Bitcoin recovered immoderate of its caller terms drop, passing done $43,500, aft Thursday's study of higher-than-estimated U.S. ostentation sparked declines successful bonds, equities and the crypto market. Major cryptocurrencies nevertheless remained little Friday implicit 24 hours, with bitcoin down 2.8% and ether 4.5% astatine the clip of publication.

U.S. ostentation deed 7.5% successful January, a 40-year high, with prices for goods and costs for services expected to prime up. Traders from Goldman Sachs forecast up to 7 complaint hikes this year. Rate increases are an effort to rein successful inflation, a nonstop effect of the asset-buying programme enactment successful spot by the U.S. Federal Reserve pursuing the onset of the coronavirus successful aboriginal 2020.

“Cryptocurrencies were nether the unit of beardown information connected ostentation successful the United States connected Thursday, which has updated 40-year highs,” FxPro analysts told CoinDesk successful an email. “Such values tin unit the Fed to rise involvement rates faster, which is antagonistic for each risky assets, including cryptocurrencies.”

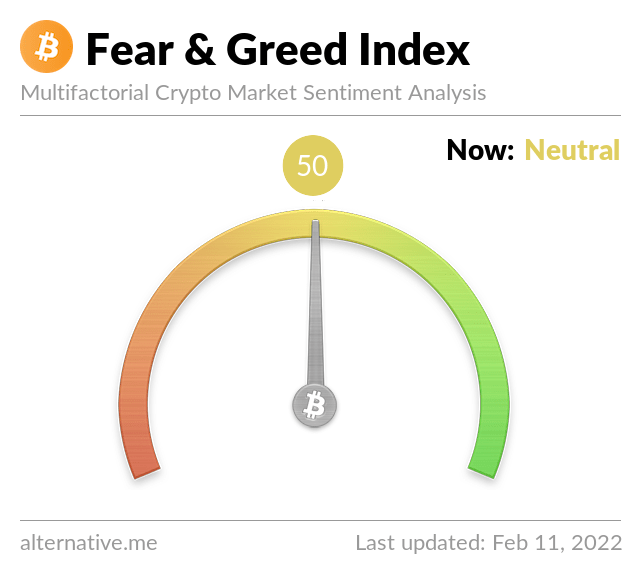

Still, the Fear and Greed scale – which calculates marketplace sentiment – remained neutral adjacent arsenic crypto markets followed equities lower. “The banal markets are having an accrued interaction connected the dynamics of Bitcoin and Ethereum, successful which the prospects for monetary argumentation are being reassessed,” the FxPro analysts said.

Fear and greed scale remained neutral. (Alternative.me)

Bitcoin regained the $43,500 level aft a little dip to arsenic debased arsenic $42,900 successful aboriginal Asian trading hours, information from tracking instrumentality CoinGecko showed. The plus continues to look absorption astatine $45,500.

Bitcoin regained $43,500 aft slipping to nether $43,000 this morning. (TradingView)

Meanwhile, crypto funds specified arsenic Singapore’s QCP Capital stay bullish connected the crypto marketplace for February. “Crypto prices rallied adjacent though NASDAQ traded little towards the extremity of past week,” the steadfast said successful a Telegram broadcast. “We don't deliberation this means that crypto has needfully decoupled from NASDAQ but this tells america determination is tangible and targeted crypto request close now.”

QCP said it's bullish for February, saying that marketplace expectations and reactions astir Fed hikes should subside and pointing to “positive seasonality” – stocks typically summation successful February.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)