By James Van Straten (All times ET unless indicated otherwise)

Bitcoin BTC broke done to caller highs supra $118,000, but still has more to prove. It needs to reclaim records against different large assets specified arsenic golden and the British lb to show that it is outpacing them connected a comparative basis.

Since July 9, BTC has surged from $108,000, with each rally seeing precise constricted pullbacks, highlighting the spot of the bull run. It is up 60% from its April lows, erstwhile tariff concerns rattled the market. Notably, for the archetypal clip since February, bitcoin has overtaken golden successful year-to-date performance, rising 27% versus gold’s 26%.

Significant liquidations person people followed the gains, arsenic the $112,000 level, which marked the erstwhile all-time high, was a well-defended position. Heavy abbreviated positions were defending that level, and their unwinding has fueled further upside momentum. U.S. crypto stocks are besides higher successful pre-market trading.

Meanwhile, the Bitcoin web hash rate, which measures the computational powerfulness utilized to excavation the proof-of-work blockchain, has rebounded supra 915 exahashes per 2nd (EH/s), signaling beardown web participation. A important trouble accommodation exceeding 7% is apt implicit the weekend.

Looking ahead, 1 cardinal hazard that could derail bitcoin’s momentum is the U.S. ostentation data, owed July 15. Last month, header ostentation printed astatine 2.4%, portion halfway ostentation came successful astatine 2.8% twelvemonth implicit year. For immoderate hopes of complaint cuts to stay intact, these numbers volition request to inclination lower. Stay alert!

What to Watch

- Crypto

- July 14, 10 p.m.: Singapore High Court hearing connected WazirX’s Scheme of Arrangement, marking a captious measurement successful the exchange's restructuring aft the $234 cardinal hack connected July 18, 2024.

- July 15: Alchemist staking update launches, allowing token holders to involvement ALCH for entree to precocious features, premium benefits and ecosystem rewards, perchance boosting token inferior and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing digital-asset colony web for institutions. Built connected Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury money shares, Lynq enables instant settlement, continuous output accrual and improved superior efficiency.

- July 15, 3 p.m.: U.S. Senate Committee connected Agriculture, Nutrition, and Forestry holds a marketplace operation hearing titled “Stakeholder Perspectives connected Federal Oversight of Digital Commodities.” Livestream link.

- July 16: July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century."

- Macro

- Day 2 of 2: The 4th Ukraine Recovery Conference successful Rome, bringing unneurotic planetary leaders and stakeholders to beforehand Ukraine’s betterment and reconstruction arsenic the warfare with Russia drags on.

- July 11, 8:30 a.m.: Statistics Canada releases June employment data.

