A humble claim. A bold number. Both are connected the array for Bitcoin this week arsenic a statement implicit however to work short-term streaks successful terms gains grows louder.

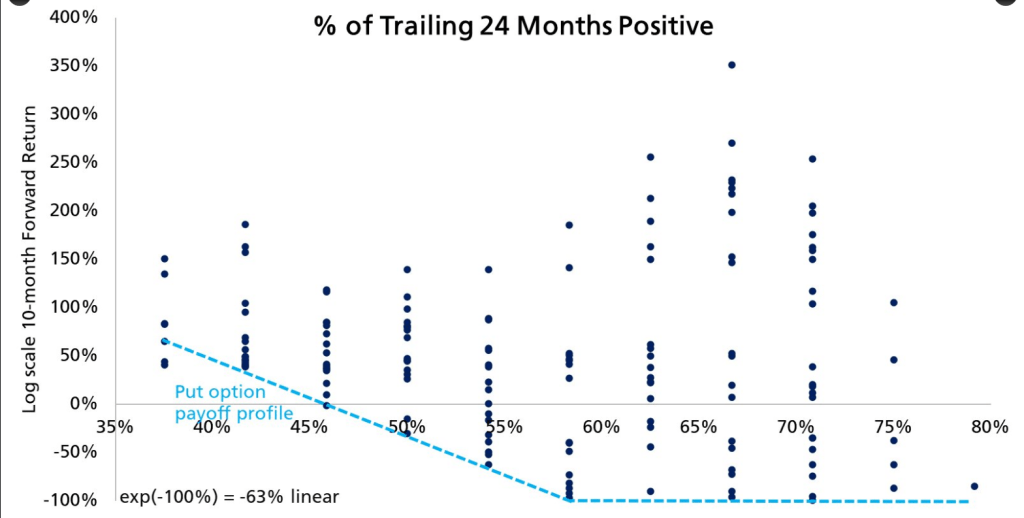

Crypto expert Timothy Peterson has pointed retired that fractional of the past 24 months showed positive returns. Based connected reports, helium past gave a astir 90% accidental that Bitcoin would beryllium higher successful 10 months.

That leap from a elemental number to a steadfast probability is the header grabber. It should beryllium met with cautious questions astir however the likelihood were calculated and what assumptions were built into the model.

Counting Positive Months

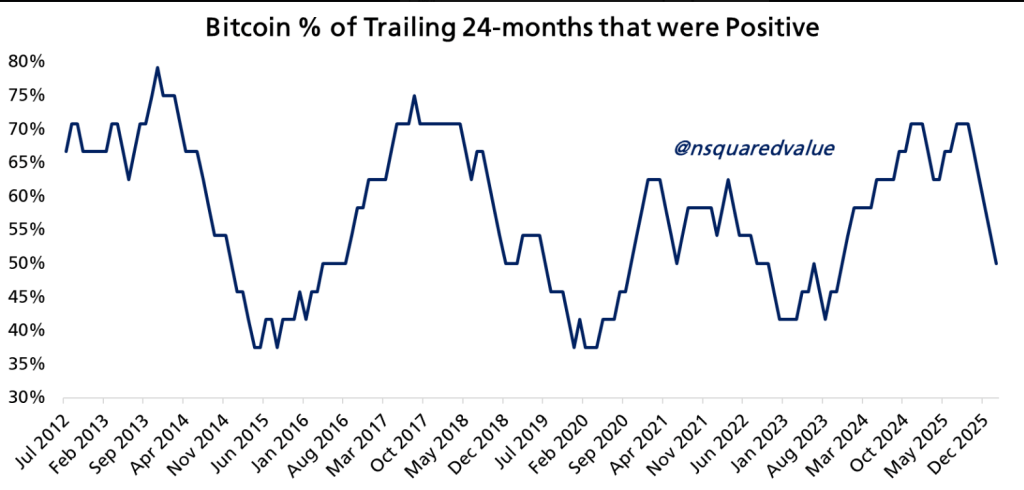

Peterson based his presumption connected a reappraisal of monthly show data. Figures compiled by CoinGlass amusement that Bitcoin closed six months of 2025 successful affirmative territory, portion the remaining six finished lower.

