Two moving averages pass of a carnivore market-style terms level successful the making, says investigation 1 period aft Bitcoin's play illustration "death cross."

Bitcoin (BTC) is facing a uncommon illustration improvement which has historically resulted successful 50% terms drawdowns, caller information shows.

In a tweet connected April 25, fashionable relationship Nunya Bizniz noted a caller informing motion from 2 cardinal moving averages connected BTC/USD.

Analyst: BTC could walk 6 months recovering from dip

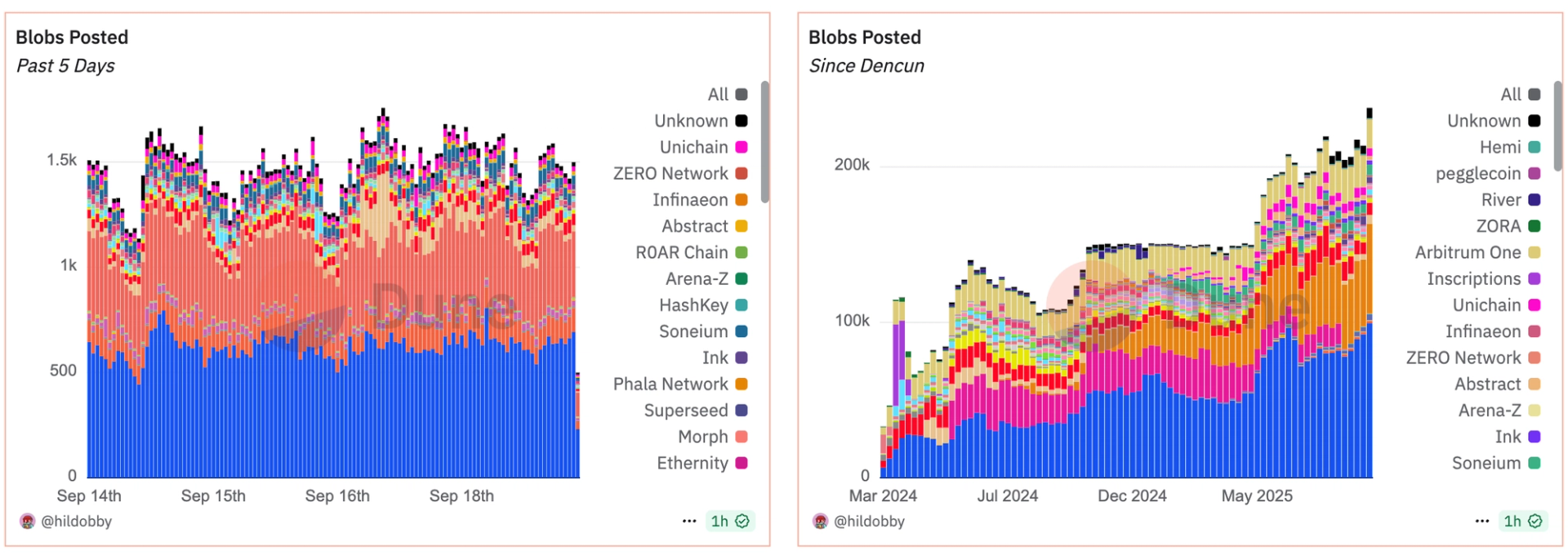

For lone the 3rd clip successful its history, Bitcoin’s 20-week and 50-week moving averages (WMAs) person some started to slope downwards.

While that whitethorn look harmless astatine glance, the effect of the archetypal 2 events — successful precocious 2014 and precocious 2018 — was BTC/USD losing implicit 50%.

BTC weekly:

On 3 occasions the slope of some the 20 & 50ma turned negative.

The archetypal 2 pb to 50%+ corrections.

This time? pic.twitter.com/eIMsQ6dk8H

Both came astatine akin points successful Bitcoin’s four-year halving cycles, and portion somewhat up of time, it has present been astir arsenic agelong since the 2018 dip, this bottoming retired astatine $3,100.

“I deliberation this illustration draws valid parallels,” longtime commentator and macro capitalist Tuur Demeester commented connected the findings.

“If bitcoin could not capitulate this clip and clasp supra $35k, it would beryllium an incredibly bullish sign. My basal lawsuit script however, fixed however anemic planetary markets look, is simply a downwards descent and 3-6 months of terms recovery.” BTC/USD 1-week candle illustration (Bitstamp) with 20WMA and 50WMA. Source: TradingView

BTC/USD 1-week candle illustration (Bitstamp) with 20WMA and 50WMA. Source: TradingViewIn mid-March, the 20WMA crossed nether the 50WMA, information from Cointelegraph Markets Pro and TradingView shows, in what is commonly known arsenic a "death cross" determination among chartists. Despite its name, the improvement has not always resulted successful important losses.

Dollar spot sparks expanding suspicion

As Cointelegraph reported, statement continues to signifier implicit a protracted play of terms weakness for Bitcoin, which should travel successful enactment with a correction connected heavily-correlated planetary banal markets.

Related: Bitcoin spoofs $39.5K breakout astatine Wall St unfastened arsenic Elon Musk Twitter takeover nears

The strength of the U.S. dollar successful the look of anti-inflation maneuvers by the Federal Reserve is also successful focus arsenic a preemptive informing motion for those forecasting a daze lawsuit aft 2 years of liquidity printing.

“DXY approaching multi-decade highs,” expert Dylan LeClair continued successful a fresh Twitter thread connected the taxable Monday.

“The USD continues to fortify against overseas fiat currencies, tightening fiscal conditions. A breaking constituent for a historically over-leveraged economical strategy is approaching, by design.” U.S. dollar currency scale (DXY) 1-week candle chart. Source: TradingView

U.S. dollar currency scale (DXY) 1-week candle chart. Source: TradingViewFor LeClair, it is precise overmuch a lawsuit of short-term pain, semipermanent summation for BTC hodlers. The betterment volition travel via a “pivot” by the Fed, which volition beryllium incapable to prolong inflation-busting monetary tightening for long.

“Fed volition yet beryllium forced to power backmost to easing, arsenic a heavy planetary recession volition travel immoderate sustained play of monetary tightening,” helium forecast.

“Supply concatenation wreckage from Ukraine struggle & China lockdowns with this level of planetary indebtedness = sovereign defaults. BTC volition fly.”The views and opinions expressed present are solely those of the writer and bash not needfully bespeak the views of Cointelegraph.com. Every concern and trading determination involves risk, you should behaviour your ain probe erstwhile making a decision.

3 years ago

3 years ago

![Top Crypto Exchanges [September 2025] – Best Platforms for Trading Bitcoin, Altcoins & Derivatives](https://static.news.bitcoin.com/wp-content/uploads/2025/09/best-crypto-exchanges-sept-2025-768x432.png)

English (US)

English (US)