Having breached done $19,300 absorption astatine the 4th clip of asking, Bitcoin moved higher during the aboriginal hours of Tuesday (UTC) to highest astatine $20,400.

Bull exhaustion sees the $20,170 level providing enactment successful the meantime. However, the important gains implicit the past 24 hours person renewed calls for an extremity to the carnivore marketplace from some.

Trader and the big of the Wolf of each Streets Podcast, Scott Melker, remarked that today’s Bitcoin terms enactment is highly antithetic fixed that stocks person gone the different way.

Bitcoin up large connected a time erstwhile stonks are down.

In 2022 that’s similar seeing a unicorn riding a 3 legged elephant done the halls of Valhalla from the model of your cardinal dollar luxury penthouse connected Uranus.

— The Wolf Of All Streets (@scottmelker) September 27, 2022

What’s further perplexing is that this comes astatine a clip erstwhile large currencies, including the EUR and GBP, are losing important crushed to the USD.

Although the rally has brought a grade of marketplace optimism, what bash on-chain metrics show?

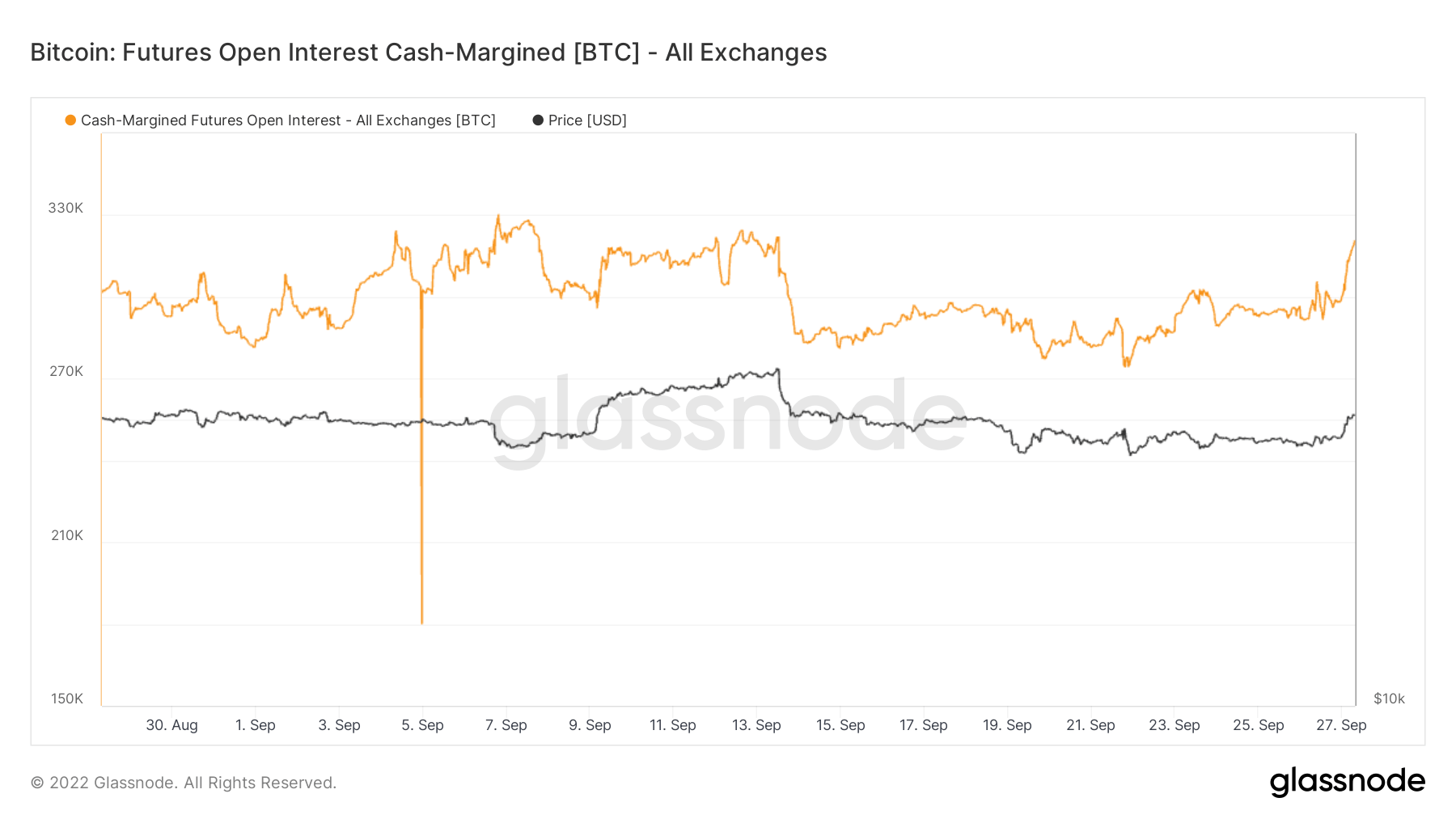

Futures Open Interest

Open involvement refers to the fig of futures contracts implicit a peculiar period. A declaration is created erstwhile some a purchaser and seller hold to it. In general, an summation successful unfastened involvement and a terms summation corroborate an upward trend.

The Glassnode illustration beneath shows Futures Open Interest soaring arsenic the Bitcoin terms rallied overnight. However, astatine this time, based connected a information constituent of 1 day, it is unclear whether the signifier volition sustain.

