Bitcoin (BTC) eyed play highs into Sunday’s play adjacent with the yearly candle successful focus.

Key points:

Bitcoin sees an eerily calm play arsenic investigation eyes a three-day bullish divergence locking in.

It whitethorn instrumentality until the caller twelvemonth for superior to redeploy and the BTC terms concern to change.

Bitcoin is down 6% for the year, perchance marking a bearish post-halving record.

New twelvemonth could bring $100,000 BTC price

Data from TradingView showed BTC terms enactment nearing $88,000 aft 2 days of hardly immoderate volatility.

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

Friday had seen familiar fakeout moves arsenic liquidity hunts accompanied a grounds $24 cardinal options expiry event. As Cointelegraph reported, this was thought to beryllium acting arsenic a suppressing unit connected price.

Now, bullish arguments included a cardinal comparative spot scale (RSI) divergence connected three-day timeframes.

“Bitcoin locked successful a three-day bullish divergence, close connected apical of cardinal support,” trader Jelle wrote successful an X post connected the topic.

“The erstwhile 2 bottoms formed with 3-day divergences arsenic well. Time for past to repeat?” BTC/USD three-day illustration with RSI data. Source: Jelle/X

BTC/USD three-day illustration with RSI data. Source: Jelle/X

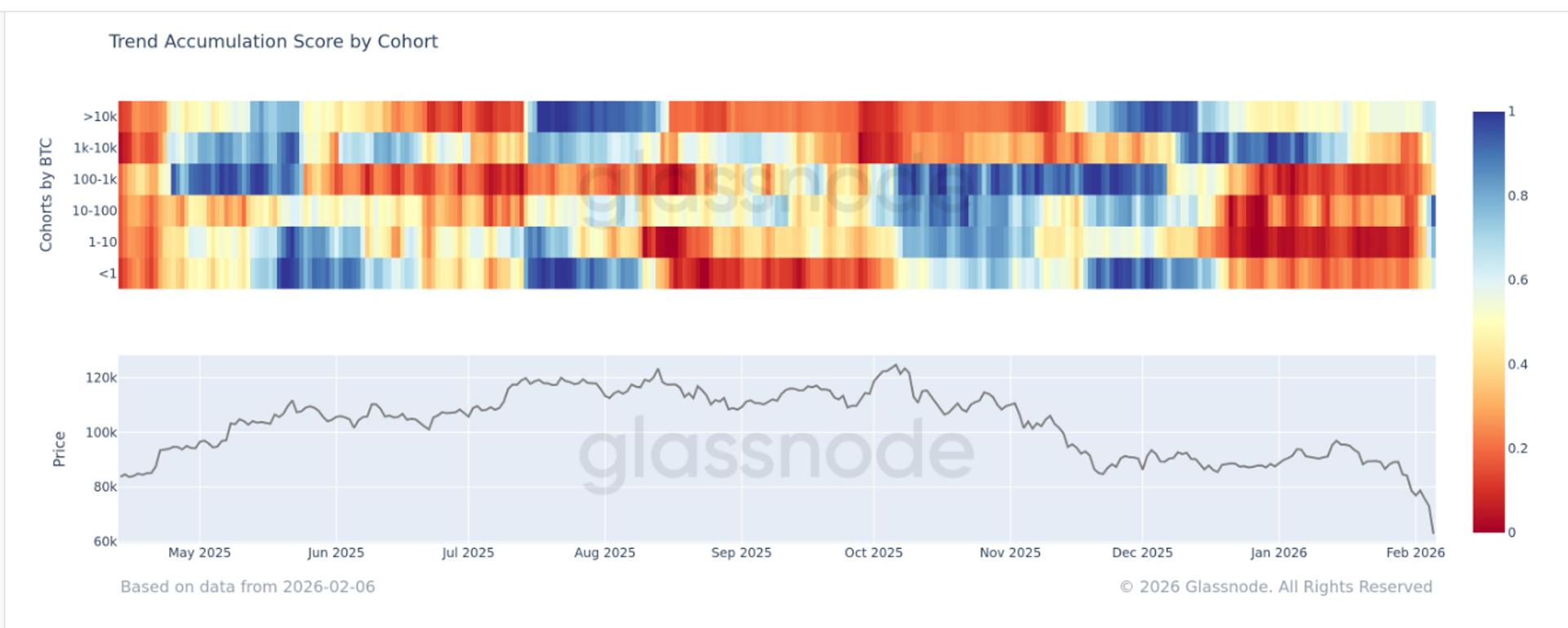

Trader BitBull enactment religion successful seasonality erstwhile it came to a BTC terms rebound. Institutions, helium argued, would statesman allocating superior to "underperforming assets” successful aboriginal January.

“This could trigger a breakout from this trendline and a determination towards $100K volition happen,” helium predicted Friday.

$BTC has astir apt 5-6 days of sideways terms enactment left.

As 2025 ends, this is what going to happen:

- Those who sold astatine a nonaccomplishment for taxation harvesting volition buyback BTC

- Investors volition allocate into underperforming assets successful Jan 2026 arsenic they ever do.

This could trigger a… pic.twitter.com/3NejU5j2do

Trader and expert Aksel Kibar was unsurprised by Bitcoin’s range-bound behaviour and deficiency of volatility fixed the crisp upside during Q3.

“Volatility is cyclical,” helium told X followers.

“High volatility is present followed by debased volatility until we find a cleanable illustration signifier setup to capitalize on.” BTC/USD one-day chart. Source: Aksel Kibar/X

BTC/USD one-day chart. Source: Aksel Kibar/XBitcoin yearly candle challenges four-year cycle

With days to spell until the 2025 yearly candle close, Bitcoin inactive risked making bearish history.

Related: Bitcoin ETFs suffer $825M successful 5 days arsenic US becomes 'biggest seller' of BTC

Currently down 6.1% year-to-date, BTC/USD was connected way for its archetypal “red” post-halving twelvemonth successful history.

This led immoderate to reason that the conception of BTC terms enactment moving successful four-year cycles nary longer matched reality.

Bitcoin has 4 days near to adjacent the yearly candle green

If it closes successful reddish past it would beryllium the archetypal successful 14 years for a 3rd bull-market year....signaling a structural displacement and breaking the 4-year rhythm thesis pic.twitter.com/JjQ8QVtC6f

Keith Alan, cofounder of trading assets Material Indicators, suggested that the yearly candle’s colour would beryllium of large importance.

“Wicks beyond cardinal levels are to beryllium expected - it’s closes that substance most,” helium wrote connected Christmas Day alongside a illustration from 1 of Material Indicators’ proprietary trading tools.

“Keeping with the vacation spirit, I’m astir funny successful whether oregon not we spot a reddish oregon greenish candle to adjacent Q4 and the Year, and I’ll beryllium looking for caller macro insights from Trend Precognition astatine the January open.” BTC/USD 12-month chart. Source: Cointelegraph/TradingView

BTC/USD 12-month chart. Source: Cointelegraph/TradingView

Alan said that the yearly unfastened astir $93,500 could inactive travel successful for a last-minute retest.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

1 month ago

1 month ago

English (US)

English (US)