- Unemployment Rate est. 7.1% vs. Prev. 7%

- Employment Change Est. 0K vs. Prev. 8.8K

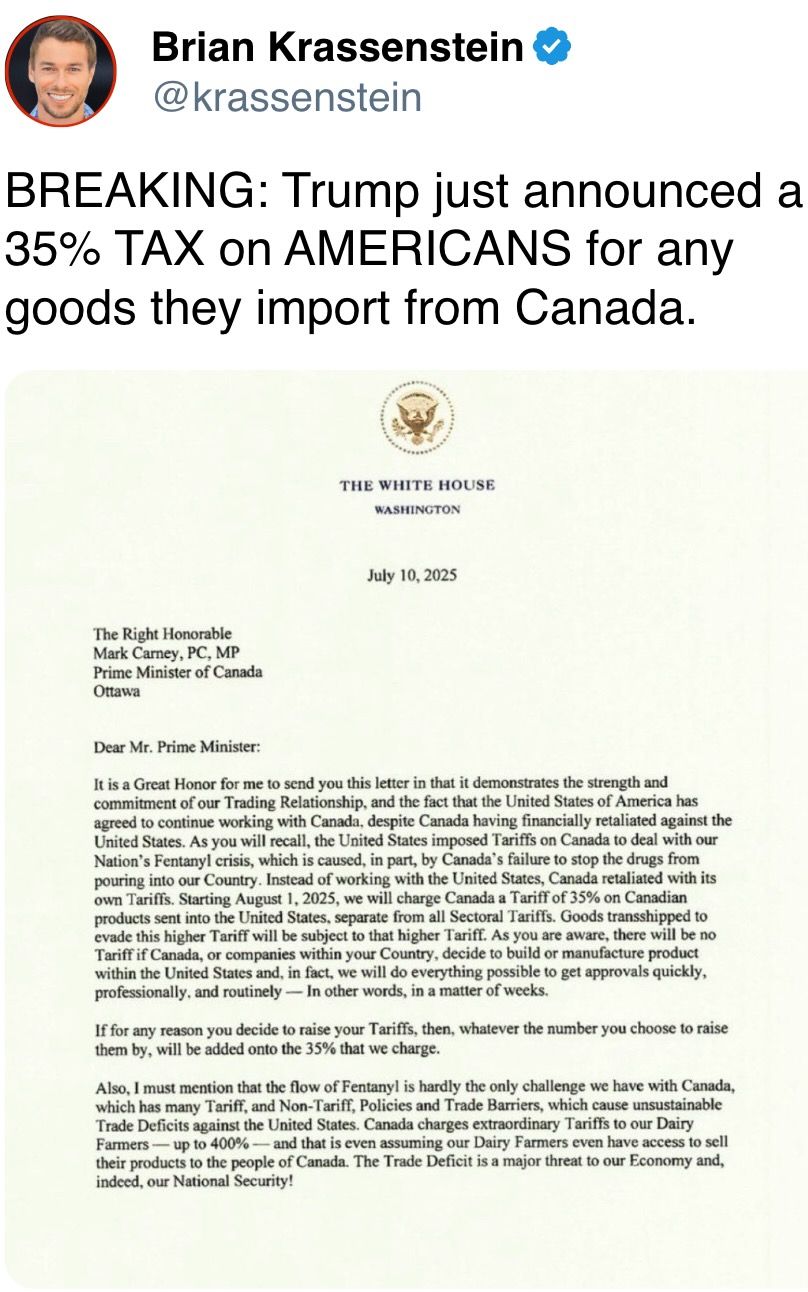

- Aug. 1, 12:01 a.m.: Reciprocal tariffs instrumentality effect aft President Trump’s July 7 executive order delayed the archetypal July 9 deadline, making this the commencement day for higher tariffs connected imports from countries without commercialized deals.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Compound DAO is moving multiple votes connected whether to follow an Oracle Extractable Value (OEV) solution for Ethereum mainnet, Unichain, Base, Polygon, Arbitrum, Optimism, Scroll, Mantle, Ronin and Linea. Delegates tin take betwixt implementing Api3, Chainlink’s Secure Value Relay (SVR), oregon maintaining the existent setup without OEV. All votes extremity July 12.

- 1inch DAO is voting connected a $25,000 assistance connection to probe crustless cross-chain swaps betwixt Bitcoin and Ethereum Virtual Machine networks utilizing autochthonal Bitcoin tools similar Taproot. Voting ends July 14.

- Aavegotchi DAO is voting connected a $245,000 backing proposal to grow Gotchi Battler into a revenue-generating crippled with PvE modes, NFTs and conflict passes, aiming to reverse declining subordinate numbers, boost GHST inferior and make sustainable rewards. Voting ends July 22.

- July 16, 5 p.m.: VeChain to big a monthly update with assemblage representatives and the VeChain Foundation.

- Unlocks

- July 12: Aptos (APT) to unlock 1.76% of its circulating proviso worthy $56.44 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $19.04 million.

- July 15: Sei (SEI) to unlock 1% of its circulating proviso worthy $18.79 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating proviso worthy $39.25 million.

- July 17: ZKSync (ZK) to unlock 2.41% of its circulating proviso worthy $10.29 million.

