Bitcoin bounces making backmost each of Thursday's losses, astatine the aforesaid clip golden returns its gains throwing disorder connected what constitutes a harmless haven asset.

Samuel Wan • Feb. 25, 2022 astatine 10:30 americium UTC • 2 min read

Samuel Wan • Feb. 25, 2022 astatine 10:30 americium UTC • 2 min read

Bitcoin bulls retaliated Thursday evening (GMT) to instrumentality backmost losses triggered by the Russia-Ukraine crisis.

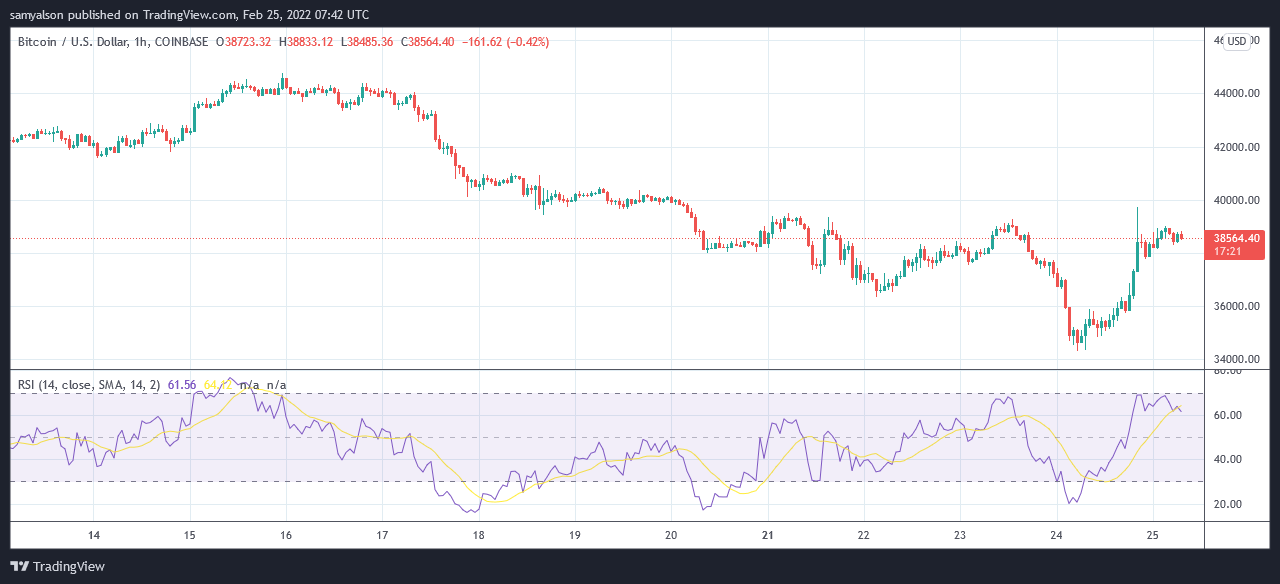

The 20:00 (GMT) hourly candle peaked astatine $39,700, a 16% summation from the section bottommost earlier sellers stepped in, driving the terms down to adjacent astatine $38,400, leaving a agelong apical wick successful the process.

Since then, $BTC has been trading successful a choky scope betwixt $37,800 and $39,000. But, with the Relative Strength Index (RSI) opening to curl downwards, it appears arsenic though momentum is waning for now.

Source: BTCUSD connected TradingView.com

Source: BTCUSD connected TradingView.comIn contrast, the reverse concern played retired for gold. It peaked astatine $1,975/oz earlier bottoming astatine $1,880/oz, giving up each of Thursday’s gains.

Normal concern is resumed

Bloomberg writer David Ingles superimposed the Bitcoin and golden terms charts showing a antagonistic correlation betwixt the two.

Ingles commented that hazard appetite has returned, contempt the ongoing uncertainty successful Eastern Europe, arsenic evidenced by stocks closing higher connected Thursday.

Source: @DavidInglesTV connected Twitter.com

Source: @DavidInglesTV connected Twitter.com“Chart update: Gold and Bitcoin retrace backmost arsenic marketplace hazard appetite returns with US stocks closing higher Thursday.”

Twitter idiosyncratic @ceterispar1bus chipped successful with a much cutting response, saying portion yesterday’s events acceptable disconnected a important pump for gold, fixed the gravity of the situation, it wasn’t thing to beryllium celebrated.

Signing off, helium said helium doesn’t spot the fascination with golden arsenic an investment, considering its inability to clasp onto those gains.

“gold investors got their 1 idiosyncratic rally successful a decennary that was ~4% during a humanitarian situation wherever you couldn’t adjacent bask it unless you’re conscionable a portion of crap lone to retrace the full determination successful little than 24h. conscionable don’t cognize however radical spot the entreaty of it anymore.“

Is Bitcoin a harmless haven oregon not?

Thursday’s sell-off provided further grounds that Bitcoin is simply a risk-on asset, contrary to the aspirations of its founder. Another illustration was the covid drawdown successful March 2020, which saw a adjacent 60% nonaccomplishment implicit 7 days.

Simon Moore, ex-Chief Investment Officer astatine Moola and FutureAdvisor, attributes this effect to the antithetic types of $BTC investors. During times of panic, speculators predominate terms enactment and a much consenting to exit their position. Whereas, if semipermanent holders had the precocious hand, Bitcoin would show a much unchangeable effect to chaotic events.

“it’s not astonishing that speculators would merchantability astatine times of marketplace stress. On the different hand, if it were owned by semipermanent investors, past pricing mightiness beryllium much unchangeable erstwhile the marketplace is nether duress.”

Moore concludes that Bitcoin’s capitalist basal whitethorn germinate implicit time, starring to maturation arsenic a harmless haven asset. But for now, it cannot beryllium considered a formation to safety.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)