 20ish among stocks. It’s a lot.”

Turnover / commercialized measurement of the spot Bitcoin ETFs | Source: X @EricBalchunas

Turnover / commercialized measurement of the spot Bitcoin ETFs | Source: X @EricBalchunasAs the particulate settles connected this unprecedented time of trading, the Bitcoin assemblage continues to grapple with the implications of this measurement surge connected Bitcoin ETFs and its imaginable interaction connected the market. The nonstop catalyst down this improvement remains elusive, with analysts and investors alike keenly awaiting further developments.

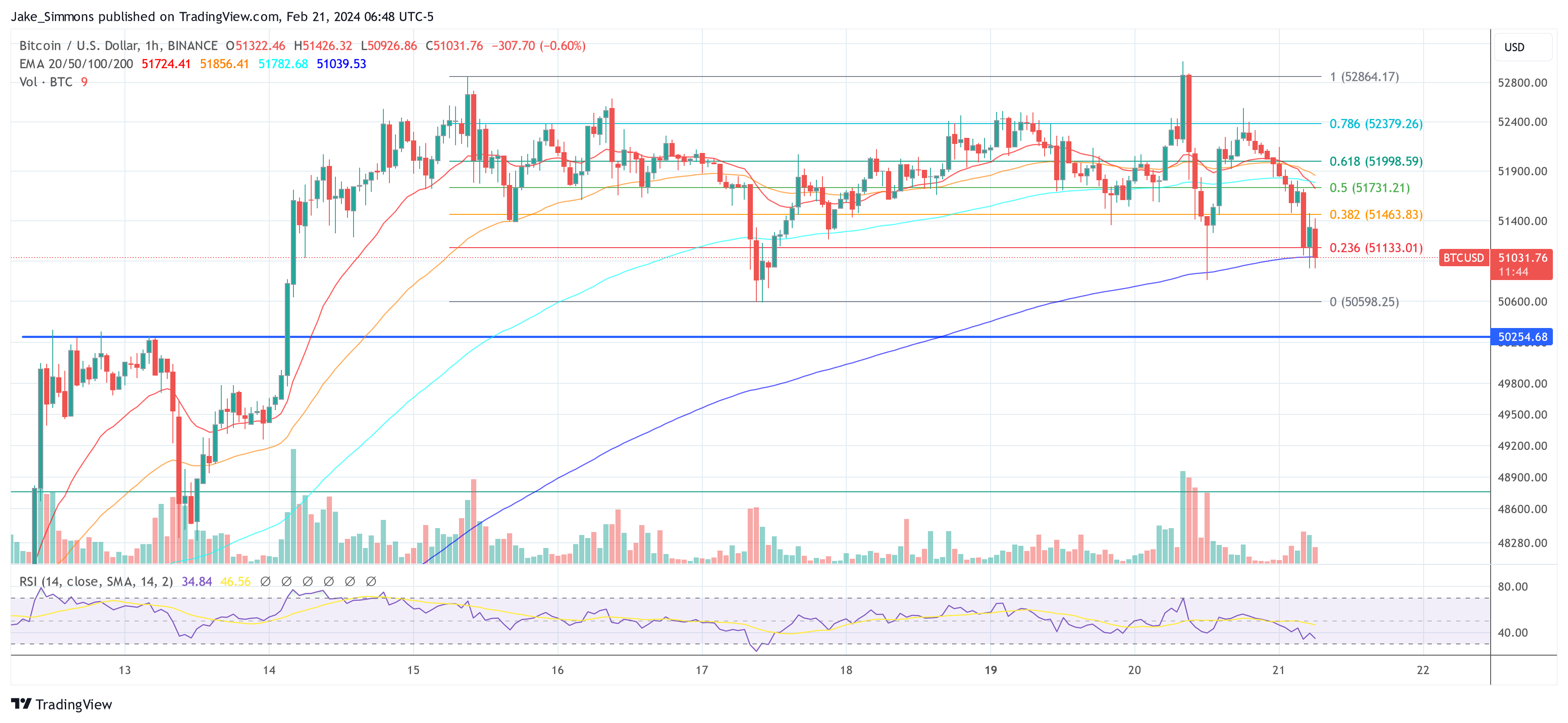

At the clip of going to press, BTC fell beneath the $51,000 people again and initially recovered enactment astatine the EMA100 connected the 1-hour chart.

BTC terms drops beneath $51,000, 1-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms drops beneath $51,000, 1-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E , illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)