- July 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.51 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating proviso worthy $912.43 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $88.8 million.

- Token Launches

- July 11: PrompTale AI (TALE) to beryllium listed connected Binance, KuCoin, MEXC, and others.

- July 11: Kraken to database Propy (PRO) and AIOZ Network (AIOZ).

- July 12: Pump.fun to launch an archetypal coin offering (ICO) successful which 33% of the proviso of PUMP volition beryllium sold. The ICO volition beryllium conducted connected Bybit, Kraken, Bitget, MEXC, KuCoin and Gate.io.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- Day 2 of 4: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Shaurya Malwa

- Ether's (ETH) interruption supra $3,000 catalyzed a crisp rally crossed Ethereum-native memecoins and ecosystem tokens.

- Memecoins are again serving arsenic leveraged bets connected broader ether strength, with flows rotating into lower-cap tokens similar MOG for higher upside.

- MOG jumped astir 40%, lifting its marketplace headdress to $645 million, with implicit $90 cardinal successful 24 hr volume.

- PEPE besides rallied, adding implicit 30% implicit the past week and holding a $6 cardinal marketplace headdress — highlighting its continued dominance among ETH-based memecoins.

- Both MOG and PEPE debuted successful 2023 and person since go mainstays successful Ethereum’s memecoin ecosystem, trading alongside DOGE and SHIB connected large exchanges.

- Outside of memes, protocol tokens besides caught a bid, with Lido (LDO) rising 15% and Arbitrum (ARB) gaining 18% successful the past day.

- The inclination echoes erstwhile cycles, wherever breakout rallies successful halfway assets similar ETH often trickle down into ecosystem tokens and yet into high-beta meme plays.

- While PEPE remains the largest ETH-native memecoin issued successful caller years MOG’s caller tally suggests traders are progressively consenting to descent further down the hazard curve for exposure.

Derivatives Positioning

- BTC and ETH perpetual futures unfastened involvement fell adjacent arsenic prices roseate precocious Thursday. The divergence calls for caution connected the portion of the bulls.

- XRP's unfastened involvement continued to rise, lending enactment to the terms rally.

- The marketplace shows small to nary signs of overheating with backing rates for large coins lone somewhat elevated astatine astir 10%, good abbreviated of the 50% threshold that suggests overheating.

- On Deribit, the $120K telephone is the astir fashionable option, boasting an unfastened involvement of implicit $2 billion. That's the cardinal level to ticker retired for arsenic BTC's rally gathers steam.

- Risk reversals amusement telephone bias crossed tenors, with request for upside much pronounced astatine the short-end, a motion of nether positioned traders chasing the rally with short-term bullish bets.

