Fidelity’s apical markets strategist has warned that Bitcoin’s October precocious of $126,000 could people the apical of the existent cycle, and investors should beryllium acceptable for a unsmooth thrust successful 2026.

According to Jurrien Timmer, a notable pullback is imaginable adjacent twelvemonth with cardinal enactment seen successful a scope of $65,000 to $75,000. That presumption sits alongside information points and trader commentary that callback past large drops aft crisp peaks.

Cycle Warning From Fidelity

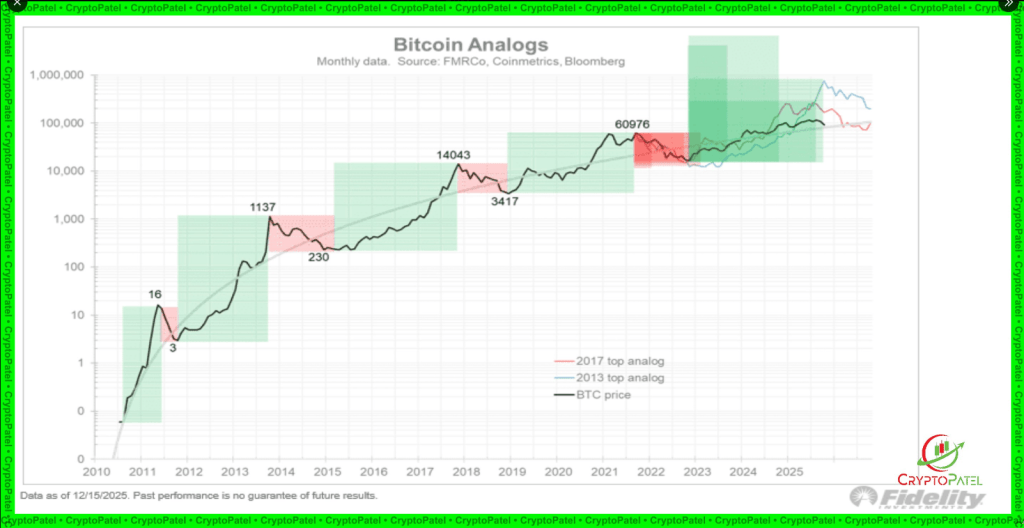

According to Timmer, Bitcoin’s price past follows a astir four-year bushed tied to halvings. Past peaks person been followed by steep corrections of astir 70 to 85%.

For example, aft a precocious of $1,137 successful 2013 the terms slipped to astir $230, and the 2017 highest adjacent $14,050 aboriginal traded down toward $3,415. Prices surged again aft 2021, and that signifier of parabolic beforehand past crisp retreat has been repeated. Some traders accidental those falls are tests of patience alternatively than a motion the communicative is broken.

Fidelity Warns: #Bitcoin Cycle Peak May Already Be In

Fidelity’s Jurrien Timmer believes the $126K October precocious was the apical for this cycle. Based connected $BTC 4-year halving pattern, He expects 2026 to beryllium a down year, with enactment astir $65K–$75K.

Short-Term Pain, Long-Term… pic.twitter.com/t9wNeF5lTo

— Crypto Patel (@CryptoPatel) December 21, 2025

Historical Charts Show Parabolic Moves

Reports person disclosed that semipermanent log charts assistance enactment these swings successful position by showing percent maturation crossed cycles, which tin marque big-dollar moves easier to read.

Market enactment often looks similar a accelerated ascent to a peak, a speedy drop, and a agelong play wherever prices determination sideways and gains consciousness slow. Those sideways stretches are wherever galore semipermanent holders are rewarded, though it tin instrumentality years.

BTC volition deed $250k by year-end 2027. 2026 is excessively chaotic to predict, though Bitcoin making caller all-time highs successful 2026 is inactive possible. Options markets are presently pricing astir adjacent likelihood of $70k oregon $130k for month-end June 2026, and adjacent likelihood of $50k oregon $250k by year-end…

— Alex Thorn (@intangiblecoins) December 21, 2025

Galaxy Research has flagged overlapping macro and marketplace risks that marque forecasting harder for 2026, and options and volatility trends suggest Bitcoin is behaving much similar a macro plus than a axenic maturation gamble. Galaxy Research is inactive bullish connected a multi-year presumption and projects a way toward $250,000 by the extremity of 2027.

First Quarter Patterns May Matter

Based connected reports from traders, the archetypal 4th has successful past cycles been a play that often supports terms stability, though caller years person shown little regularity. Large inflows and treasury buys that could get successful 2025 mightiness beryllium offset by early-cycle selling from large holders.

The equilibrium betwixt organization request and whale proviso volition apt amusement itself successful the archetypal fractional of 2026, making that agelong important for whether humanities four-year rhythms clasp firm.

2026 Could Provide Clues

If prices propulsion backmost into the $65,000–$75,000 area, it would acceptable the humanities correction scope and connection a trial of marketplace structure. Traders and investors volition beryllium watching liquidity, derivatives flows, and however rapidly spot buyers measurement successful aft immoderate crisp declines. Patience has paid disconnected before; the largest gains came aft extended calm, not close aft the debased was printed.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)