According to the data, 50% of the past 24 months ended with gains. Peterson said helium tracks this rolling two-year model to spot imaginable turning points successful terms trends.

50% of the past 24 months person been positive.

This implies a 88% accidental that Bitcoin volition beryllium higher 10 months from now.

The mean instrumentality is exp(60%)-1 = 82% => $122,000.

Data goes backmost to 2011. https://t.co/k4IjTisuTH pic.twitter.com/ZxfTyequjt

— Timothy Peterson (@nsquaredvalue) February 21, 2026

Market Odds And Betting

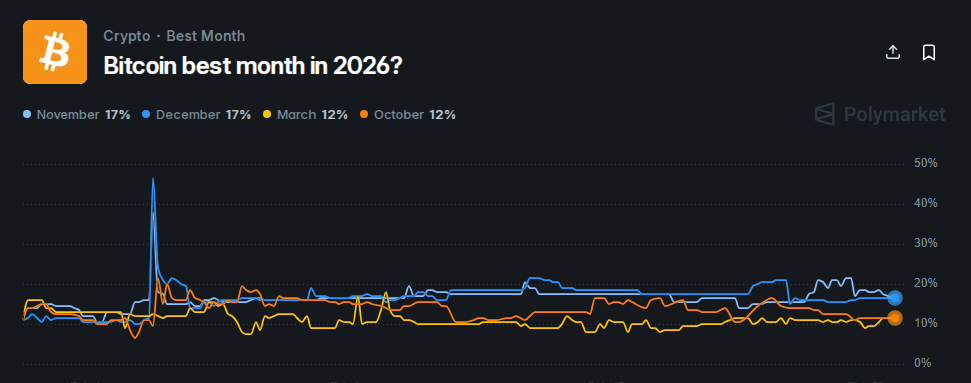

An speech of bets shows a precise antithetic view. Polymarket presently prices December arsenic lone a 17% changeable astatine being the champion period of 2026, with November a hairsbreadth higher.

Those numbers reply a antithetic question from Peterson’s: they bespeak marketplace bets connected which period volition outperform others, not whether the terms volition simply beryllium higher astatine a aboriginal date.

Betting markets tin beryllium blunt tools, but they bash battalion the corporate presumption of galore traders into a azygous number.

Source: Timothy Peterson

Source: Timothy PetersonBitcoin Price Action

Price has not been calm. Bitcoin traded successful a astir $67,000–$68,000 set this week arsenic geopolitical hostility successful the Middle East tightened.

Safe-haven assets similar golden and lipid jumped connected quality flows, and Bitcoin felt the compression arsenic immoderate buyers stepped back. At the aforesaid time, unrecorded tickers showed the token astir 20% beneath its level astatine the commencement of the year, a reminder that header percentages fell wide intraday swings.

Source: Polymarket

Source: PolymarketAnalysts Are Split

Voices from the trading table are divided. Michael van de Poppe suggested near-term green candles could beryllium coming, urging traders to ticker for a lift. On the different hand, Peter Brandt has argued a deeper debased whitethorn not get until precocious 2026.

Both views remainder connected antithetic sets of signals — 1 connected momentum and illustration structure, the different connected longer rhythm patterns and hazard of macro shocks.

Sentiment Still Down

Meanwhile, travel information from spot ETF purchases, derivatives positioning, and on-chain liquidity figures would adhd value to immoderate forecast.

Peterson’s forecast comes arsenic crypto marketplace sentiment continues to decline, with reports noting that treatment and enactment astir Bitcoin predictions person slowed. Traders look cautious, weighing past trends against existent uncertainty successful the market.

Featured representation from Vecteezy, illustration from TradingView

3 hours ago

3 hours ago

English (US)

English (US)