Market Movements

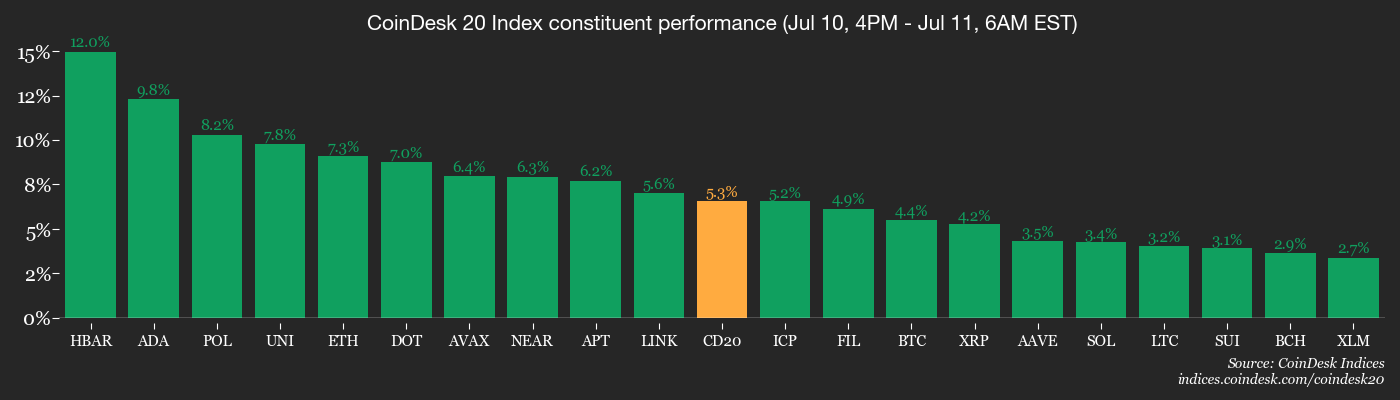

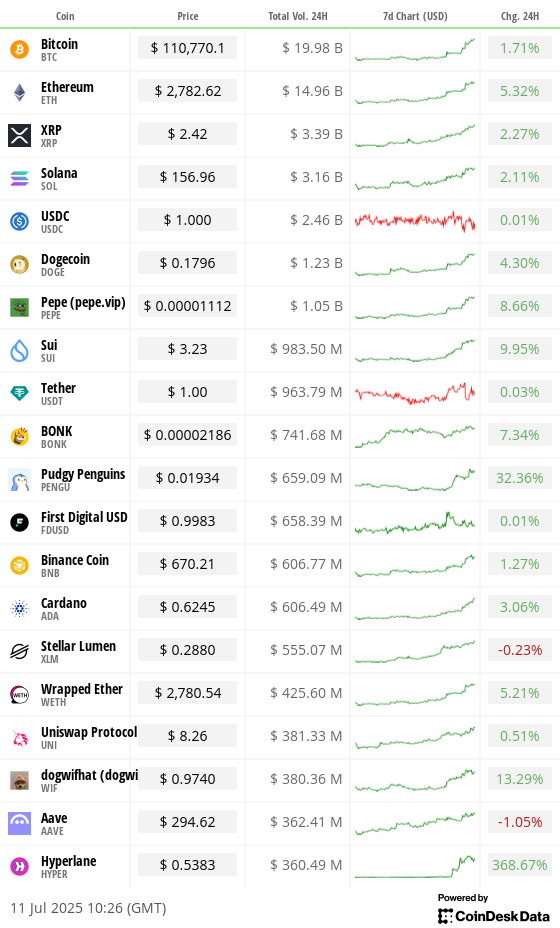

- BTC is up 6.8% from 4 p.m. ET Thursday astatine $118,308 (24hrs: 6.42%)

- ETH is up 8% astatine $3,006.71 (24hrs: 7.92%)

- CoinDesk 20 is up 5.3% astatine 3,513.29 (24hrs: 7.33%)

- Ether CESR Composite Staking Rate is down 5 bps astatine 3.00%

- BTC backing complaint is astatine 0.0300% (10.9500% annualized) connected Binance

