Bitcoin climbed to a three-week precocious connected Tuesday earlier slipping back, a determination that has traders and analysts watching closely.

According to TradingView data, Bitcoin terms topped retired astatine $94,600 precocious successful the league — its highest level since November 25 — past eased to astir $92,450 astatine the clip of reporting.

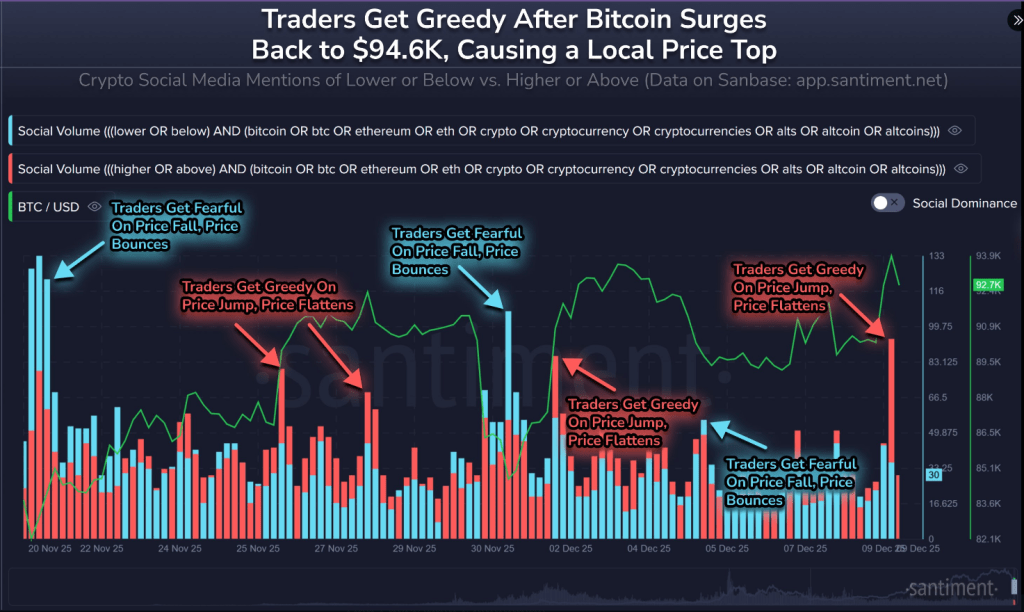

Santiment, a blockchain analytics firm, said societal chatter calling for “higher” and “above” exploded during the spike, but marketplace enactment remained uneven.

Bitcoin: Trader Frenzy And Skepticism

Reports person disclosed that the surge drew dense retail attraction and a flurry of social-media posts urging much buying.

Some marketplace watchers questioned however integrated the emergence was. A well-known semipermanent capitalist utilizing the grip “NoLimit” told his 53,000 X followers that the $94,000 propulsion looked engineered: large buys packed into a fewer minutes, bladed bid books, past small follow-through.

🤑 Bitcoin enjoyed a overmuch needed rebound backmost to $94.6K today, reinvigorating traders, causing them to FOMO backmost successful and expect higher prices. According to our societal information scraping X, Reddit, Telegram, & different data, calls for “higher” & “above” exploded.

🟦 High bars indicate… pic.twitter.com/o3U3yWkwkk

— Santiment (@santimentfeed) December 9, 2025

That pattern, helium argued, is however larger traders tin make short-term fearfulness of missing retired truthful they tin merchantability into strength.

Santiment besides highlighted a behavioral twist: smaller traders look to heap successful aft spikes, often leaving them connected the incorrect broadside of moves.

Volatility followed the high, arsenic prices pulled backmost by a mates 1000 dollars wrong hours. Exchange bid extent and timing of ample blocks, analysts say, substance a batch erstwhile liquidity is shallow.

Fed Decision Could Shift Momentum

The US cardinal slope meeting this week is simply a cardinal wildcard. Market pricing connected CME Group futures showed an 88% accidental of a 0.25% complaint cut, which galore traders deliberation helped substance the rally. Yet immoderate analysts warned that immoderate motion of hesitation astir aboriginal cuts could dampen hazard appetite.

Beyond US policy, adjacent week’s imaginable Bank of Japan rate action is being watched due to the fact that a tighter stance determination could assistance yields and propulsion superior backmost to Japan, tightening planetary liquidity. That benignant of travel tin unit risky assets crossed markets.

Liquidity, Institutions And The Bigger Picture

Meanwhile, semipermanent holders pared backmost proviso aft a 36% correction from the all-time high, and immoderate addresses present clasp levels seen successful March.

Jessica Gonzales, an expert cited successful reports, said M2 wealth proviso sits astatine astir $22.3 trillion and stablecoin reserves stay elevated, suggesting determination is superior astir but not needfully evenly distributed successful markets.

Institutional moves besides feature: large firms specified arsenic BlackRock and Strategy person expanded crypto exposure, which could adhd a steadier purchaser basal — oregon simply displacement wherever hazard sits.

What Traders Should Watch

Short-term traders should way order-book depth, ample commercialized clusters, and however terms reacts to immoderate Fed wording astir aboriginal cuts.

The adjacent 25 days were flagged arsenic particularly important by respective observers due to the fact that liquidity swings and regulatory updates could flip the communicative fast. If a existent broad-based bid forms, prices could determination quickly. If the Fed signals caution, the other could happen.

Featured representation from Gemini, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)