At the commencement of the week, Bitcoin (BTC) terms succumbed to unit from sellers, declining from $84,500 connected March 17, to $81,300 astatine the clip of writing. This downward question was astir apt a sell-off related to the Federal Open Market Committee’s (FOMC) two-day meeting, which takes spot connected March 18-19.

Federal Open Market Committee (FOMC) meetings thin to enactment arsenic marketplace resets. Each clip the FOMC meets to deliberate connected US monetary policy, crypto markets brace for impact.

Historically, traders de-risk and trim leverage up of the announcement, and aft the gathering and property league from Federal Reserve Chair Jerome Powell the markets tin beryllium arsenic reactive.

The property merchandise of the existent FOMC gathering scheduled for Wednesday, March 19, astatine 2:30 p.m. ET, and it could trigger large movements successful the Bitcoin market. Analyzing marketplace behaviour starring to its merchandise could connection clues astir Bitcoin’s adjacent move.

To traders, FOMC means volatility

Traders are intimately monitoring the FOMC minutes for immoderate shifts successful the Fed’s stance connected ostentation and involvement rates.

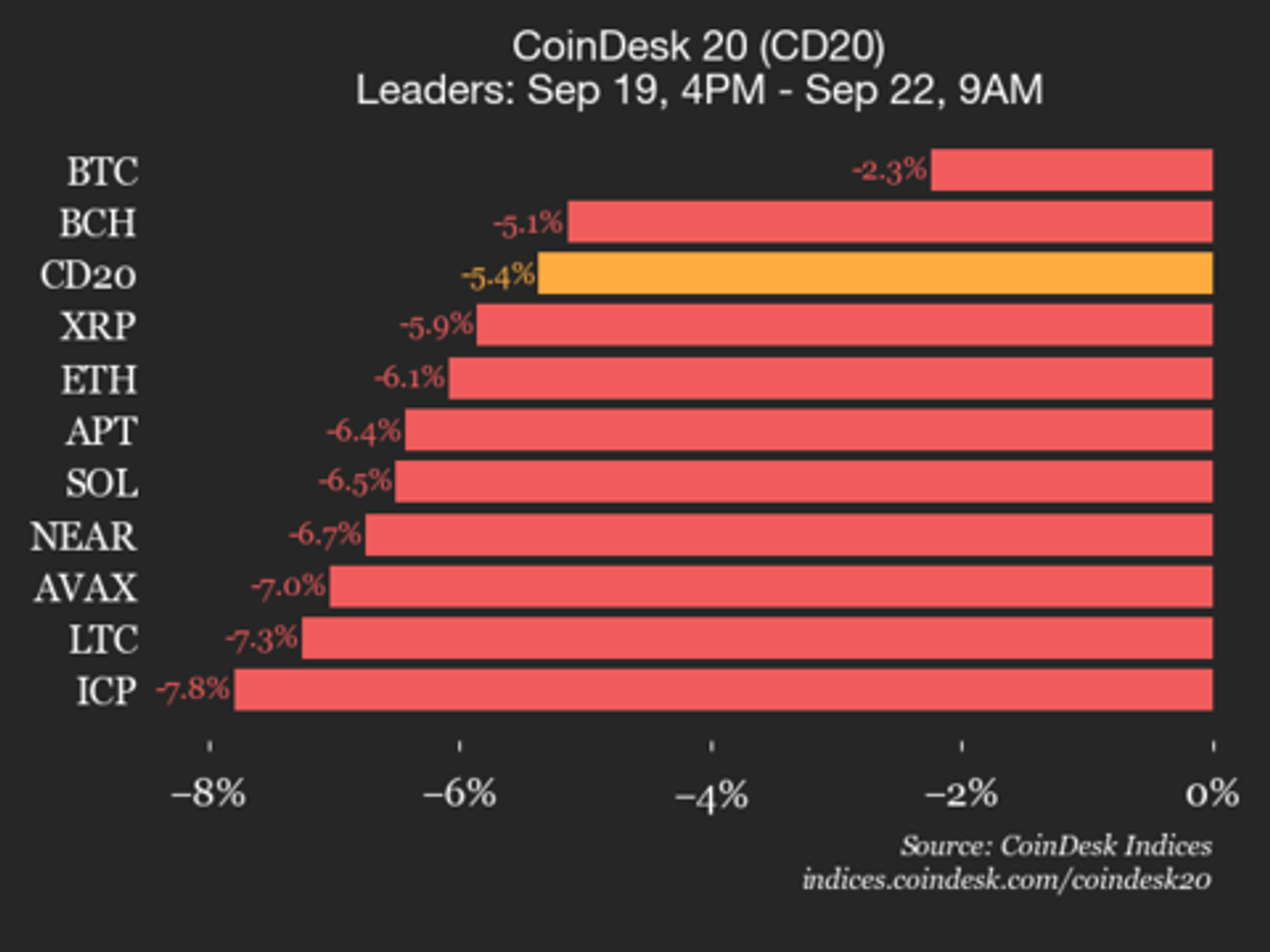

After the FOMC announcement, Bitcoin terms tends to respond sharply. Since the opening of 2024, BTC prices mostly declined aft the FOMC decided to support rates, arsenic tin beryllium seen connected the illustration below.