- DXY is up 0.09% astatine 97.74

- Gold futures are up 0.82% astatine $3,352.90

- Silver futures are up 2.98% astatine $38.42

- Nikkei 225 closed down 0.19% astatine 39,569.68

- Hang Seng closed up 0.46% astatine 24,139.57

- FTSE is down 0.55% astatine 8,926.12

- Euro Stoxx 50 is down 1.22% astatine 5,372.21

- DJIA closed connected Thursday up 0.43% astatine 44,650.64

- S&P 500 closed up 0.27% astatine 6,280.46

- Nasdaq Composite closed up 0.09% astatine 20,630.66

- S&P/TSX Composite closed up 0.41% astatine 27,082.30

- S&P 40 Latin America closed down 1.14% astatine 2,639.33

- U.S. 10-Year Treasury complaint is up 3.7 bps astatine 4.383%

- E-mini S&P 500 futures are down 0.62% astatine 6,284.75

- E-mini Nasdaq-100 futures are down 0.56% astatine 22,885.50

- E-mini Dow Jones Industrial Average Index are down 0.68% astatine 44,601.00

Bitcoin Stats

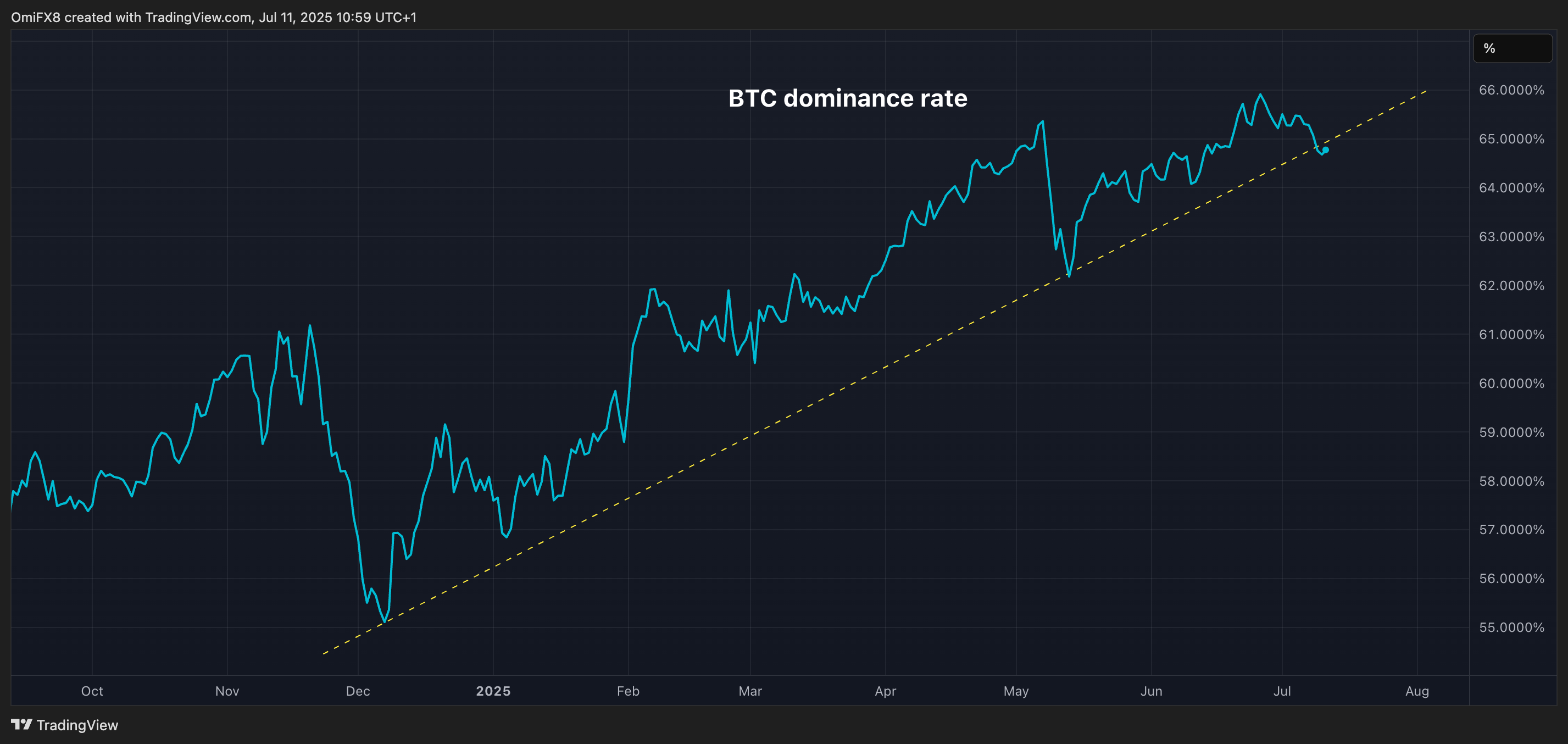

- BTC Dominance: 64.77% (0.16%)

- Ether to bitcoin ratio: 0.02544 (unchanged)

- Hashrate (seven-day moving average): 916 EH/s

- Hashprice (spot): $64.17

- Total Fees: 4.97 BTC / $558,499

- CME Futures Open Interest: 152,685 BTC

- BTC priced successful gold: 35.6 oz

- BTC vs golden marketplace cap: 10.08%

Technical Analysis

- BTC's dominance complaint is astir to penetrate the uptrend line.