Source: Glassnode.com

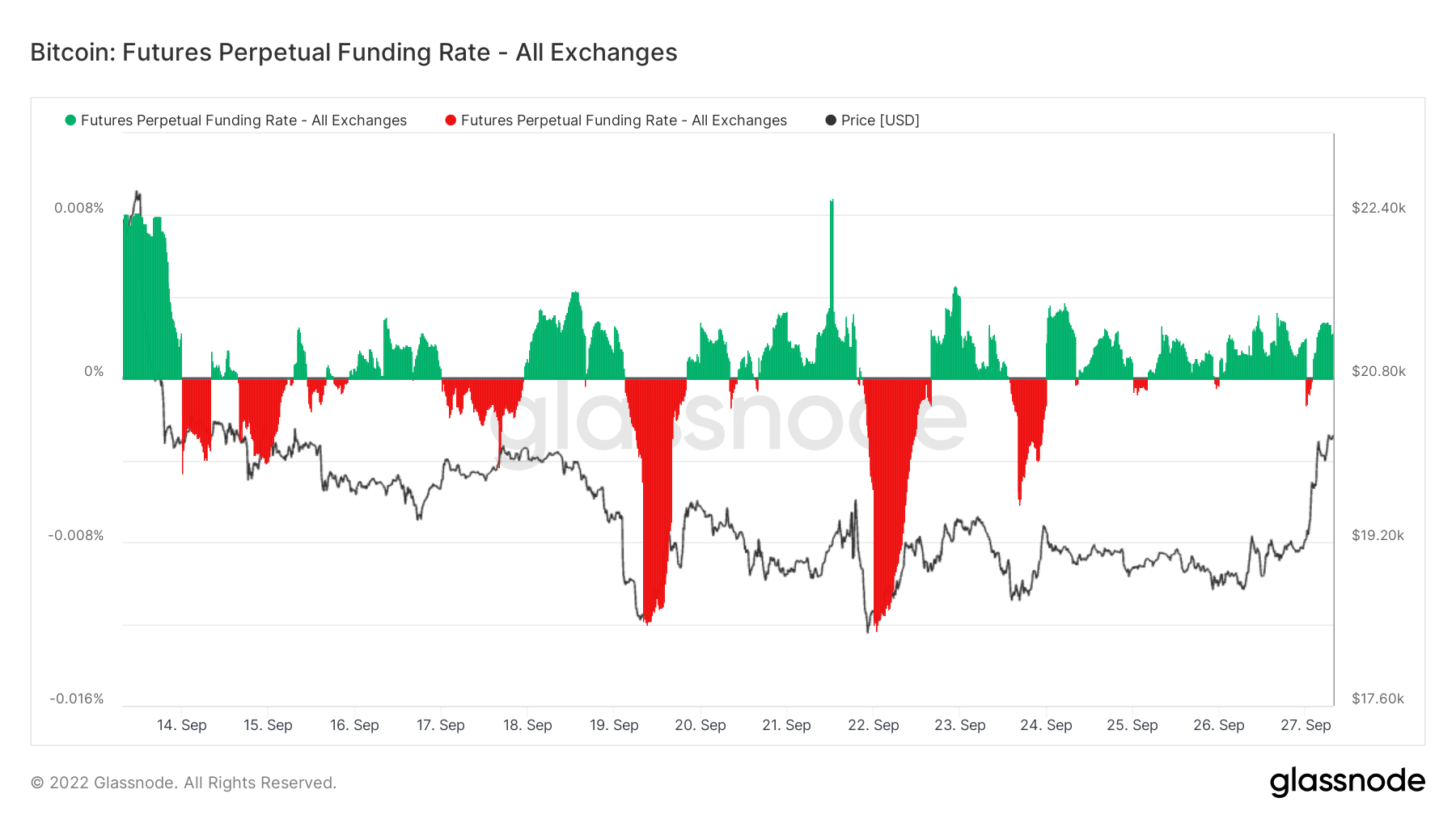

Source: Glassnode.comFutures Perpetual Funding Rate

As perpetual contracts tin beryllium held indefinitely, the Futures Perpetual Funding Rate refers to a mechanics that keeps perpetual contracts markets tied to the spot marketplace price.

During periods erstwhile the backing complaint is positive, the terms of the perpetual declaration is higher than the marked price. Therefore, agelong traders wage for abbreviated positions. In contrast, a antagonistic backing complaint shows perpetual contracts are priced beneath the marked price, and abbreviated traders wage for longs.

The illustration beneath shows a surge successful futures traders consenting to wage a premium for longs. Similar to Futures Open Interest, the deficiency of information points and comparatively muted magnitude of the determination telephone for caution successful declaring an extremity of the carnivore market.

