The Bitcoin marketplace has witnessed a important downturn, with prices plummeting beneath the $66,000 mark. This abrupt -5.6% terms question tin beryllium attributed to 4 large factors: a agelong liquidation event, a rising US Dollar Index (DXY), profit-taking by investors, and spot Bitcoin ETF outflows.

#1 Long Liquidations

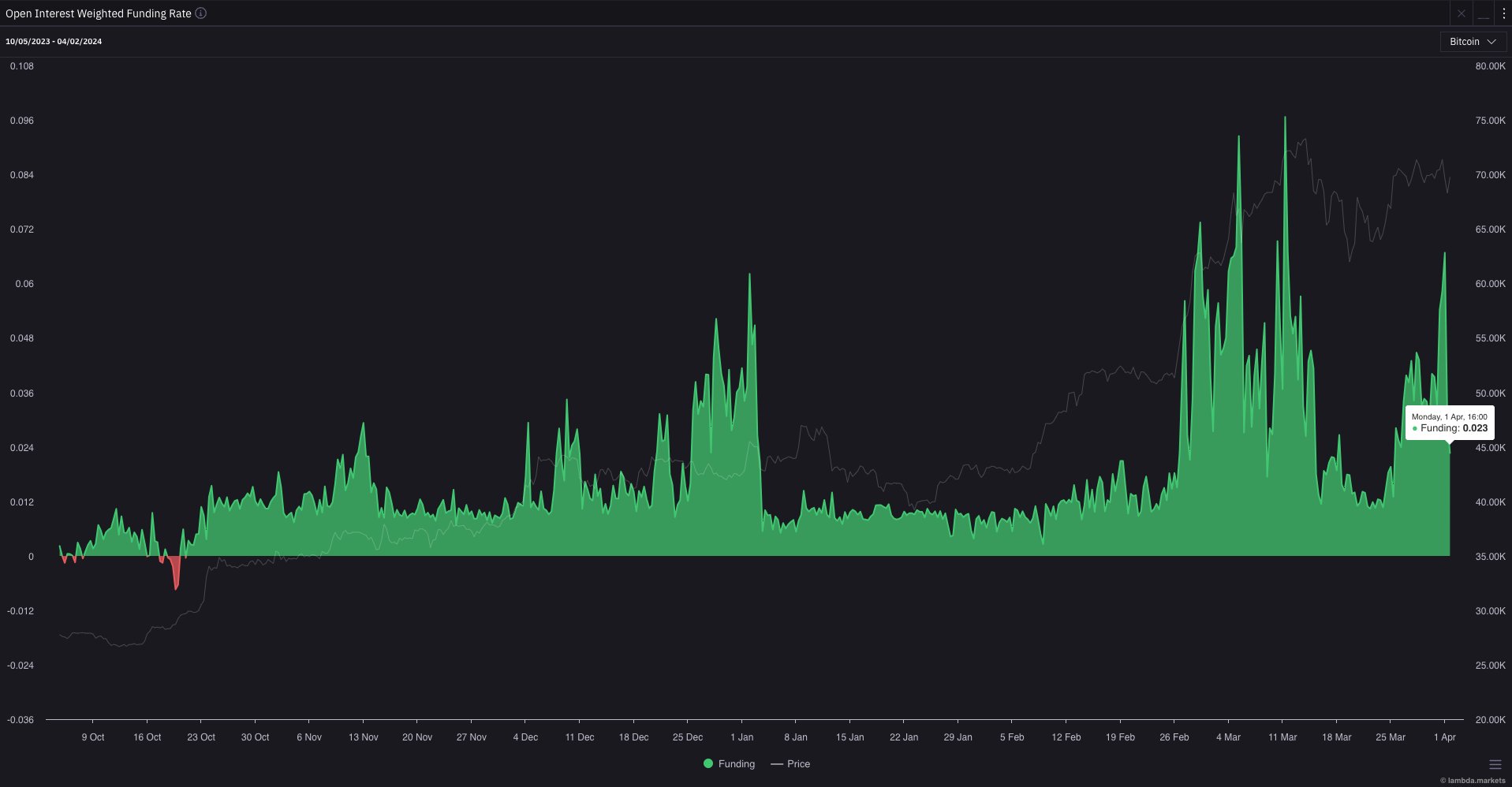

The main unit starring to today’s downturn successful Bitcoin’s terms was a important deleveraging event characterized by an unusually precocious level of agelong liquidations. Before the downturn, Bitcoin’s Open Interest (OI) Weighted Funding Rate was unusually high, indicating that leveraged traders were paying premiums to support agelong positions successful anticipation of aboriginal terms increases. This optimism, however, made the marketplace susceptible to abrupt corrections.

Crypto expert Ted, known arsenic @tedtalksmacro connected X (formerly Twitter), remarked, “Today was the largest agelong liquidation lawsuit since the 19th March.” He further elaborated connected the effects of this correction by noting, “Nice reset successful wide positioning today, adjacent connected conscionable a 5% driblet little for Bitcoin… Next limb higher is loading I think.” This remark highlights the severity of the liquidations and suggests a imaginable rebound oregon restructuring wrong the marketplace arsenic it stabilizes.

