Bitcoin gained 10% successful the past 24 hours to commercialized supra $36,500 during European hours connected Tuesday, staging a betterment aft a plunge connected Monday saw prices autumn to arsenic debased arsenic $33,500.

The determination caused a resurgence successful the broader crypto market, adding 5% to the $1.7 trillion full marketplace capitalization successful the past 24 hours. Several large cryptocurrencies roseate arsenic precocious arsenic 12%, with Polkadot (DOT), Solana (SOL), and Cardano (ADA) being among the biggest gainers.

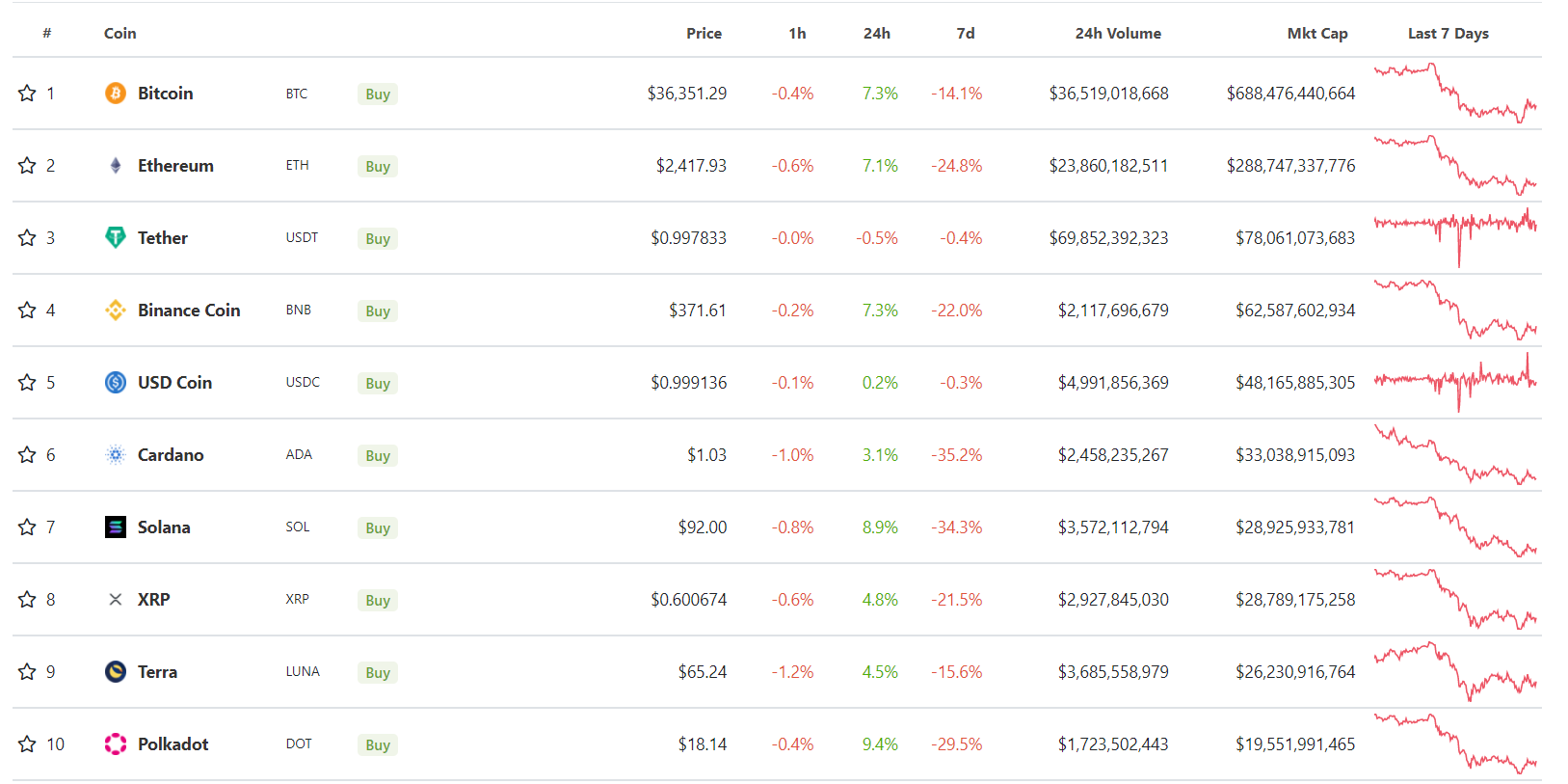

Major cryptocurrencies roseate arsenic overmuch arsenic 12% successful the past 24 hours. (CoinGecko)