- The impending breakdown indicates that outperformance of alternate cryptocurrencies comparative to bitcoin.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $421.74 (+1.52%), up 3.38% pre-market astatine $436.06

- Coinbase Global (COIN): closed astatine $388.96 (+4.04%), up 1.58% pre-market astatine $395.12

- Circle (CRCL): closed astatine $202.9 (+1.11%), down 0.5% pre-market astatine $201.91

- Galaxy Digital (GLXY): closed astatine $20.41 (+1.19%), up 2.55% pre-market astatine $20.93

- MARA Holdings (MARA): closed astatine $19 (+2.93%), up 3.51% pre-market astatine $19.66

- Riot Platforms (RIOT): closed astatine $12.59 (+2.86%), up 3.89% pre-market astatine $#13.08

- Core Scientific (CORZ): closed astatine $13.18 (-1.86%), down 1% pre-market astatine $13.05

- CleanSpark (CLSK): closed astatine $12.9 (+3.45%), up 3.33% pre-market astatine $13.33

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.49 (+0.99%)

- Semler Scientific (SMLR): closed astatine $45.97 (+8.62%), up 2.9% pre-market astatine $47.3

- Exodus Movement (EXOD): closed astatine $31.79 (-1.88%), up 3.24% pre-market astatine $32.47

