Strategy seat Michael Saylor signaled that his steadfast whitethorn adhd to its Bitcoin holdings conscionable arsenic the marketplace slid again connected Sunday, a determination that kept traders connected borderline and fed caller statement implicit what is driving the declines.

Back To More Orange Dots

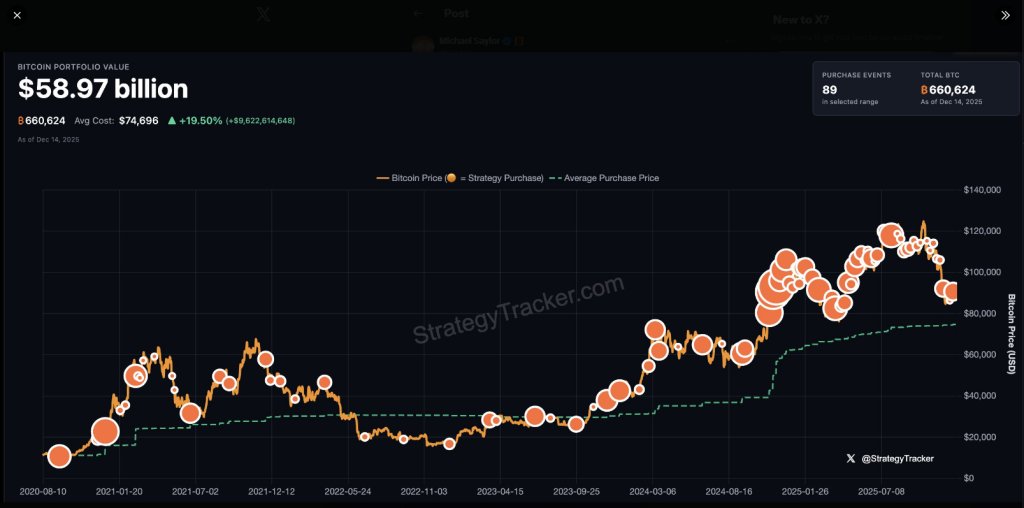

According to a station connected X, Saylor shared a illustration with the operation “Back to More Orange Dots,” a shorthand that investors construe arsenic caller buying.

Based connected reports tracked by SaylorTracker, Strategy bought 10,624 BTC connected Dec. 12 — its biggest azygous acquisition since precocious July.

The steadfast present holds astir 660,624 BTC, which astatine existent prices is worthy astir $58.5 billion, and its mean outgo per coin stands astatine $74,696.

₿ack to More Orange Dots. pic.twitter.com/rBi1aagDVO

— Michael Saylor (@saylor) December 14, 2025

Sunday Wick, Low Liquidity

Bitcoin concisely dipped to a two-week debased adjacent $87,750 successful precocious trading connected Sunday, earlier climbing backmost supra $89,000 by the clip of writing.

Traders pointed to a acquainted pattern: speedy wick-downs connected weekends erstwhile liquidity is thin. Ether showed comparative spot portion large altcoins lagged, and marketplace participants were seen positioning up of a packed calendar of US data and cardinal slope decisions this week.

Analysts Eye Bank Of Japan

According to expert commentary, immoderate marketplace participants blasted the selling connected expectations astir the Bank Of Japan.

People are earnestly underestimating what the slope is astir to bash to crypto, said 1 expert utilizing the grip NoLimit.

Justin d’Anethan, caput of probe astatine Arctic Digital, said the descent toward $88,000 “feels similar a defeat,” and linked the determination to fearfulness of a transportation commercialized unwind tied to Japanese complaint expectations.

Markets May Have Priced It In

Sykodelic, different marketplace watcher, argued that Japan’s actions are mostly priced in. “Markets are forward-thinking, forward-moving. They determination successful anticipation of events, not erstwhile those events happen,” they wrote.

Based connected that view, the caller driblet is little astir a caller daze and much astir mean back-and-forth: macro funds trimming exposure, short-term traders taking profit, and buyers stepping successful astatine little levels.

That push-and-pull helps explicate wherefore Bitcoin keeps snapping little connected bladed pockets of liquidity but does not interruption decisively beneath cardinal support.

Meanwhile, the hostility betwixt semipermanent holders — represented by companies similar Strategy — and short-term macro flows is shaping terms action.

There is nary motion yet of wide liquidations oregon a backing crisis, which suggests the declines are measured alternatively than chaotic.

Featured representation from Australian Farmers, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)