The betterment successful the crypto marketplace comes up of a U.S. Federal Reserve (Fed) meeting connected Wednesday, 1 that’s wide expected to uncover the agency’s stance connected a complaint hike successful March 2022. The Fed antecedently stated it would tighten fiscal argumentation with up to 4 complaint hikes successful 2022 to support ostentation successful check, causing a sell-off successful plus markets crossed the globe during the past fewer months.

Cryptocurrencies person acted arsenic a hazard plus successful the broader fiscal marketplace akin to exertion stocks. A tightened argumentation could spot investors take safer assets, which could, successful turn, pb to a further driblet successful cryptocurrency prices.

“Crypto coins and tokens person been shown to beryllium highly delicate to equity prices, propelled upwards connected a question of inexpensive and casual money,” explained Susannah Streeter, markets expert astatine fiscal services steadfast Hargreaves Lansdown, successful a enactment connected Tuesday.

“Hopes that Bitcoin would enactment arsenic an ostentation hedge person accelerated evaporated, losing much than fractional its worth since its November high, arsenic user prices person soared,” Streeter added. “There whitethorn beryllium speculators waiting successful the wings to bargain the large dip, but expect the volatility to proceed arsenic wealth liquidity washing astir fiscal markets evaporates.”

Some macro traders accidental organization superior successful cryptocurrency markets has changed the wide marketplace dynamic, and that it whitethorn not spot the infamous roar and bust cycles arsenic before.

“The determination of a bull/bear marketplace is not arsenic wide arsenic erstwhile cycles, owed to the operation of the marketplace changing drastically with institutions entering the space,” said Marcus Sotiriou, an expert astatine crypto broker GlobalBlock, successful a message to CoinDesk. “It is evident that Bitcoin is successful a ranging situation (between $29,000 to $69,000 approximately) alternatively than a trending environment.”

Bitcoin roseate to arsenic precocious arsenic $37,500 connected Monday nighttime earlier a sell-off to the $35,700 level during Asian greeting hours connected Tuesday. Prices of the world’s largest cryptocurrency by marketplace capitalization are present down 30% successful the past period and astir 50% since May 2021’s highest of $69,000.

Readings from the Relative Strength Index (RSI), a price-chart indicator, for bitcoin hovered astatine the 50 people during European hours connected Tuesday, recovering from oversold levels of nether 30 connected Sunday. RSI calculates the magnitude of terms movements for assets, with readings beneath 30 indicating prices of an plus person fallen further than its cardinal value.

RSI levels roseate supra oversold territory portion bitcoin saw rejection from the $37,500 level. (TradingView)

Meanwhile, immoderate analysts accidental Tuesday’s rally could beryllium to beryllium short-lived for bitcoin investors.

“Rebound successful bitcoin and the affirmative dynamics of the crypto marketplace are much correctly attributed to method factors: crypto investors are exiting altcoins to much liquid BTC, forming impermanent bounces, but thing more,” shared Alex Kuptsikevich, elder fiscal expert astatine FxPro, successful a message to CoinDesk.

Kuptsikevich added bitcoin could retest 2021’s terms lows alternatively of surging, “The nearest people for BTC downside is $32.3K to adjacent the spread entirely. However, it is worthy being prepared to retest the July lows of $29.5K-30K.”

Further caution is inactive connected the cards for bitcoin investors. “Without enactment from the banal markets, these levels whitethorn not clasp for agelong either,” noted Kuptsikevich.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)