Renowned crypto plus hedge money manager Charles Edwards has made a bold prediction regarding the aboriginal terms of Bitcoin. Edwards, laminitis of Capriole Investments, shared his insights via X (formerly Twitter), outlining a compelling lawsuit for Bitcoin’s imaginable to scope $280,000 successful the coming year.

In his statement, Edwards referenced humanities information and respective cardinal factors that could thrust Bitcoin’s terms to caller heights. He began by comparing Bitcoin’s show aft the 2020 halving event, stating, “If Bitcoin’s station halving returns are the aforesaid arsenic 2020, we are looking astatine $280K Bitcoin adjacent year.”

Bitcoin Price Could Top $300,000 Next Year

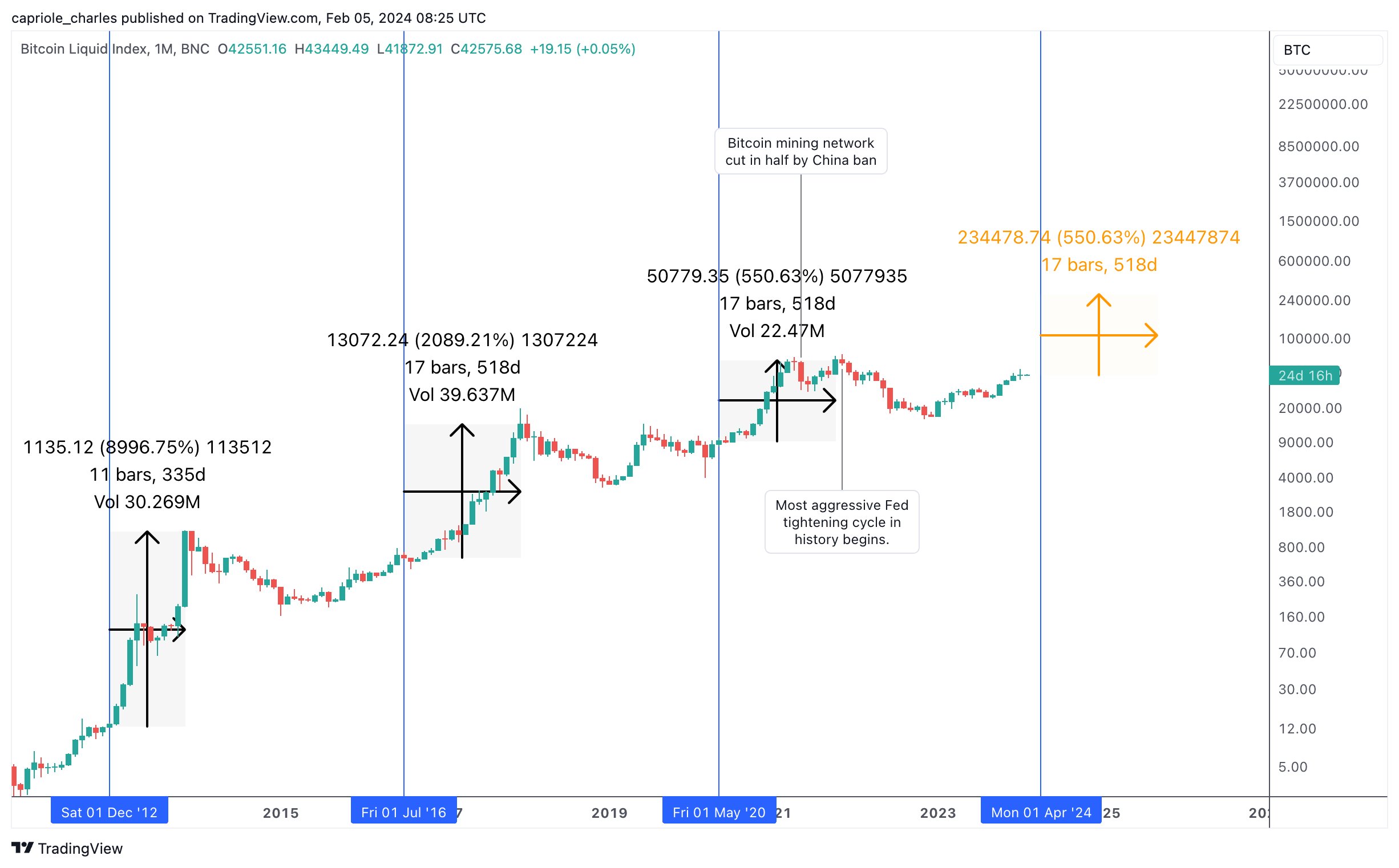

As the illustration by Edwards shows, the 3rd bull tally successful 2020 was alternatively subdued successful examination to the erstwhile ones. The archetypal bull marketplace (halving cycle) successful 2012 saw Bitcoin terms highest astatine $1132, marking a melodramatic summation of 8,996% implicit 11 months (335 days). The 2nd bull tally successful 2016 ended successful December 2017 erstwhile the terms reached astir $20,000, marking a 2,089% summation implicit 17 months (518 days).

Bitcoin price, monthly illustration | Source: X @caprioleio

Bitcoin price, monthly illustration | Source: X @caprioleioEdwards acknowledged that immoderate mightiness reason that profits diminish with each cycle. However, helium made a counterpoint that 2020’s show was pinned down owed to main factors. First, Edwards attributed the lackluster show of the 2020 bull marketplace to China’s determination to prohibition Bitcoin mining, which led to a 50% simplification successful hash complaint and had a stifling effect connected Bitcoin.

Second, helium highlighted the aggressive tightening measures taken by the Federal Reserve, which negatively impacted Bitcoin’s show during that period, stating, “2020 was the worst Bitcoin bull marketplace successful history. I judge wide show was pinned down owed to the -50% demolition of mining web by China and the astir assertive Fed tightening rhythm successful history.”