ETF Flows

Spot BTC ETFs

- Daily nett flows: $1,175.6 million

- Cumulative nett flows: $51.31 billion

- Total BTC holdings ~1.26 million

Spot ETH ETFs

- Daily nett flows: $383.1 million

- Cumulative nett flows: $5.12 billion

- Total ETH holdings ~4.29 million

Source: Farside Investors

Overnight Flows

Chart of the Day

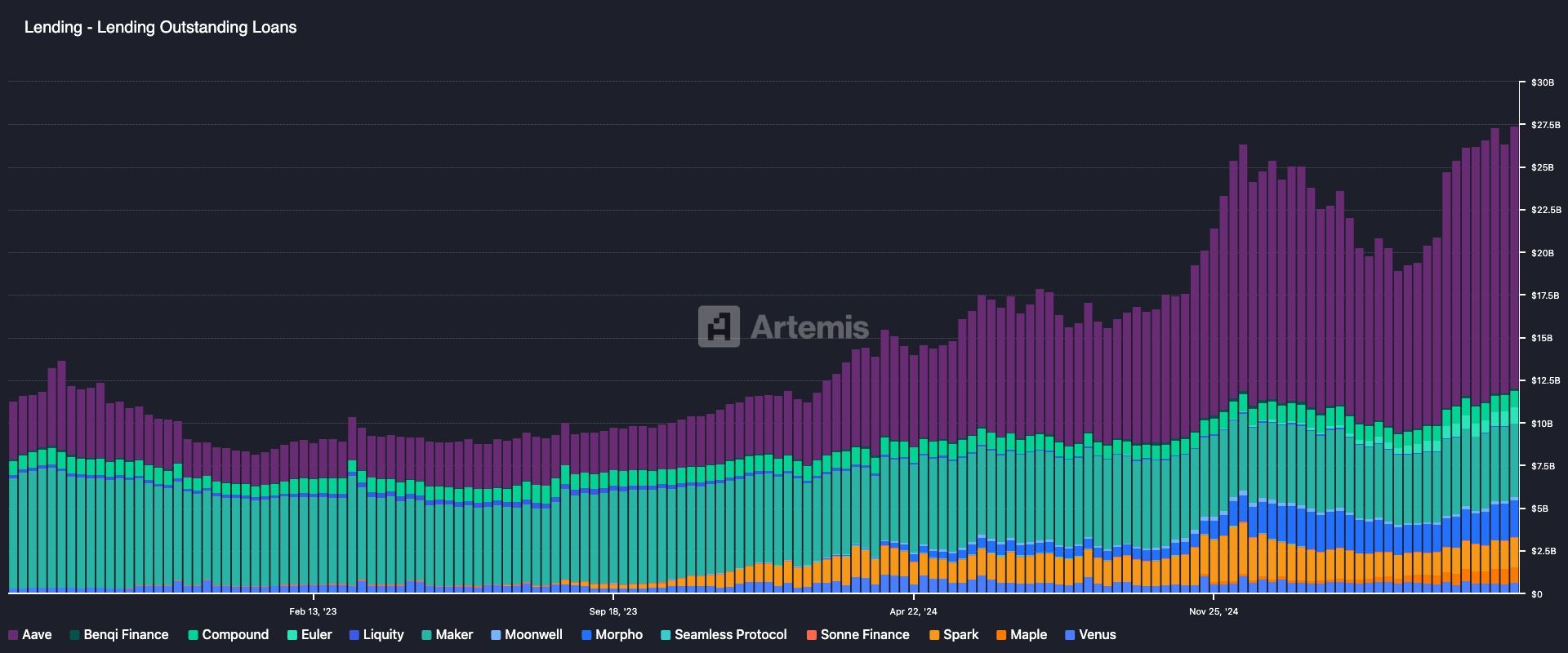

- The full magnitude of DeFi loans outstanding has accrued to astir $28 billion, topping the erstwhile beingness clip precocious of $26.4 cardinal successful December, according to information root Artemis.

- Its a motion of acceleration successful the on-chain lending business, a motion of capitalist willingness to instrumentality much risk.

While You Were Sleeping

- Trump Threatens 35% Tariff connected Some Canadian Goods (The Wall Street Journal): Trump raised tariffs connected Canadian imports not covered by the U.S.-Mexico-Canada Agreement from 25% to 35%, portion compliant goods stay exempt. Canada aims to scope a woody by Aug. 1.

- Bitcoin Rockets Past $118K, Leads to Over $1B Shorts Getting Liquidated (CoinDesk): More than $1.13 cardinal successful crypto positions were liquidated successful 24 hours, including $1.01 cardinal from shorts, led by bitcoin and ether futures astatine $590 cardinal and $241 million, respectively.

- Markets Embolden Trump connected Tariffs, Stoking Fear He’ll Go Too Far (Bloomberg): Trump cited grounds marketplace highs portion floating a 15%–20% cosmopolitan baseline tariff Thursday. JPMorgan’s CEO warned traders whitethorn beryllium underestimating the risks of rising planetary commercialized tensions.

- Bitcoin's Record Rally From $70K to $118K: A Tale of Transition From Wild West to Wall Street-Like Dynamics (CoinDesk): Bitcoin’s latest rally features dependable gains and declining volatility, reflecting organization adoption and marketplace maturity. Current macro conditions whitethorn support volatility low, though unexpected shocks could inactive trigger crisp spikes.

- Robinhood’s OpenAI Tokens Walk a Legal Tightrope, Says Crypto Lawyer (CoinDesk): Lawyer John Montague warned that tokenizing backstage institution shares carries risks of lawsuits from those firms, regulatory blowback owed to securities laws’ requirements and capitalist losses if the level goes bankrupt.

- Some of Iran’s Enriched Uranium Survived Attacks, Israeli Official Says (The New York Times): Israeli quality believes enriched uranium stored heavy astatine Isfahan survived June’s strikes, but says immoderate Iranian betterment effort would apt beryllium detected successful clip for a renewed attack.

In the Ether

5 months ago

5 months ago

English (US)

English (US)