The notable objection was the pre-halving rally of February 2024, which besides coincided with the motorboat of the archetypal spot BTC ETFs. When US involvement rates were chopped connected September, 18, 2024 and November 7, 2024, Bitcoin rallied.

However, the 3rd chopped connected December 18, 2024, did not output the aforesaid result. The humble alteration by 25 ground points to the 4.50%–4.75% scope marked the section Bitcoin terms apical astatine $108,000.

BTC/USD 1-day illustration with FOMC dates. Souce: Marie Poteriaieva, TradingView

Markets deleverage earlier FOMC, but this time

A cardinal indicator that provides penetration into marketplace sentiment is Bitcoin unfastened interest—the full fig of derivative contracts, mostly $1 perpetual futures, that person not been settled.

Historically, Bitcoin unfastened involvement falls earlier FOMC meetings, showing that traders are reducing leverage and hazard exposure, arsenic per the graph based connected CoinGlass data.

Bitcoin futures unfastened involvement and FOMC dates. Source: Marie Poteriaieva, CoinGlass

However, this period different signifier has emerged. Despite Bitcoin’s $12 cardinal unfastened involvement shakeout earlier this month, successful the days preceding the FOMC determination was nary noticeable alteration successful Bitcoin’s unfastened interest. BTC price, however, declined, which is antithetic and could bespeak a beardown directional bet.

This could besides beryllium a motion that traders consciousness little anxiousness astir the Fed’s decision, perchance expecting a neutral outcome. Supporting this view, CME Group’s FedWatch instrumentality indicates a 99% probability that the Fed volition support rates astatine 4.25%–4.50%.

If the rates stay unchanged, it is imaginable that Bitcoin terms volition proceed its existent downtrend. This whitethorn beryllium precisely what the HyperLiquid whale was hoping for erstwhile it opened a 40x leveraged abbreviated position worthy implicit $500 cardinal astatine its peak. However, this presumption is present closed.

Related: Bitcoin stalls nether $85K— Key BTC terms levels to ticker up of FOMC

How are the spot Bitcoin ETFs reacting?

Unlike Bitcoin whales, investors successful the spot Bitcoin ETFs person historically offloaded BTC holdings earlier FOMC meetings.

Since the spot BTC ETFs launched successful January 2024, astir FOMC events person coincided with ETF outflows or, astatine best, humble inflows, according to CoinGlass data. The notable objection was the erstwhile all-time precocious of January 2025, erstwhile adjacent the spot Bitcoin ETF investors couldn’t defy the impulse to buy.

Bitcoin spot ETF nett inflows and FOMC dates. Source: Marie Poteriaieva, CoinGlass

On March 17, the spot Bitcoin ETFs saw $275 cardinal successful nett inflows, marking a displacement from a period of outflows. This whitethorn awesome a displacement successful capitalist sentiment and expectations regarding the Fed’s argumentation decisions.

If spot ETF inflows are rising earlier the FOMC, investors mightiness beryllium anticipating a much dovish stance from the Fed, specified arsenic signaling aboriginal complaint cuts oregon maintaining liquidity-friendly policies.

Investors could besides beryllium loading up connected Bitcoin arsenic a hedge against uncertainty. This suggests that immoderate organization investors judge Bitcoin volition execute good careless of the Fed’s decision.

Investors could besides beryllium anticipating a imaginable abbreviated squeeze. If traders were expecting Bitcoin to driblet and positioned short, a abrupt summation successful ETF inflows could play a relation successful traders’ behaviors and trigger a abbreviated squeeze.

Following the FOMC, BTC’s terms action, on with onchain information and spot ETF flows volition amusement whether the caller enactment was portion of a semipermanent accumulation inclination oregon conscionable speculative positioning.

However, 1 happening that galore traders hold connected present is that BTC could acquisition a important terms question aft the FOMC announcement. As crypto trader Master of Crypto enactment it successful a caller X post:

“The FOMC is tomorrow, and a Big Move is expected.”Even without complaint cuts, the accidental of the Fed issuing dovish statements could assistance markets, portion the lack of them could thrust prices lower.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

6 months ago

6 months ago

English (US)

English (US)