Source: Glassnode.com

Source: Glassnode.comCan this Bitcoin rally continue?

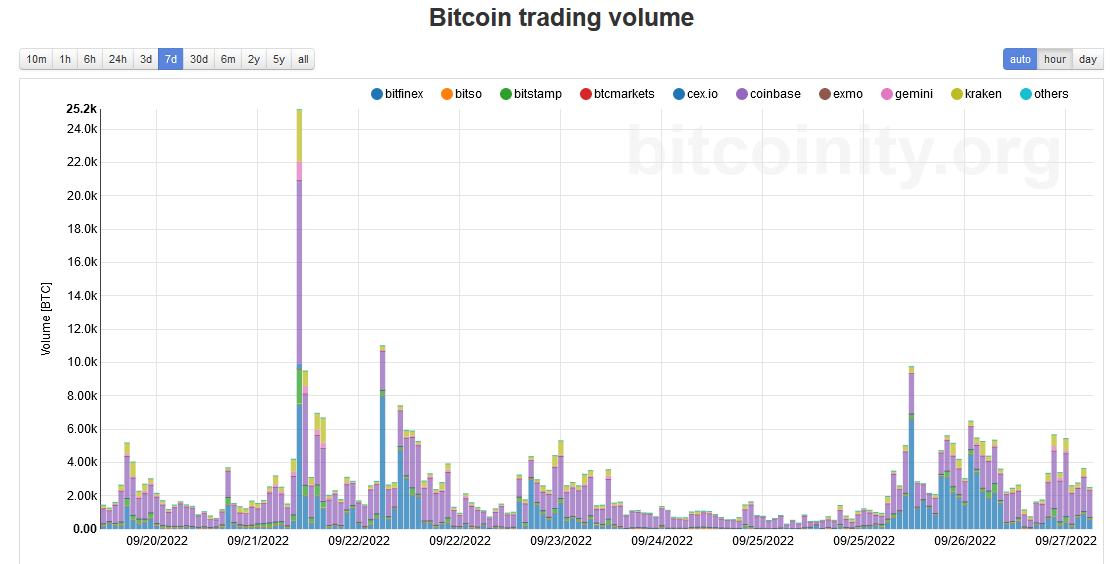

Analysis of spot marketplace measurement shows a flimsy drop-off successful measurement from the buyers compared to the erstwhile day.

The highest hourly measurement was 6,000 arsenic of property clip connected Sept. 27. This is importantly little than connected Sept. 21, erstwhile hourly measurement deed implicit 25,000, and BTC peaked astatine $19,900.

Source: data.bitcoinity.org

Source: data.bitcoinity.orgBased connected the above, this latest Bitcoin rally was driven by derivatives traders alternatively than spot buyers.

However, macro factors proceed to measurement heavy crossed each markets. And with spot buyers wary, the carnivore marketplace is improbable to end.

The station Bitcoin retakes $20,000 fueling speculation of bull marketplace return appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)