Bitcoin’s terms enactment successful the past 2 weeks has opened a caller signifier of stress among traders, with on-chain information showing realized losses climbing to heights past observed successful 2022.

Glassnode’s latest Week-On-Chain study shows Bitcoin is trading supra an important cost-basis level but is besides visibly straining nether intensified nonaccomplishment realization, fading request and weakening liquidity, which has placed short-term investors successful a hard position.

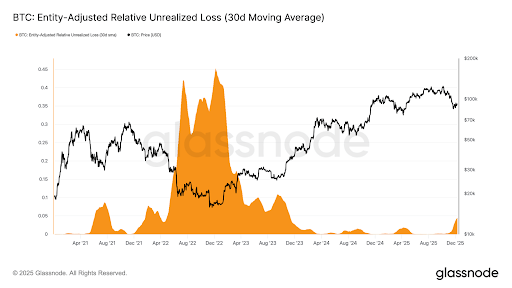

Realized Losses Return To Deep Territory

According to Glassnode, realized losses among Bitcoin entities person risen massively, and is present astir astatine the aforesaid magnitudes recorded during the heavy retracements of the 2022 carnivore market. Particularly, the Relative Unrealized Loss (30D-SMA) has climbed to 4.4% aft astir 2 years beneath 2%.

The escalation successful nonaccomplishment realization reflects however the caller drawdown beneath $90,000 has forced a ample fig of marketplace participants to offload coins astatine prices beneath their acquisition cost. This, successful turn, has disrupted the gradual betterment successful profitability seen earlier successful the year.

Bitcoin’s caller bounce from the November 22 debased to supra $92,000 hasn’t eased the strain connected holders. Glassnode noted that entities are inactive locking successful losses astatine an expanding pace, with the 30-day mean of realized losses present astatine astir $555 cardinal per day.

Source: Chart from Glassnode

Source: Chart from GlassnodeThese conditions mean that investors are losing assurance successful short-term upside prospects for Bitcoin and take to trim exposure, adjacent astatine unfavorable prices. Therefore, the study noted that resolving it volition necessitate a renewed question of liquidity and request to rebuild confidence.

Glassnode besides highlights a crisp emergence successful profit-taking among semipermanent holders, whose realized gains person climbed to astir $1 cardinal per time and concisely acceptable a caller grounds supra $1.3 billion.

Even with this elevated level of distribution, Bitcoin is presently positioned conscionable supra the True Market Mean, which is simply a long-standing cost-basis benchmark that serves arsenic a constituent of structural support. The caller terms downturn beneath $90,000 has pushed this portion adjacent to its limits, but the glimpse of request reflected astir it suggests that terms could revisit the 0.75 quantile adjacent $95,000 and perchance attack the short-term holder outgo ground arsenic well.

Spot ETF, Futures, And Options Markets Indicate Weakness

Glassnode’s study points to persistent softness crossed ETF flows, which person cooled notably aft a play of beardown inflows earlier successful the year. This slowdown represents a simplification successful 1 of the largest and astir contiguous sources of buy-side liquidity for Bitcoin.

Spot marketplace liquidity has besides faded, with bid books connected large exchanges adjacent the little bound of their 30-day range. This has created an situation where trading enactment has weakened through November and into December, and less liquidity flows are disposable to sorb volatility oregon prolong directional moves.

Derivatives positioning reflects akin caution, with backing rates pinned adjacent neutral. Futures unfastened involvement has besides been subdued and has failed to meaningfully rebuild since the breakdown beneath $90,000.

Across each large venues, the code is the same: liquidity is lighter, sentiment is softening, and participants are leaning antiaircraft alternatively than pursuing short-term rallies. The attraction is present connected however Bitcoin will respond successful the aftermath of the Federal Reserve’s caller complaint cut.

Featured representation from Pixabay, illustration from Tradingview.com

1 month ago

1 month ago

English (US)

English (US)