According to the latest on-chain data, investors person been excessively betting connected the Bitcoin terms successful caller weeks, starring to its wide struggles.

Longs Vs Shorts Imbalance — How This Induced Price Crash

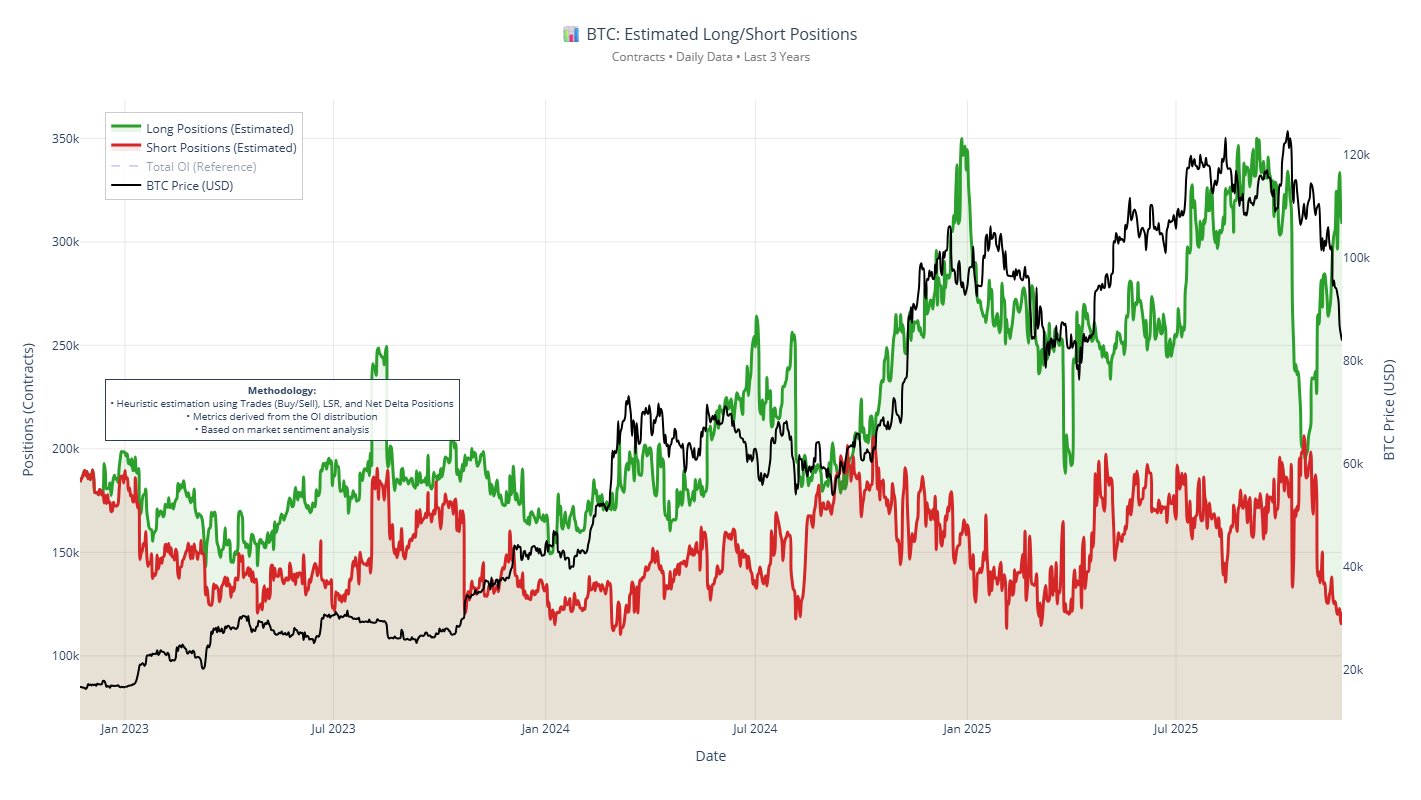

In a November 22 station connected societal media level X, Alphractal CEO and laminitis Joao Wedson revealed the underlying dynamics down Bitcoin’s caller unchecked fall. In deciphering this downward trend, the crypto pundit evaluated the Estimated Long/Short Positions metric, which estimates however overmuch of the Open Interest crossed exchanges is dedicated to agelong positions comparative to abbreviated positions.

Wedson reported that, crossed 19 exchanges, determination are astir 71,000 BTC positioned successful longs, portion a comparatively smaller magnitude of BTC (27,900) is dedicated to shorts. While this reflection does not see information from the Chicago Mercantile Exchange (CME), the discrepancy betwixt longs and shorts remains unusually large.

This imbalance is important due to the fact that erstwhile determination are clusters of agelong positions astatine akin terms levels, the marketplace tends to thin into a much fragile state. Moderate pullbacks beneath these clusters often pb to a cascade of forced liquidations (known arsenic a agelong squeeze) — an lawsuit which could successful crook propulsion prices further south.

Source: @joao_wedson connected X

Source: @joao_wedson connected XNotably, Wedson pointed retired that traders indispensable person been convinced that $100,000 was Bitcoin’s terms bottommost — a speculation that soon became null aft its failure. Afterwards, $90,000 came into focus, with different bid of liquidations pursuing suit. At the moment, $84,000 seems to beryllium the price bulk of Bitcoin’s speculative traders people arsenic the caller terms bottom.

These liquidation events that took spot aft the $100,000 and $90,000 supports were breached provided much buy-side liquidity for the Bitcoin terms to topple. At the aforesaid time, astir important abbreviated positions person been closed off, making it hard for a much defined terms betterment to instrumentality place, arsenic determination is hardly immoderate sell-side liquidity to nonstop the Bitcoin terms to the upside.

For Bitcoin to recover, Wedson explained that determination needs to beryllium a important alteration successful agelong positioning, portion abbreviated vulnerability goes connected the rise.

Watch Out For $81,250 — Analyst

In different station connected X, method expert Ali Martinez noted that Bitcoin’s 2-year moving average, which stands astatine astir $81,250, is an important landmark for the aboriginal trajectory of the flagship cryptocurrency.

The expert explained that humanities failures of the 730-day SMA person often marked the beginnings of carnivore markets. Thus, successful the script wherever the Bitcoin terms slips past its existent 2-year mean price, we could beryllium witnessing the commencement of a agelong bearish cycle

As of property time, Bitcoin holds a valuation of $86,251, reflecting an implicit 3% terms leap successful the past 24 hours.

Featured representation from iStock, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)