Bitcoin Open Interest (OI) Weighted Funding Rate | Source. X @tedtalksmacro

Bitcoin Open Interest (OI) Weighted Funding Rate | Source. X @tedtalksmacroCoinglass information reveals that implicit the past 24 hours, 120,569 traders were liquidated, amounting to $395.53 cardinal successful full liquidations, with $311.97 cardinal being agelong positions. Bitcoin-specific agelong liquidations were astatine $87.42 million.

#2 DXY Puts Pressure On Bitcoin

With 105.037, the DXY closed astatine its highest level since November yesterday, evidencing a strengthening US dollar. Given Bitcoin’s inverse correlation with the DXY, the stronger dollar mightiness person shifted capitalist penchant towards safer assets, moving distant from riskier investments similar Bitcoin.

This correlation stems from the planetary market’s hazard sentiment, wherever a rising DXY often signals a displacement towards safer investments, detracting from riskier assets similar Bitcoin. However, expert Coosh Alemzadeh provided a antagonistic perspective, suggesting done a Wyckoff redistribution schema that contempt the DXY’s caller uptick, the adjacent determination could favour hazard assets, perchance including Bitcoin.

#DXY ⬆️4 weeks successful a row/broke retired of its downtrend truthful statement is that a caller uptrend is starting yet hazard assets are consolidating astatine ATH

Next determination ⬆️in hazard assets connected platform IMO pic.twitter.com/u6ORa76vkj