However, Edwards expressed optimism astir the future, pointing to a contrasting economical scenery successful 2024. He stated, “In fact, 2024 marks the polar other to 2021. QE has resumed and the Fed has started easing, with Fed seat Powell expecting 3 cuts this year. A weaker dollar = a stronger Bitcoin.”

He besides compared the upcoming motorboat of Bitcoin ETFs successful January to a “second halving,” highlighting the imaginable marketplace impact, saying, “Further, I see the January Bitcoin ETF launches arsenic almighty arsenic a ‘second halving’.”

Drawing parallels to the golden market, Edwards emphasized that Bitcoin’s existent marketplace headdress of astir $800 cardinal is importantly smaller than gold’s marketplace headdress erstwhile the GLD ETF launched successful 2004.

He noted that golden experienced a parabolic emergence of implicit 300% successful conscionable 7 years pursuing the motorboat of the ETF, stating, “With a marketplace headdress of astir $3.3T, Gold commenced a parabolic emergence of implicit 300% to $13T successful nether 7 years. Bitcoin’s marketplace headdress contiguous is conscionable implicit $800B. Smaller assets are mostly susceptible of experiencing larger upside returns.”

Furthermore, Edwards underscored the accelerated maturation of Bitcoin, asserting that it is presently outpacing the adoption complaint of the Internet, saying, “Bitcoin is presently increasing faster than the Internet.”

The hedge money manager concluded by summarizing his prediction, stating:

A 500% instrumentality implicit the 18 months pursuing the halving would not beryllium antithetic for Bitcoin historically. An further 300% instrumentality implicit the adjacent 2-5 years from the ETFs unsocial would beryllium a blimpish assumption. When you drill it down to the 2 astir important factors for Bitcoin this cycle, and adhd them together, it’s casual to get astatine a blimpish Bitcoin terms of $300K successful the adjacent mates of years.

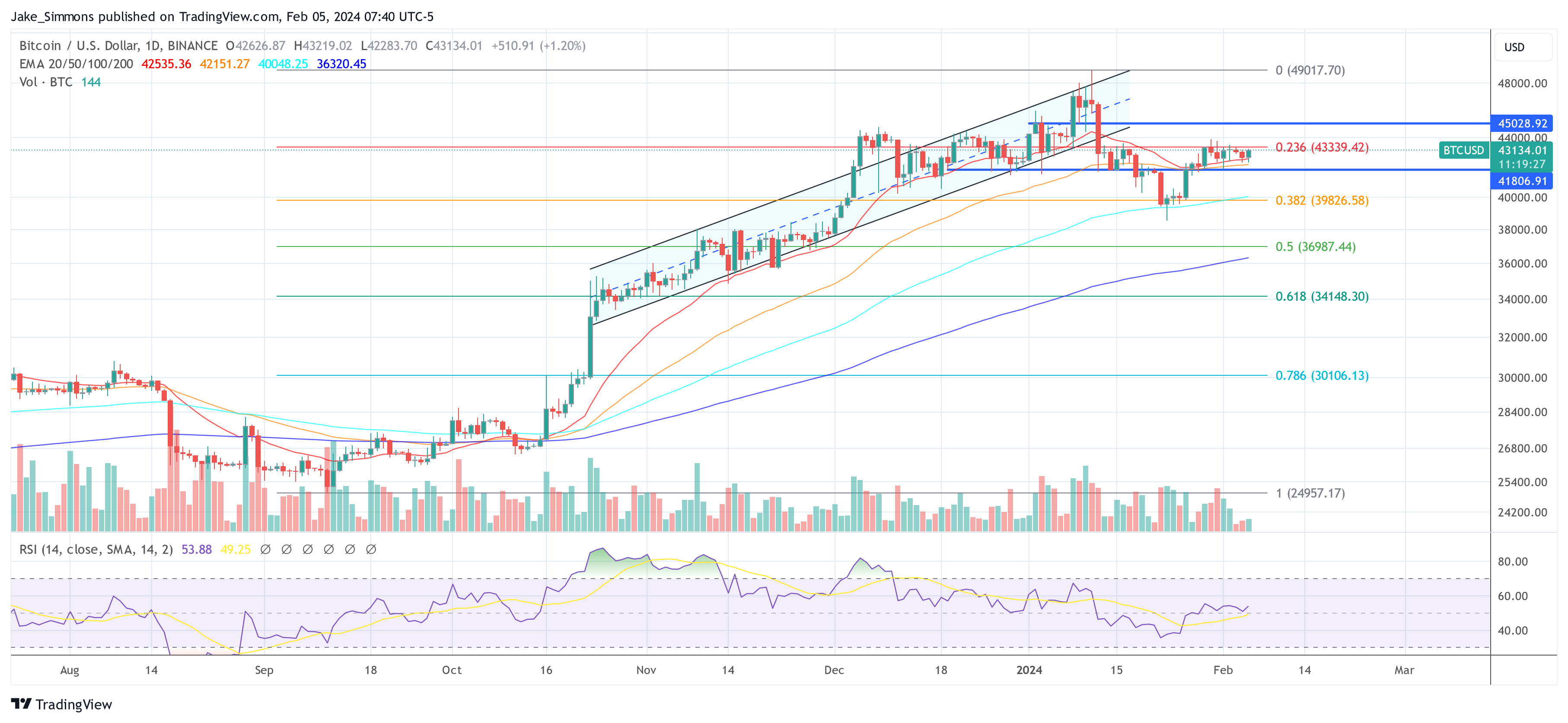

At property time, BTC traded astatine $43,134.

BTC terms hovers beneath cardinal resistance, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms hovers beneath cardinal resistance, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from YouTube / Blockworks, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)