Bitcoin surged supra $87,000 during aboriginal Asia trading connected Monday, extending gains arsenic broader markets reopened aft trading level passim the Easter vacation closure.

The integer asset’s determination followed 3 sessions of choky consolidation, coinciding with wide dollar weakness and a record-setting rally successful gold.

BTC/USD climbed from astir $84,450 to an intraday precocious adjacent $87,650 successful nether 3 hours, breaking supra a multi-day falling wedge pattern. According to TradingView data, Bitcoin was trading astatine astir $87,640 astatine the clip of publication.

Bitcoin surges amid dollar weakness (Source: TradingView)

Bitcoin surges amid dollar weakness (Source: TradingView)The breakout unfolded during low-liquidity conditions successful aboriginal Asia hours, with the dollar scale (DXY) falling to its lowest level since 2021.

This coincided with increasing speculation astir the imaginable removal of Federal Reserve Chair Jerome Powell.

As ZeroHedge reported, comments made Friday by National Economic Council Director Kevin Hassett, who stated that “the president and his squad volition proceed to study” options regarding Powell’s position, were cited by traders arsenic a catalyst for the dollar’s decline.

Dollar weakness triggers haven flows.

The dollar’s accelerated decline, occurring portion respective planetary markets remained closed, pushed request toward accepted and integer stores of value.

Gold prices surged to an all-time precocious of $3,391.62 during the aforesaid session, registering a 2.4% gain. Per Reuters, the determination marked the metal’s astir substantial single-day rally successful months.

Digital golden successful the signifier of Bitcoin roseate successful tandem, diverging from caller behavior, erstwhile some assets had moved inversely to the 10-year U.S. Treasury note. Notably, enslaved prices fell Monday; the US10 and CN10 plots connected the illustration correspond enslaved prices, not yields, implying a concurrent emergence successful long-dated yields.

The operation of a falling dollar, climbing yields, and soaring golden presents a script wherever Bitcoin is being repriced successful airy of perceived instability successful accepted fiscal instruments.

As ZeroHedge framed it, the alignment of golden and Bitcoin spot during a play of fiat accent whitethorn bespeak “a authorities shift” wherever integer assets are progressively treated arsenic monetary hedges.

Broader marketplace divergence

Equity markets opened weaker contempt haven strength. The S&P 500 futures fell 1.54% successful Monday’s aboriginal session, erasing late-week gains. Oil markets besides declined, with WTI crude down much than 3%, trading adjacent $62.83 astatine the league low.

This divergence betwixt accepted hazard assets and alternate stores of worth mirrors conditions observed during other periods of monetary uncertainty.

Gold and Bitcoin rising unneurotic portion enslaved prices autumn and equity indices gaffe suggests positioning distant from rate-sensitive assets and into instruments perceived arsenic politically insulated.

Per ZeroHedge, the dollar’s descent whitethorn not stabilize quickly. If cardinal banks similar the Bank of Japan and European Central Bank respond with easing measures to antagonistic their ain currency strength, further dollar unit could ensue.

In specified an environment, Bitcoin whitethorn proceed to decouple from rate-based instruments and way much intimately with carnal commodities similar gold.

Structural implications

The correlation breakdown betwixt Bitcoin and accepted macro proxies raises questions astir portfolio allocation and plus classification.

With enslaved prices and equities weakening portion golden and Bitcoin outperform, traders whitethorn statesman to reevaluate however integer assets are categorized successful cross-asset frameworks.

This determination follows weeks of gradual decorrelation betwixt Bitcoin and the DXY, arsenic observed done 30-day rolling correlation metrics.

Should this continue, Bitcoin volition suffer its cognition arsenic a tech-aligned hazard plus and go much of a monetary hedge with characteristics akin to commodities.

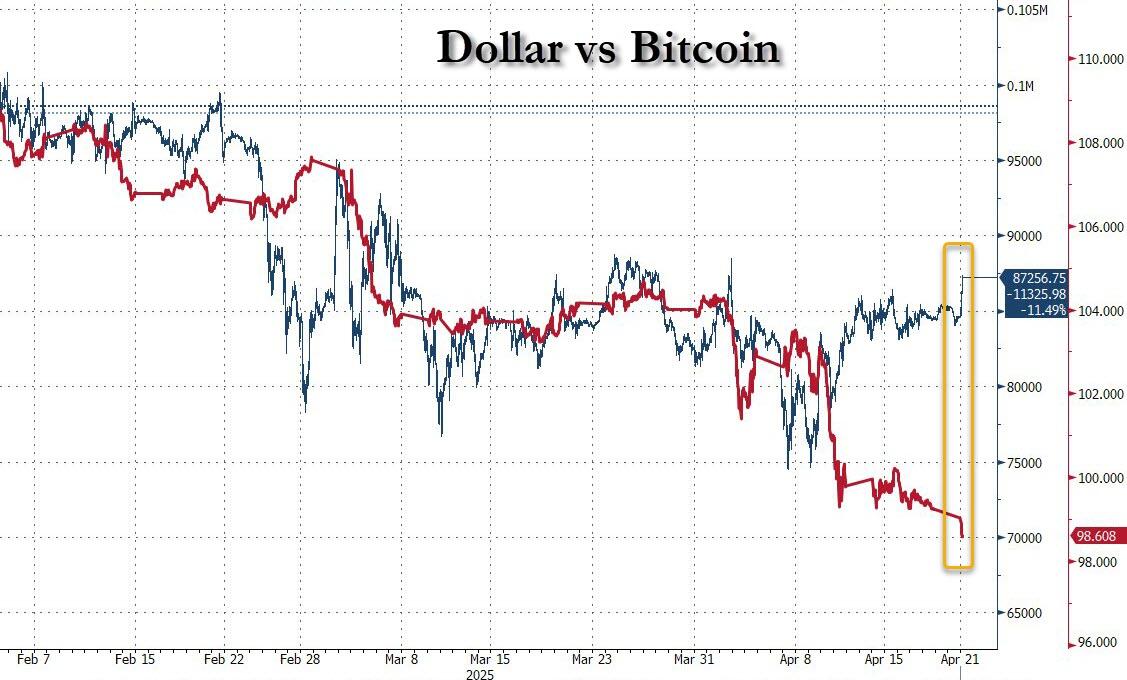

Dollar vs Bitcoin (Source: ZeroHedge)

Dollar vs Bitcoin (Source: ZeroHedge)The governmental magnitude besides looms large. While erstwhile episodes of Trump-Fed tensions triggered impermanent volatility, the existent occurrence introduces nonstop sermon astir imaginable Federal Reserve enactment changes. This whitethorn power marketplace pricing of aboriginal complaint decisions and broader monetary argumentation expectations, some of which could spill into crypto markets.

As trading resumes successful afloat crossed regions, Bitcoin’s behaviour adjacent the $88,400 absorption set whitethorn connection further clarity. Sustained spot supra this level could pull systematic flows and trigger algorithmic buying. At the aforesaid time, nonaccomplishment to clasp supra the breakout portion whitethorn exposure the plus to reversion toward mid-range levels.

For now, the asset’s show successful a mixed macro environment, combined with decoupling from equities and fixed income, positions it astatine the halfway of post-holiday trading narratives.

The station Bitcoin rallies supra $87k portion dollar weakens connected Powell speculation aft agelong weekend appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)