Bitcoin (BTC) terms mislaid steam aft a failed retest of the $27,400 absorption connected June 6, signaling that investors became little assured aft the caller regulatory actions by the U.S Securities and Exchange Commission against Binance and Coinbase. Both exchanges are being sued connected aggregate counts, including nonaccomplishment to registry arsenic licensed brokers and offering unregistered securities.

The SEC mightiness person a hard lawsuit ahead

According to Blockchain Association CEO Kristin Smith, the SEC is trying to circumvent ceremonial rulemaking processes and contradict nationalist engagement. Meanwhile, Insider Intelligence crypto expert Will Paige said the SEC’s intent is to constabulary the abstraction done enforcement successful the lack of a regulatory framework.

Those criticisms explicate wherefore investors whitethorn beryllium clinging to their hopes successful the U.S. Financial Services Committee hearing, scheduled for June 13.

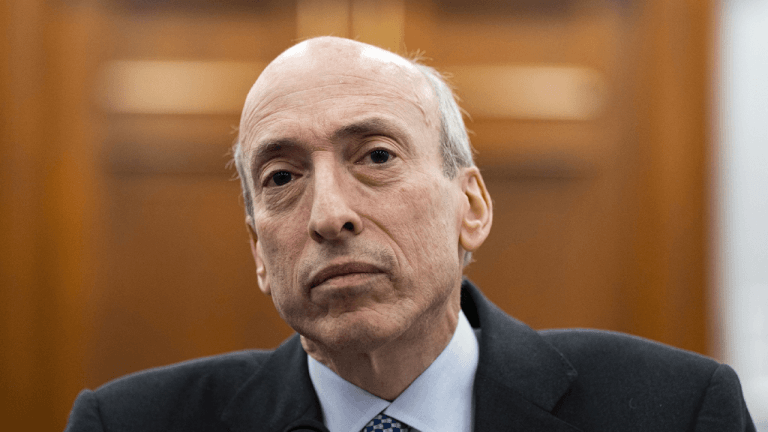

The imaginable overreach of the SEC has caused ripples aggregate times,including the U.S. legislative. Senator Bill Hagerty, for instance, stated that the regulating bureau is "weaponizing their role", and publically called retired the SEC president Gary Gensler.

The @SECGov is weaponizing their relation to termination an industry. Allowing a institution to database publically and past stonewalling their attempts to registry is indefensible. @GaryGensler, expect to perceive from Congress.https://t.co/GdprSW1Yns

— Senator Bill Hagerty (@SenatorHagerty) June 6, 2023Further supporting the thesis that the cryptocurrency abstraction tin relation without crypto-banks, arsenic the centralized exchanges are commonly known, is the abrupt summation successful decentralized concern (DeFi) volumes.

The median trading measurement crossed the apical 3 decentralized exchanges jumped 444% betwixt June 5 and June 7. As DEX volumes surged, nett outflows connected Binance reached $778 million, the quality betwixt the worth of assets entering and exiting the exchange.

Bitcoin has been trying to assertion backmost the $27,000 support, but that mightiness beryllium harder than expected fixed the upcoming $670 cardinal play enactment expiry connected June 9.

Bulls person been caught by astonishment with the antagonistic newsflow

It is worthy noting that the existent unfastened involvement for the June 9 expiry volition beryllium little since bulls concentrated their wagers supra $27,000. These traders got excessively optimistic aft Bitcoin’s terms gained 9% betwixt May 25 and May 29, investigating the $28,000 resistance.

Bitcoin options aggregate unfastened involvement for June 9. Source: CoinGlass

Bitcoin options aggregate unfastened involvement for June 9. Source: CoinGlassThe 0.63 put-to-call ratio reflects the imbalance betwixt the $410 cardinal successful telephone (buy) unfastened involvement and the $260 cardinal successful enactment (sell) options. However, if Bitcoin’s terms remains adjacent $26,500 astatine 8:00 americium UTC connected June 9, lone $38 cardinal worthy of these telephone (buy) options volition beryllium available. This quality happens due to the fact that the close to bargain Bitcoin astatine $27,000 oregon $28,000 is useless if BTC trades beneath that level connected expiry.

Related: US District Court issues summons for Binance CEO Changpeng Zhao implicit SEC action

Bitcoin bears purpose for sub-$26,000 to summation their payout

Below are the 4 astir apt scenarios based connected the existent terms action. The fig of options contracts disposable connected June 9 for telephone (bull) and enactment (bear) instruments varies depending connected the expiry price.

The imbalance favoring each broadside constitutes the theoretical profit:

- Between $25,000 and $26,000: 100 calls vs. 5,100 puts. Bears successful full control, profiting $125 million.

- Between $26,000 and $27,000: 1,500 calls vs. 3,900 puts. The nett effect favors the enactment (sell) instruments by $65 million.

- Between $27,000 and $28,000: 4,200 calls vs. 1,300 puts. The nett effect favors the telephone (bull) instruments by $80 million.

- Between $28,000 and $29,000: 8,700 calls vs. 700 puts. The nett effect favors telephone (bull) instruments by $225 million.

This crude estimation considers the enactment options utilized successful bearish bets and the telephone options exclusively successful neutral-to-bullish trades. This oversimplification disregards much analyzable concern strategies.

Given that Bitcoin longs utilizing futures contracts were liquidated to the tune of $100 cardinal connected June 5, bulls mightiness person little borderline required to effort pumping the BTC terms supra the $27,000 mark. Consequently, bears look person to scoring a decent nett connected Friday's options expiry.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)