— “Coosh” Alemzadeh (@AlemzadehC) April 2, 2024

#3 Profit Taking By Investors

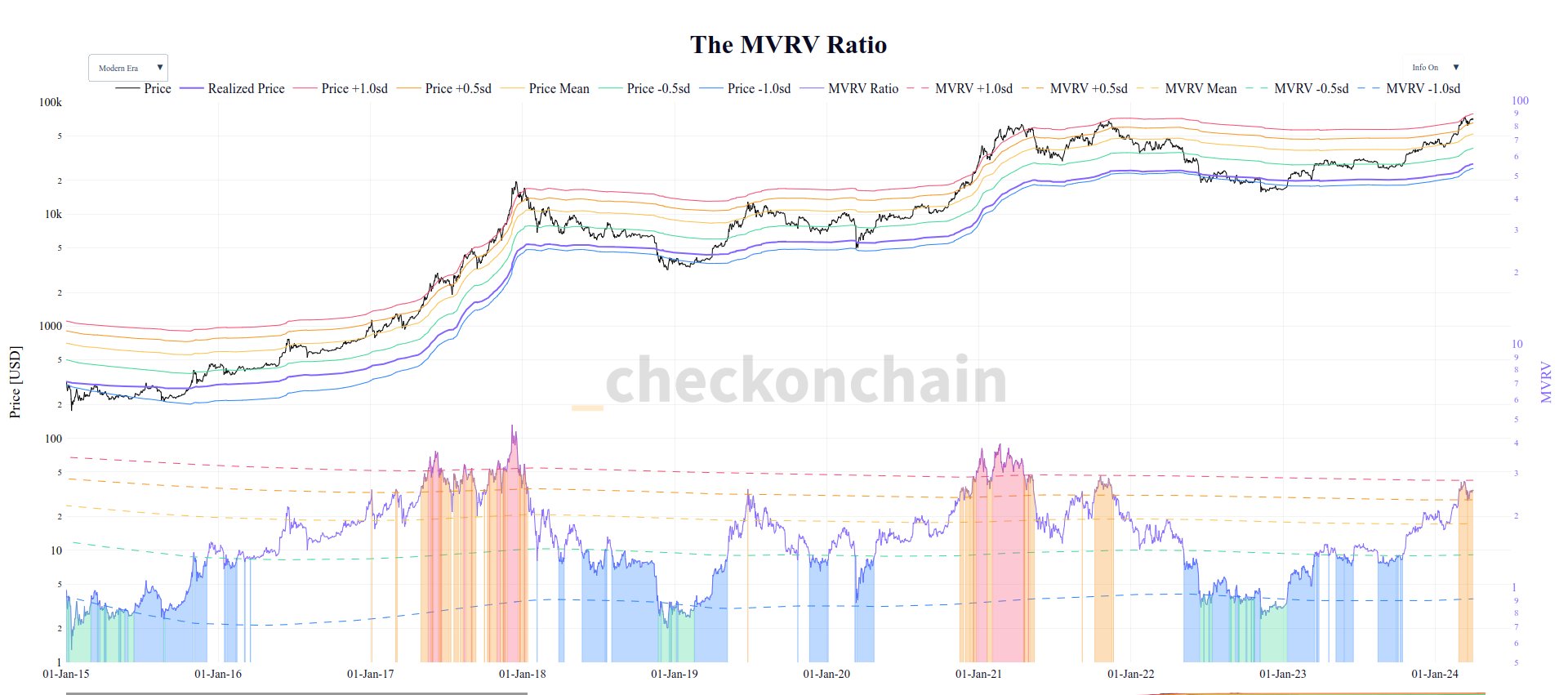

Profit-taking by investors has besides played a important relation successful the caller terms adjustments. The Bitcoin on-chain investigation level Checkonchain reported a spike successful profit-taking activities.

Glassnode’s pb on-chain analyst, Checkmatey, shared insights via X, stating, “The classical Bitcoin MVRV Ratio hits conditions we qualify arsenic ‘heated, but not yet overcooked’. MVRV = supra +0.5sd but beneath +1sd. This indicates that the mean BTC holder is sitting connected a important unrealized profit, prompting an uptick successful spending.”

MVRV Ratio | Source: X @_checkonchain

MVRV Ratio | Source: X @_checkonchainThe profit-taking coincided with Bitcoin reaching a highest of $73,000, marking a rhythm precocious successful nett realization with implicit 352,000 BTC sold for profit. This selling behaviour is emblematic successful bull markets but plays a important relation successful creating absorption levels astatine section terms tops.

#4 Bitcoin ETF Outflows

Lastly, the marketplace witnessed notable outflows from Bitcoin ETFs, marking a reversal from last week’s important inflows. The full outflows amounted to $85.7 cardinal successful a azygous day, with Grayscale’s GBTC experiencing the astir important withdrawal of $302 million.

Meanwhile, Blackrock’s IBIT and Fidelity’s FBTC reported affirmative inflows, totaling $165.9 cardinal and $44 million, respectively. Commenting connected this, WhalePanda remarked, “Overall antagonistic time but not arsenic antagonistic arsenic the terms implied. Closing of Q1 truthful taking nett present makes sense. Some fuckery astir [the] caller 4th and halving is to beryllium expected.”

At property time, BTC traded astatine $66,647.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)